There’s an previous saying {that a} home is the most important funding you’ll ever make.

For some folks that’s true. For others, there are much more vital investments.

All of it is determined by the place you reside on the wealth distribution.

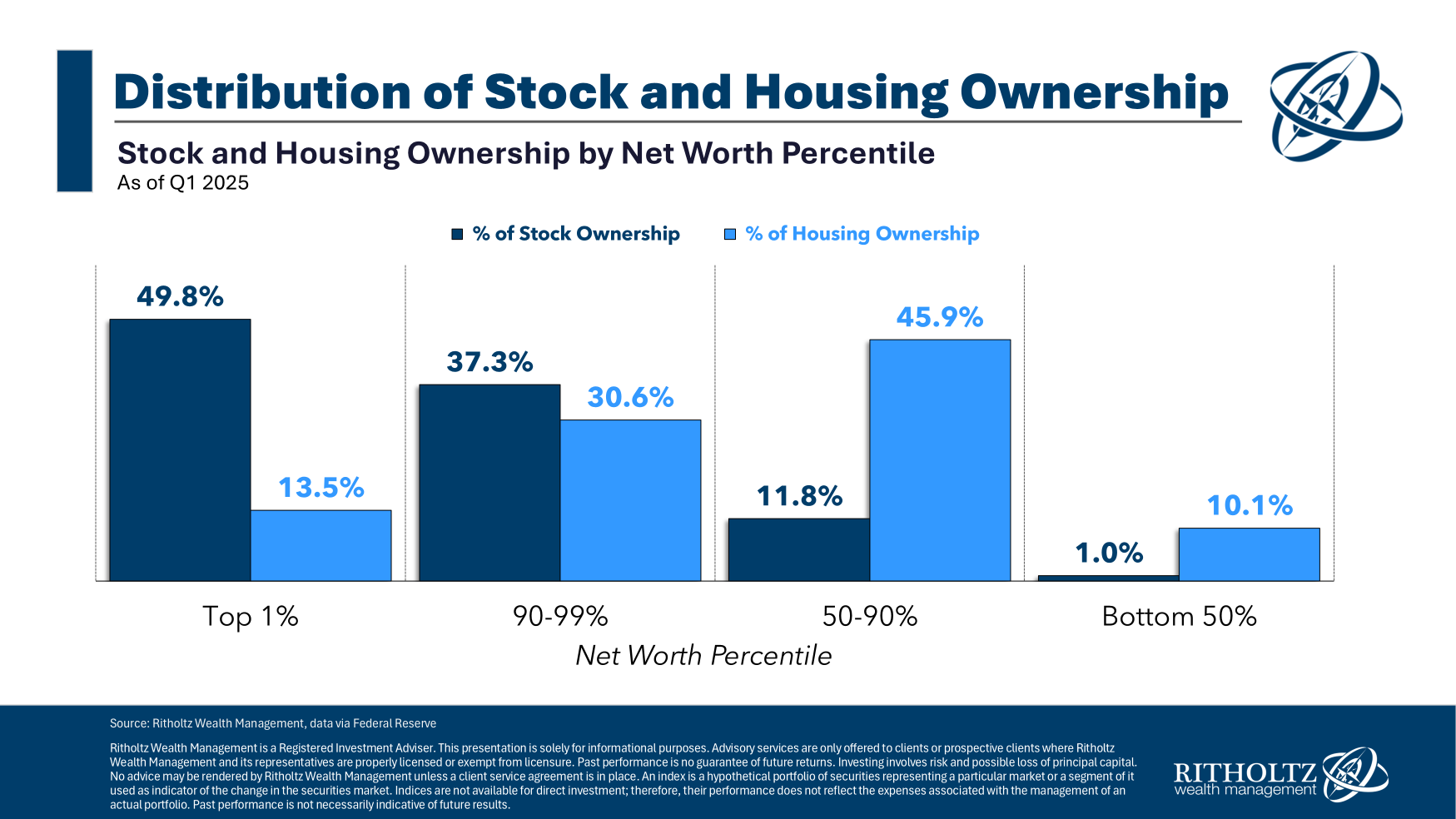

The highest 10% owns 87% of the inventory market in the US and 44% of the housing market.

The underside 90% owns 13% of the inventory market and 56% of the housing market.

Actual property is way extra vital to the center class than the higher class on the subject of their major residence. The inventory market issues extra to the higher class.

However there may be one asset that’s a lot larger than you assume on the subject of most People’ family financial savings — Social Safety.

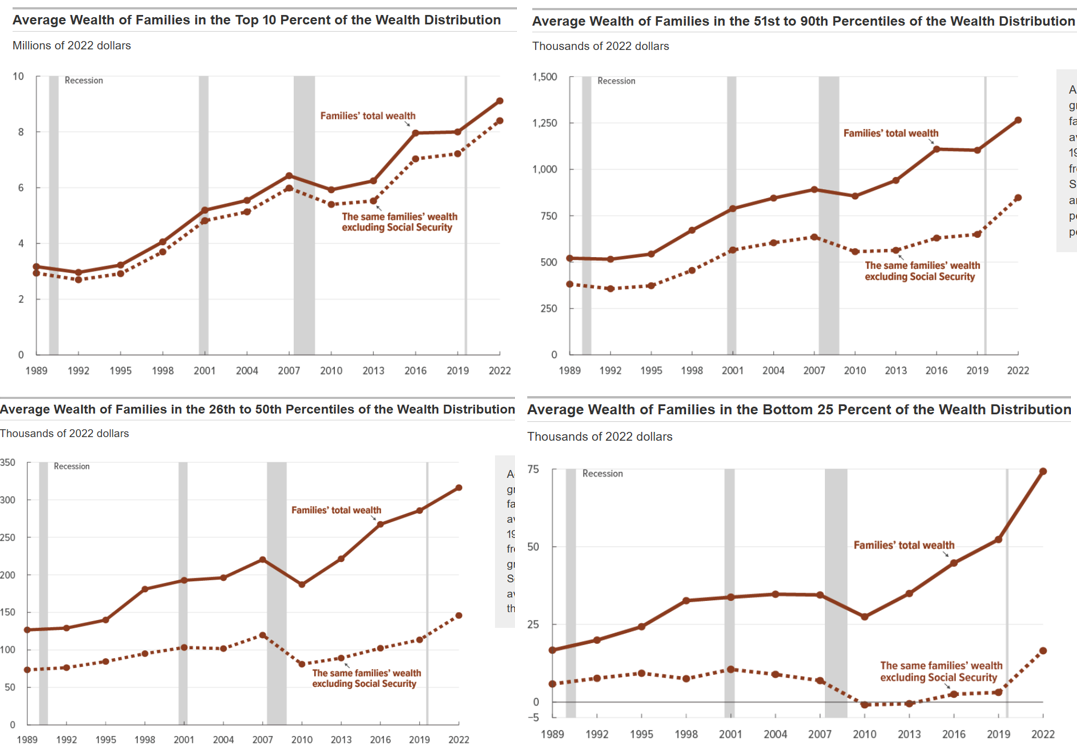

A report from the Congressional Price range Workplace breaks down family wealth by calculating the web current worth of Social Safety funds for households. The month-to-month checks are price greater than you assume.

The CBO estimates Social Safety accounted for 20% of family wealth within the U.S. by the tip of 2022. Different retirement accounts — 401k, 403b, IRA, pensions, and so forth. — made up 21% of family wealth. Mixed, that’s round $80 trillion of the $199 trillion in whole family wealth.

Like housing and the inventory market, that wealth shouldn’t be evenly distributed.

Social Safety issues an incredible deal to folks on the decrease finish of the wealth spectrum.

The CBO broke down common wealth over time by the highest 10%, 51-90%, 26-50% and backside 25% together with how these values would look excluding Social Safety:

As you progress down the wealth ladder, the hole widens. For the underside 50%, Social Safety accounts for greater than 40% of monetary belongings. For the underside 25%, it’s practically half of the family belongings.

There are extra wealthy folks than ever earlier than proper now however there are many individuals who don’t have practically sufficient cash saved for retirement. Social Safety will play a pivotal function in retirement planning for hundreds of thousands of People within the coming years.

Talking of wealthy folks, it’s fascinating to notice that the positive factors to the higher courses and decrease courses of wealth haven’t been as out of whack as one would think about, given the rampant inequality on this nation.

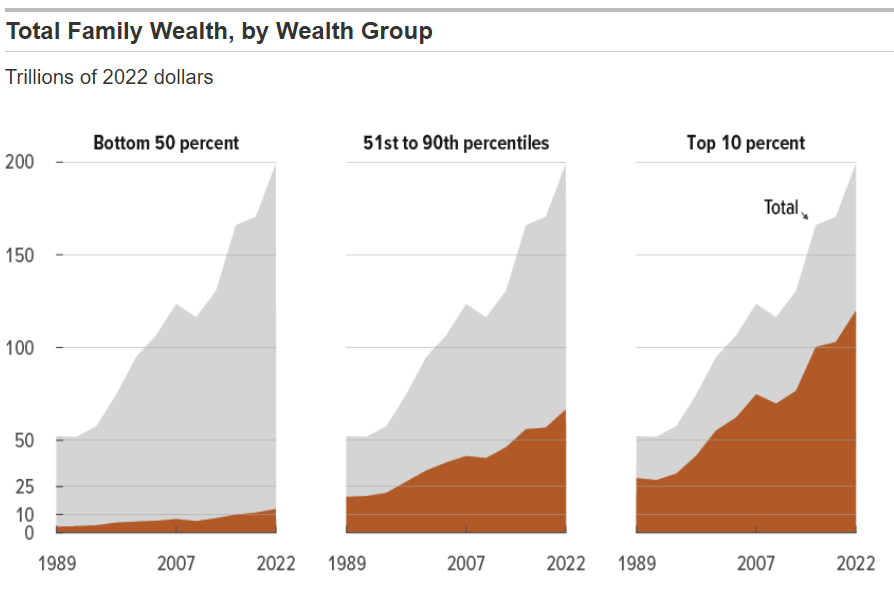

It is a have a look at the expansion in whole family wealth by the decrease, center and higher courses since 1989:

Clearly, the highest 10% has a a lot higher share of whole wealth than the underside 90%.

However this shocked me:

Between 1989 and 2022, the whole wealth held by households within the prime 10 % of the distribution elevated by 306 %; that of households within the 51st to ninetieth percentiles elevated by 243 %; and that of households within the backside half of the distribution elevated by 285 %. In 2022, households in these classes had wealth totaling $119.6 trillion, $66.5 trillion, and $12.8 trillion, respectively.

The share positive factors have been far nearer than I might have anticipated.

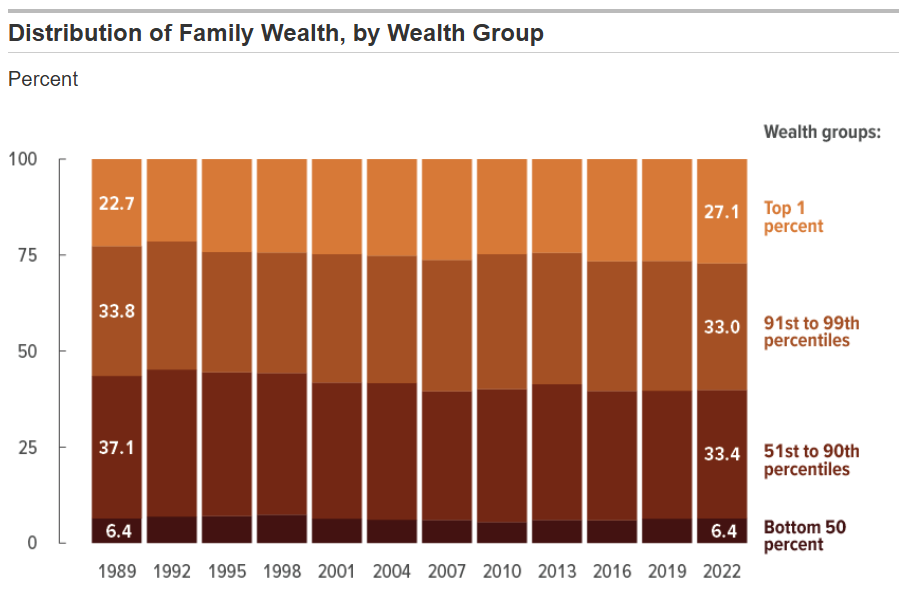

Right here’s the chart model that reveals the distribution of wealth over time:

The underside 50% has been constant. The largest change is a shrinking share of wealth within the 51-90% group and a rising share for the highest 1%. The rest of the highest 10% has been kind of unchanged.

So principally the entire wealth inequality we’ve skilled has gone to the tip of the spear.

Drilling down even additional, in response to Fed knowledge, the highest 0.1% — the highest 1% of the highest 1% — now controls 13.8% of the wealth in America, up from 8.6% in 1989. It’s not that the wealthy have gotten richer. It’s that the filthy wealthy have gotten even filthier.

The best way I might summarize all of this knowledge seems like this:

- Shares are a very powerful monetary asset for the higher class.

- Housing is a very powerful monetary asset for the center class.

- Social Safety is a very powerful monetary asset for the decrease class.

This isn’t everybody. The homeownership charge is 65%. Practically two-thirds of American households now personal shares in some type.

Nonetheless, it’s essential to acknowledge that Social Safety stays a significant monetary asset for a lot of People.

I hope we don’t screw it up sometime.

Additional Studying:

The Center Class, The Prime 10% and the Backside 50%