Gold is on hearth.

The yellow metallic is up greater than 60% this 12 months. It’s risen almost 30% within the final 3 months alone.

It’s arduous to get a nuanced opinion on gold as a holding. There are lots of excessive opinions. Some folks hate gold and suppose it’s ineffective. Some folks love gold and suppose it’s one of the best safety in opposition to authorities spending, the greenback and the Fed.

I’m not an enormous fan of going to extremes. I desire to dwell within the grey space, not black or white.

I personally don’t personal any gold however I perceive why some buyers have an allocation. Gold is likely one of the most unusual property there may be. It actually marches to its personal drummer.

Let’s do some historical past lesson on the returns of gold vs. the S&P 500 by decade after which I’ll share why I don’t personal any.

Gold went nuts within the Seventies:

One of many largest causes gold was up nearly 30% per 12 months within the 70s was that Nixon ended the Bretton Woods system that pegged gold to the greenback. Add to that sky-high inflation, oil worth shocks, a weak greenback, authorities spending, and it was like throwing a match in a Jake’s Fireworks retailer.

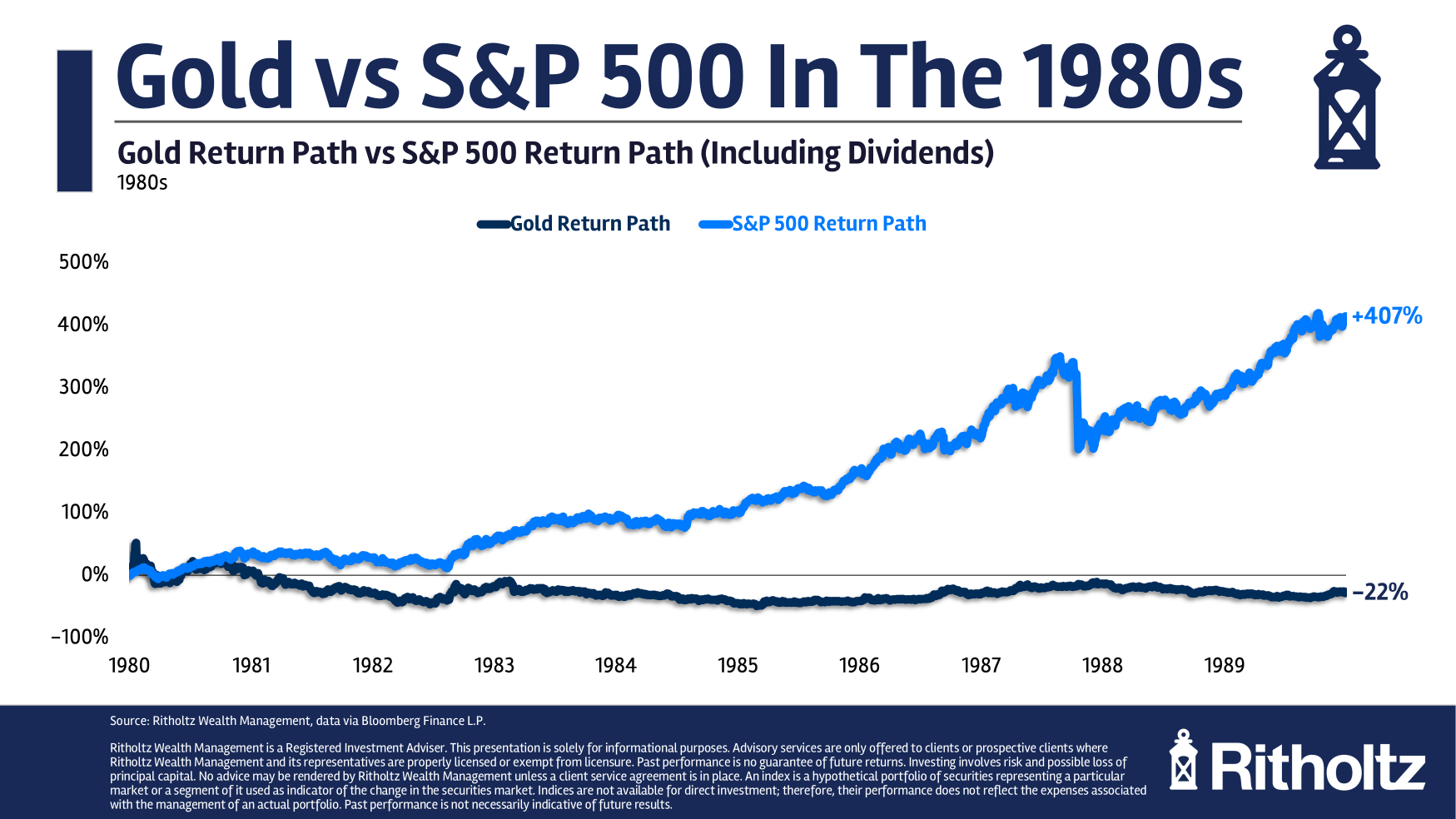

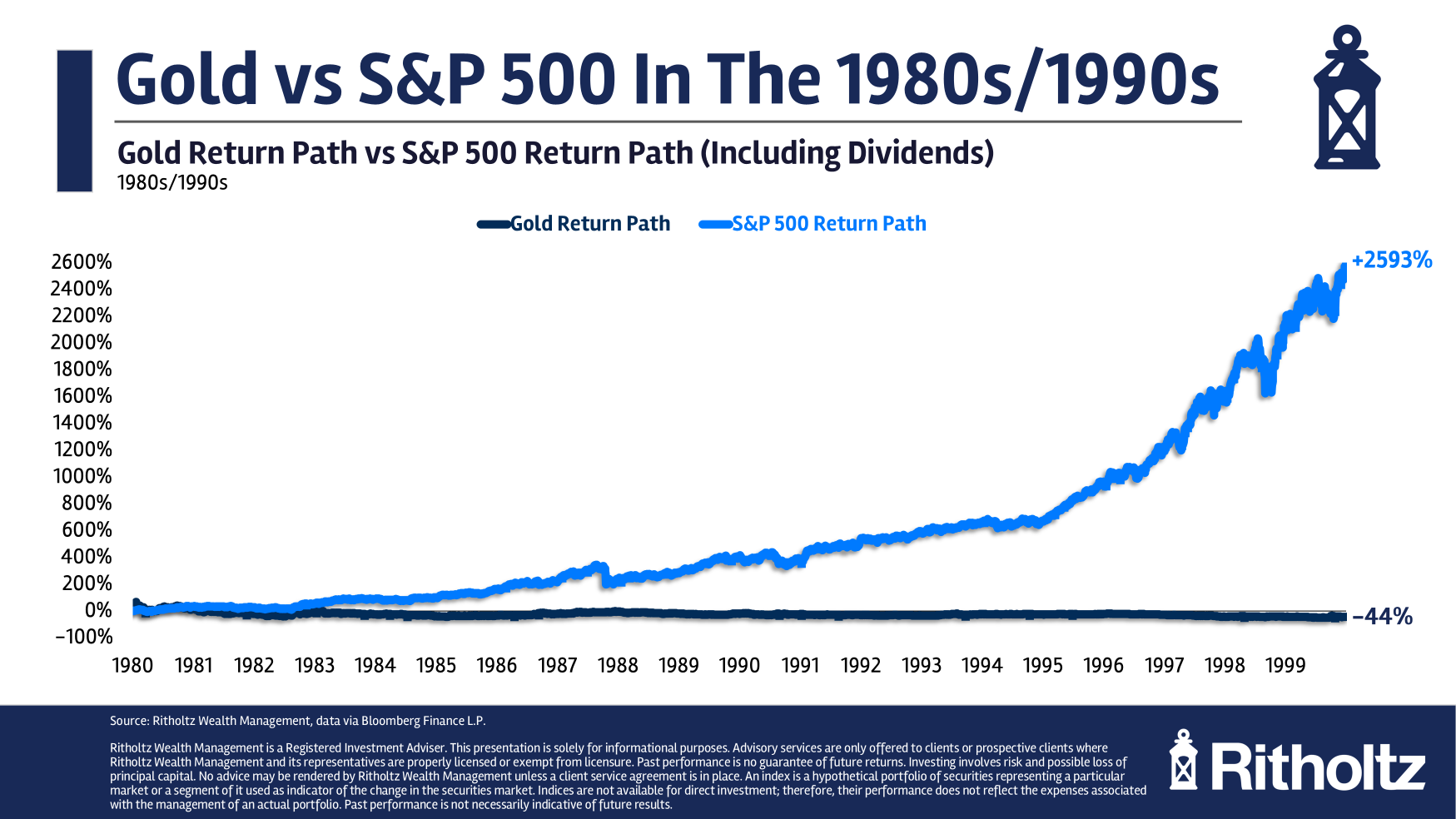

The opposite aspect of that insane run-up was a big-time reversal within the Nineteen Eighties as shares went nuts and gold received crushed:

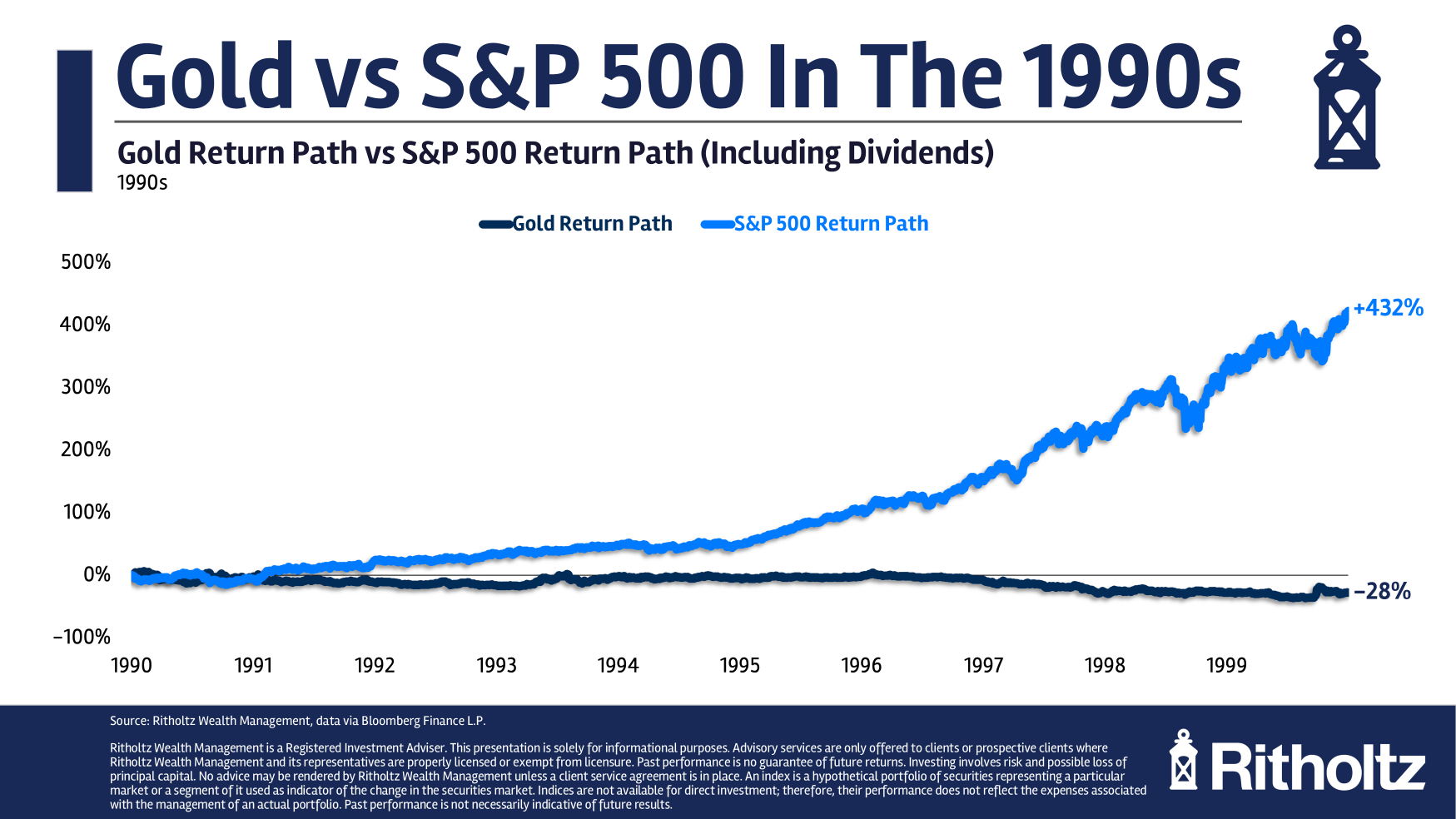

That continued within the Nineties:

Gold had a max drawdown of almost 70% and a adverse return for 20 years. On an inflation-adjusted foundation, gold didn’t move the excessive from the early-Nineteen Eighties till final 12 months.

It was a protracted tough patch.

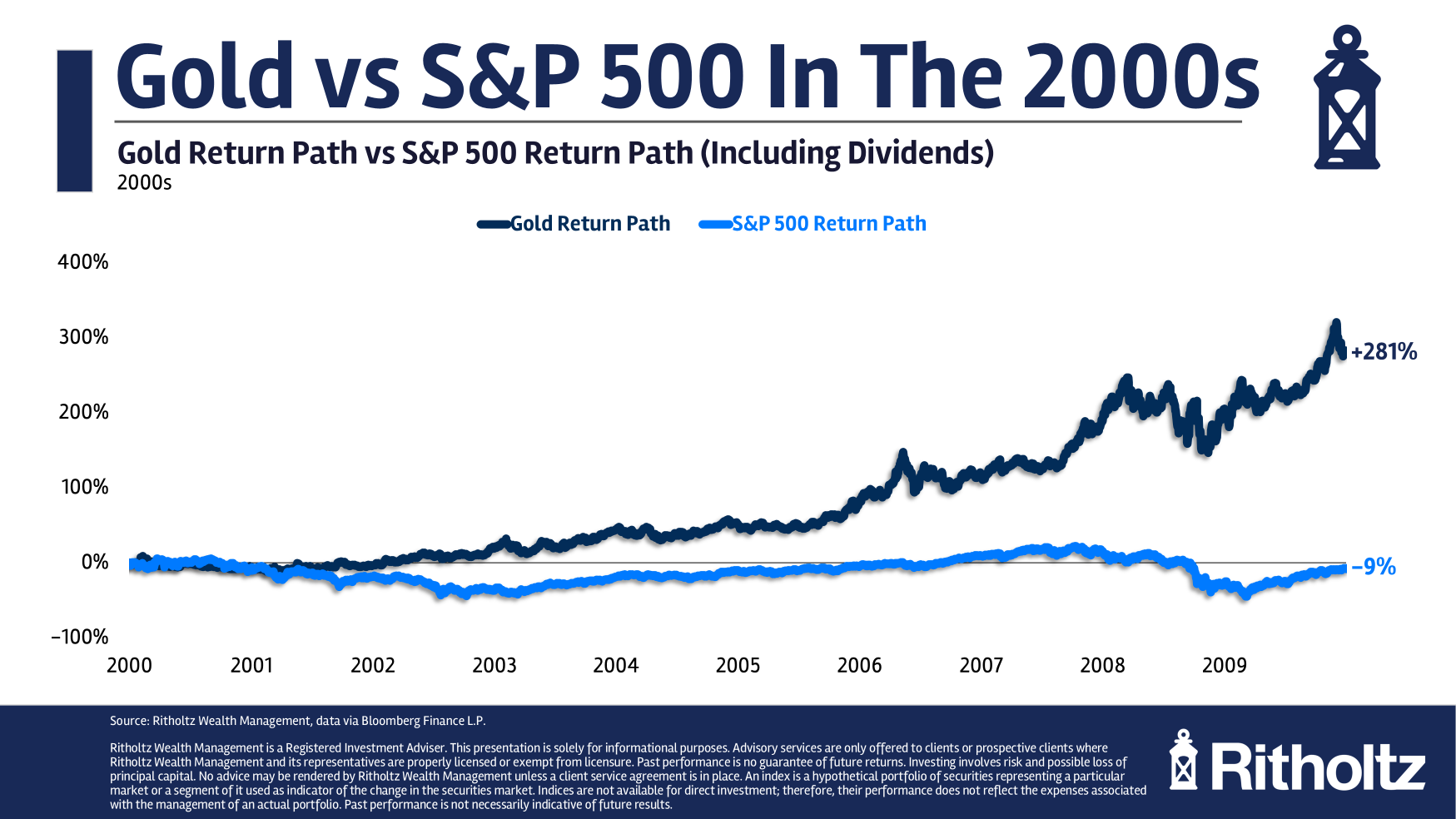

Then simply when everybody had given up on gold as an asset class, there was a misplaced decade for the S&P 500 within the 2000s whereas gold had an enormous restoration:

Gold shined and proved itself as soon as once more to be a great hedge in opposition to monetary crises. The arrival of GLD as an ETF in 2004 absolutely performed a job right here. For the primary time ever buyers had a simple means to purchase gold that didn’t require storing it someplace themselves.

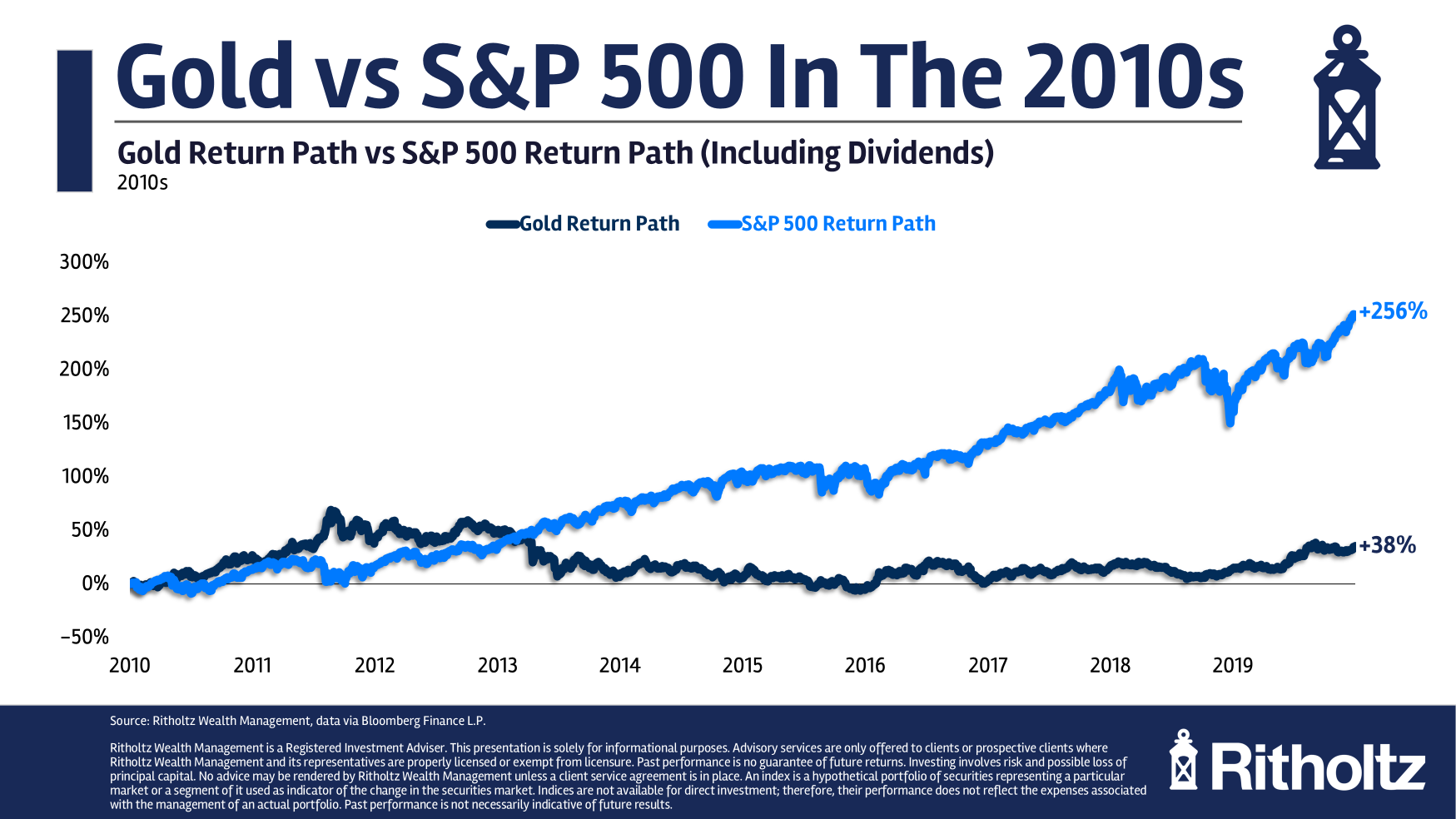

By the summer season of 2011, GLD had briefly surpassed SPY when it comes to property below administration. It wouldn’t final. That was the height for fairly a while as gold went on to have a tough decade:

Gold was up a bit of greater than 3% per 12 months versus a return of just about 14% yearly for U.S. shares within the 2010s.

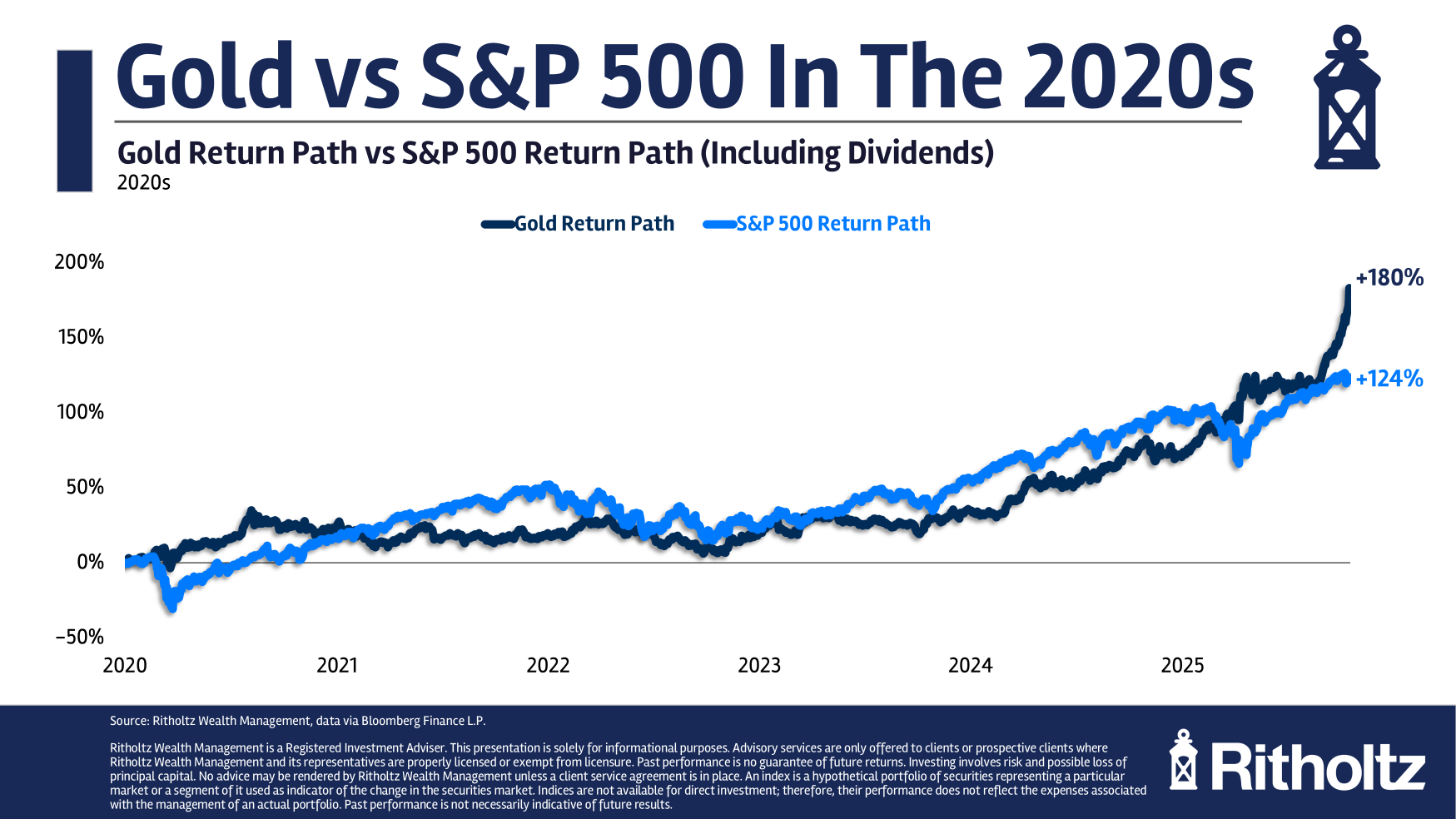

Within the 2020s gold and the S&P 500 are each booming, with gold taking off like a rocket ship in latest months:

Gold is a fairly good diversifier, particularly throughout robust a long time for shares. It’s additionally been used as a type of foreign money or asset for hundreds of years. That historical past needs to be price one thing.

So why don’t I personal any gold?

A part of it’s the truth that it’s not a productive asset. It doesn’t do something — no earnings or money circulation.

A part of it’s I’m huge on innovation and gold looks as if a relic to me. If I had to decide on I feel Bitcoin, which I do personal, makes extra sense going ahead.

However I feel it boils all the way down to the historic return profile. I do know shares undergo booms, busts and misplaced a long time however gold went on such a horrible 40-year run that it makes me nervous to carry it for the long term.

Take a look at the run within the Nineteen Eighties and Nineties:

Then you definately had a great decade within the 2000s that was roughly adopted by but one other misplaced decade within the 2010s.

From 1980 via year-end 2019, these have been the overall returns for gold and the S&P 500:

- Gold +197%

- S&P 500 +8,242%

So that you’re annual returns of two.8% versus 11.7% respectively. The worst half is that the annual inflation price was 3.1%, which means gold misplaced cash to inflation over a four-decade-long stretch.

Utilizing the identical calendar year-end returns going again to 1928, the worst 40-year return for the S&P 500 was 8.5% per 12 months.

Now you could possibly say I’m cherry-picking right here. If you happen to embody the Seventies, the long-term returns for gold look significantly better. Since 1970, gold has been up extra like 8.5% per 12 months.

I simply don’t have the abdomen for an asset that has the flexibility to expertise 3 misplaced a long time out of 4.

It might be good to personal some gold when it goes via growth occasions like 2025 however it’s a must to get used to not all the time proudly owning the most well-liked asset every year.

I like being diversified however that doesn’t imply it’s a must to personal the whole lot.

I perceive why many buyers do personal gold. It acts as a type of insurance coverage. It has little correlation to some other property. It’s unstable which makes it a great candidate for rebalancing functions. I completely perceive the enchantment.

I even get why some buyers suppose gold issues extra now as a result of authorities across the globe are spending and borrowing a lot cash whereas displaying no indicators of slowing down.

Truthful sufficient.

You all the time must be comfy with what you personal and why you personal it. The identical is true for the investments you don’t personal.

Typically it’s a must to watch different folks personal property which are up 60% in a 12 months and be OK with the truth that you don’t personal any.

Avoiding FOMO isn’t all the time straightforward however that’s a part of your job as an investor generally.

To every their very own.

Additional Studying:

What’s the Funding Case For Gold?