I discussed within the earlier publish When to Declare Social Safety: How A lot Does It Matter, Anyway? {that a} frequent advice for a married couple is for the lower-earning partner to assert Social Safety early at 62, and for the higher-earning partner to delay claiming till age 70. A number of readers raised a priority that claiming Social Safety at 62 could elevate the ACA medical health insurance premiums. The identical concern additionally applies to a single particular person contemplating claiming at 62.

We’re assuming that you just’re not working once you’re contemplating claiming Social Safety at 62. In any other case, the Social Safety earnings take a look at could apply, which defeats the aim of claiming at 62. While you’re not eligible for Medicare but, you’ll probably purchase medical health insurance from the ACA market until you will have retiree medical health insurance otherwise you’re lined by means of your partner.

ACA Premium Subsidy, Cliff or Ramp?

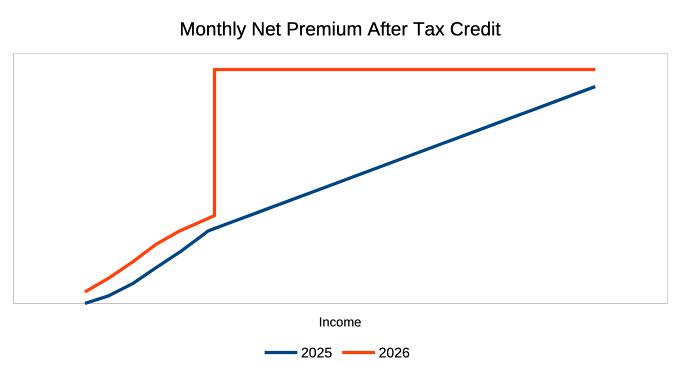

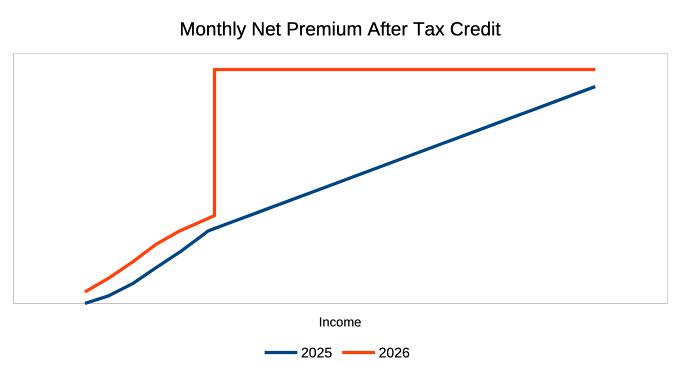

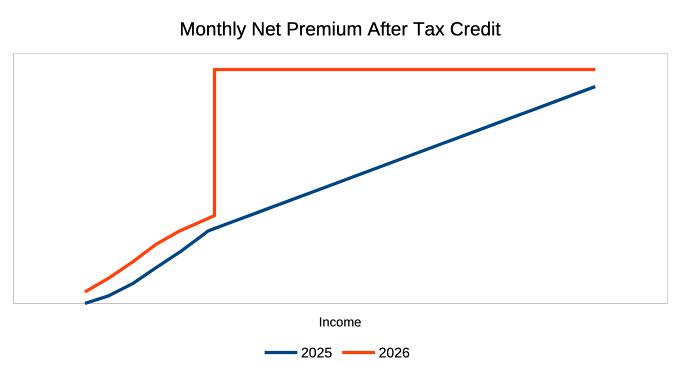

How does claiming Social Safety have an effect on the ACA medical health insurance premiums? It will depend on your family earnings. I had this chart in my publish The ACA Premium Subsidy Cliff After the 2025 Trump Tax Legislation:

The federal authorities is at the moment shut down because of disagreements in how ACA medical health insurance premiums might be structured in 2026 and past. The blue line within the chart represents the legislation in impact in 2025. As your family earnings will increase, your ACA medical health insurance premiums additionally enhance on a ramp. The orange line represents what is going to occur in 2026 and past if Congress doesn’t move a brand new legislation to cease it. The ACA medical health insurance premiums might be larger in any respect earnings ranges, after which abruptly bounce up a cliff when your family earnings exceeds 400% of the Federal Poverty Stage (FPL), which is $62,600 for a single-person family, and $84,600 for a two-person family, in 2026.

The primary query is whether or not there might be a cliff.

Suppose there’s a cliff (the orange line), and your family earnings is already over the cliff earlier than claiming Social Safety (the flat a part of the orange line). In that case, you’re already paying the complete worth with none premium tax credit score. Receiving extra earnings from Social Safety will NOT have an effect on your ACA medical health insurance premiums.

Suppose there’s no cliff (the blue line), or suppose there’s a cliff, however your family earnings will nonetheless be beneath 400% of FPL after claiming Social Safety (the left a part of the orange line). In that case, every $100 of incremental earnings from Social Safety will enhance your ACA medical health insurance premiums by $10 – $20.

If there’s a cliff (the orange line), and claiming Social Safety will push your family earnings from beneath the 400% of FPL cliff to above it, your ACA medical health insurance premiums will bounce loads. That’ll make it not value claiming Social Safety at 62.

| Family Earnings | Cliff | No Cliff |

|---|---|---|

| > 400% FPL earlier than SS | No Impact | Enhance by 10% of the incremental earnings |

| < 400% FPL after SS | Enhance by 10-20% of the incremental earnings | Enhance by 15-20% of the incremental earnings |

| Cross 400% FPL with SS | Large Soar | Enhance by 10-20% of the incremental earnings |

Changing or Growing Earnings?

Word that the desk above says “incremental earnings.” The incremental earnings isn’t essentially 100% of the Social Safety advantages you’ll obtain. The incremental earnings could be zero or unfavourable if receiving Social Safety will solely change different earnings.

The place does your family earnings come from earlier than claiming Social Safety?

Case 1. Suppose you’re withdrawing from a pre-tax account, equivalent to a Conventional IRA, to cowl dwelling bills earlier than claiming Social Safety. A $20,000 withdrawal counts as $20,000 of earnings for ACA medical health insurance. You don’t have to withdraw as a lot to cowl dwelling bills now after you declare Social Safety. $20,000 in Social Safety advantages additionally counts as $20,000 of earnings for ACA medical health insurance. Your earnings stays the identical once you change the identical quantity of withdrawals from a pre-tax account with Social Safety.

The IRS taxes at most 85% of Social Safety advantages, whereas many states don’t tax Social Safety. In distinction, pre-tax account withdrawals are totally taxable by the IRS and most states. While you obtain $20,000 in Social Safety advantages, it may change possibly $22,000 in pre-tax account withdrawals to cowl the identical quantity of dwelling bills.

Your incremental earnings might be unfavourable, and your ACA medical health insurance premiums will lower in the event you change a bigger quantity in pre-tax withdrawals with Social Safety advantages.

Case 2. Suppose you’re promoting appreciated investments in a taxable account to cowl dwelling bills earlier than claiming Social Safety. Solely the capital positive factors portion counts as earnings for ACA medical health insurance. Suppose your investments comprise 30% as price foundation and 70% as capital positive factors. $14,000 from promoting $20,000 value of investments counts as your earnings for ACA medical health insurance.

You don’t have to promote a lot to cowl dwelling bills now after you declare Social Safety. $20,000 in Social Safety advantages counts as $20,000 in your earnings for ACA medical health insurance. Changing funding gross sales with Social Safety will enhance your earnings for ACA medical health insurance, however by solely 30% of the Social Safety advantages on this instance.

Case 3. Suppose your present family earnings comes from a pension, rental earnings, curiosity and dividends, and different earnings that may’t be stopped after claiming Social Safety. On this case, 100% of the Social Safety advantages might be incremental earnings.

| Supply of Earnings Earlier than SS | Incremental Earnings |

|---|---|

| Pre-tax account withdrawals | Zero or unfavourable, after lowering withdrawals |

| Promoting investments in a taxable account | Partial, after lowering funding gross sales |

| Unstoppable earnings | Full |

How Many Years on ACA Well being Insurance coverage?

Claiming Social Safety at 62 versus claiming at 65 once you qualify for Medicare will probably have an effect on your ACA medical health insurance premiums for 3 years. When you have a youthful partner who’s additionally on ACA medical health insurance, claiming early may have an effect on your ACA medical health insurance premiums till the youthful partner can be 65. The extra years you’ll use ACA medical health insurance, the extra impression there could also be from claiming Social Safety at 62.

Evaluate with Delaying Social Safety

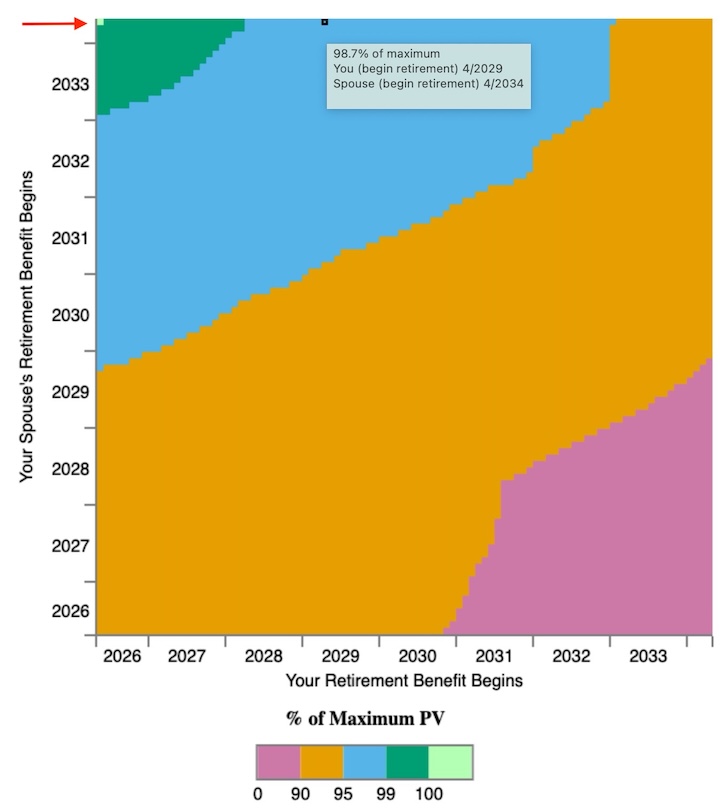

I ran a take a look at case in Open Social Safety for a married couple, each born in 1964 (might be 62 in 2026). One partner has a Major Insurance coverage Quantity of $2,000 per 30 days, and the opposite has $3,000 per 30 days. The advice from Open Social Safety is for the lower-earning partner to assert at 62 and for the higher-earning partner to attend till 70.

If the lower-earning partner waits till 65, this couple would nonetheless obtain 98.7% of the utmost current worth from Social Safety. The distinction within the whole current worth is $9,470 over their lifetime. See extra on tips on how to use Open Social Safety in When to Declare Social Safety: How A lot Does It Matter, Anyway?

Suppose their incremental earnings from claiming Social Safety falls into the “partial” class, and the impact on their ACA medical health insurance premium isn’t a giant bounce, however 10-20% of the incremental earnings. Then they should stability the rise in ACA medical health insurance premiums in opposition to the loss within the current worth of Social Safety advantages if the lower-earning partner waits till age 65.

$2,000 per 30 days at Full Retirement Age interprets to $16,900 per yr when the advantages are claimed early at age 62. Suppose receiving $16,900 in Social Safety advantages brings 30% of the advantages as incremental earnings, and it will increase their ACA medical health insurance premiums by 15% of the incremental earnings. The rise within the ACA medical health insurance premiums for 3 years is:

$16,900 * 30% * 15% * 3 = $2,282

That’s a lot lower than the $9,470 loss in whole current worth from delaying claiming till age 65. The lower-earning partner ought to declare at 62 regardless of the rise in ACA medical health insurance premiums.

Alternatively, if 100% of the $16,900 in Social Safety advantages might be incremental earnings, and it’ll push their earnings over a cliff, which can enhance their ACA medical health insurance premiums by $2,000 a month, then clearly they need to maintain off claiming Social Safety till they not use ACA medical health insurance.

It All Relies upon

Claiming Social Safety at 62 doesn’t essentially enhance your earnings for ACA medical health insurance. In some instances, it may lower your earnings and decrease your premiums. If it does enhance your earnings, the incremental earnings isn’t essentially 100% of the Social Safety advantages. It may be solely a small proportion of the advantages. The premium enhance from the incremental earnings could be lower than the loss within the whole current worth of Social Safety advantages in the event you select to delay claiming till 65. Don’t be afraid to assert Social Safety at 62 solely as a result of it could elevate your ACA medical health insurance premiums.

In another instances, claiming Social Safety at 62 will enhance your earnings by a big proportion of the advantages, which can push it over a cliff and lift your ACA medical health insurance premiums by an enormous quantity, presumably greater than the Social Safety advantages obtained.

All of it will depend on whether or not there’s a cliff, and if that’s the case, the place your family earnings is relative to the cliff earlier than and after claiming Social Safety. A ramp is far simpler to cope with than a cliff.

It’s best to calculate your incremental earnings primarily based on the earnings composition earlier than claiming Social Safety. Wait to see how the cliff state of affairs might be resolved. Then calculate the impact in your ACA medical health insurance premiums, and examine with delaying claiming Social Safety.

Handle Threat

Lastly, legal guidelines can change, and your monetary state of affairs can change. For those who assume it’s too dangerous and also you wish to keep away from any problems, it’s OK to delay claiming Social Safety till you not use ACA medical health insurance.

It comes all the way down to “What if I’m mistaken?” What in the event you assume you’ll go over a cliff, however you don’t? You delay claiming and unnecessarily lose 1.3% of your Social Safety advantages in my instance. What in the event you assume you’re safely underneath the cliff, and also you’re abruptly over? You pay an enormous quantity in ACA medical health insurance premiums. Shedding 1.3% of the lifetime Social Safety advantages could also be a small worth to pay for the peace of thoughts that your ACA medical health insurance premiums received’t blow up in your face. See Use Pascal’s Wager When You’re Not Positive About Tax Guidelines.

Study the Nuts and Bolts

I put every part I exploit to handle my cash in a e-book. My Monetary Toolbox guides you to a transparent plan of action.

Learn Critiques