Michael and I have been out in Las Vegas final week to placed on a reside Animal Spirits on the annual FPA convention.

It was a enjoyable journey.

We ate some good meals, had some fancy cocktails, performed some blackjack and talked some synthetic intelligence with just a few hundred monetary advisors.

On stage we did a deep dive into what’s occurring with the largest firms on the planet and their push for AI supremacy. You’ll be able to hearken to the audio from the podcast right here:

When you weren’t one of many fortunate individuals within the MGM convention middle that day I assumed it will be helpful to supply a number of the slides we coated in our presentation.

First up we talked in regards to the shift from investing in intangible to tangible property by the massive tech corporations utilizing Meta’s new Hyperion information middle for example:

These firms imagine AI is well worth the funding however it is a threat and a change to their enterprise fashions.

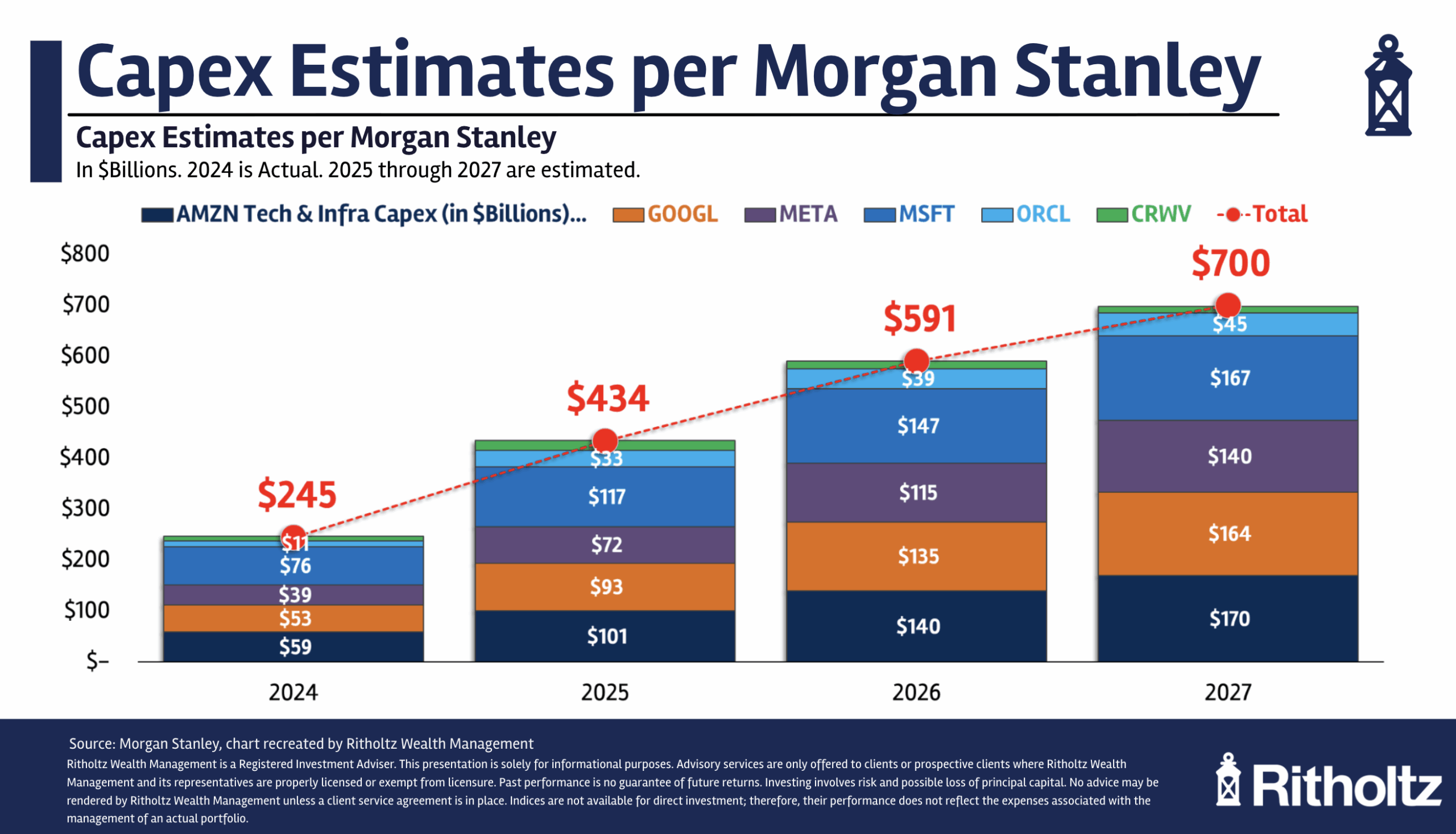

Spending from the hyperscalers continues to go up, up and away:

How lengthy will inventory market traders permit this? The businesses spending cash are getting the good thing about the doubt that this can all repay. I do marvel when the market will need to see a giant ROI on this spend.

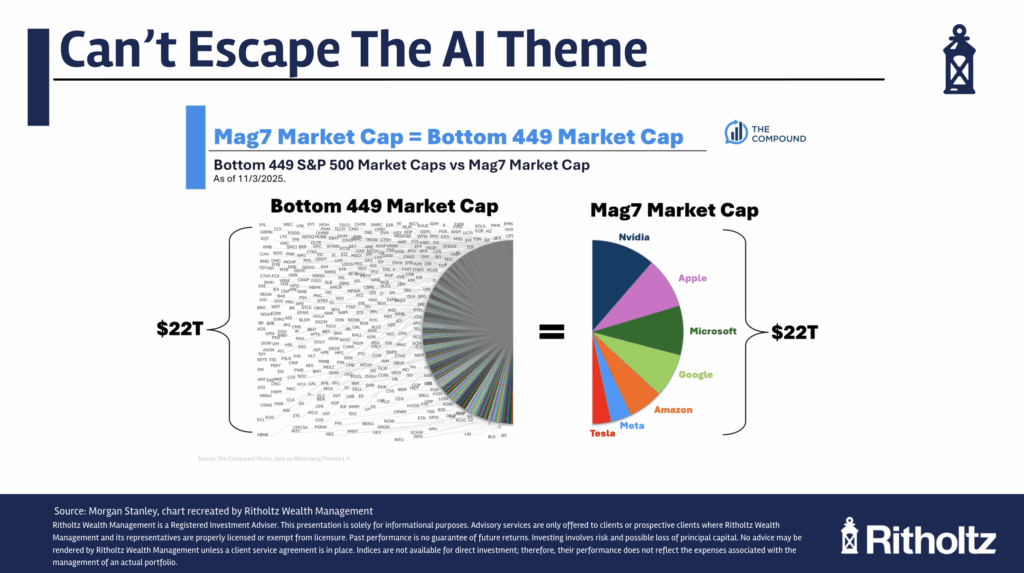

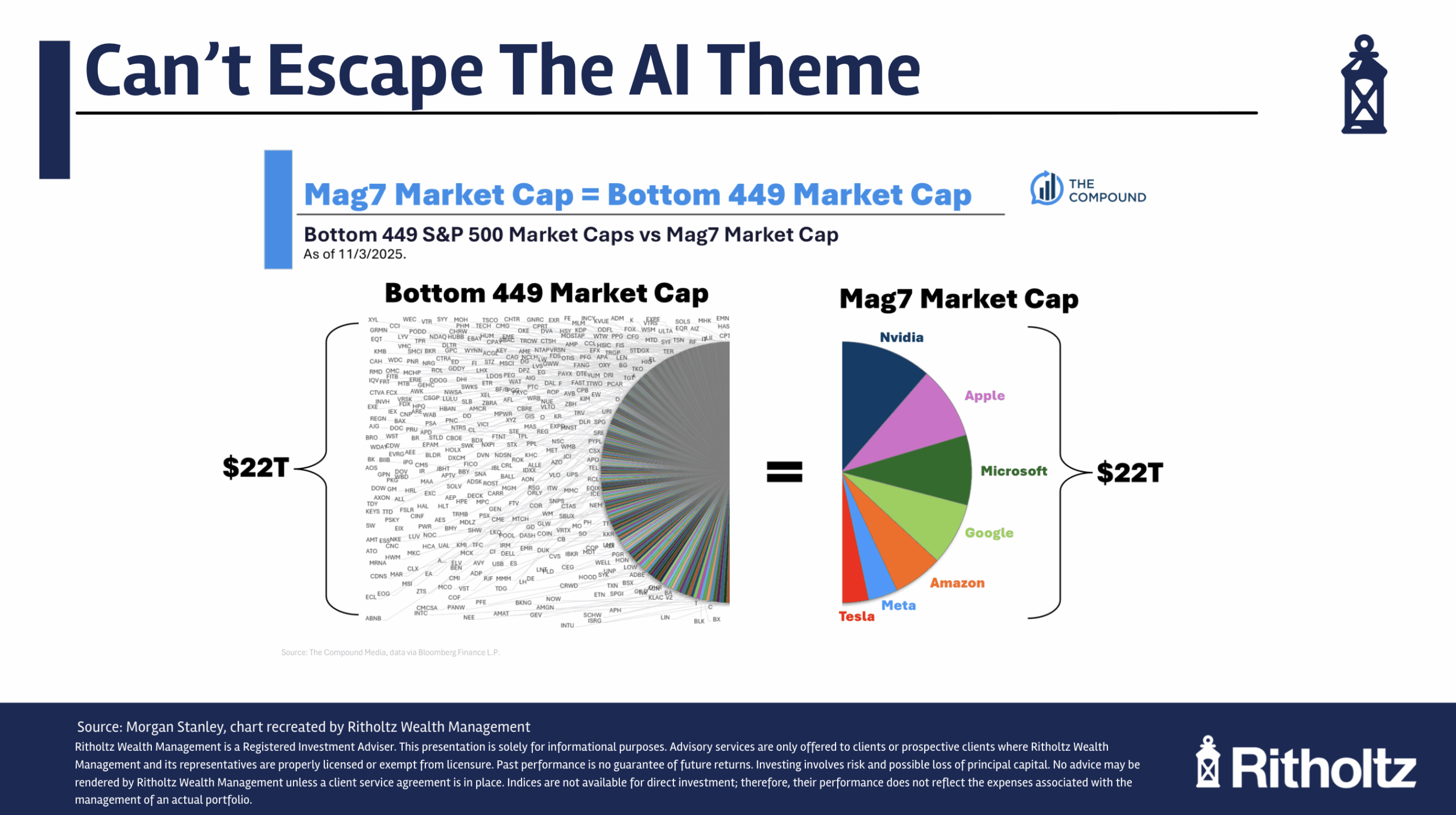

The sheer dimension of those firms is astounding:

The Magazine 7 shares at the moment are as massive as the underside 449 shares within the S&P 500 mixed.

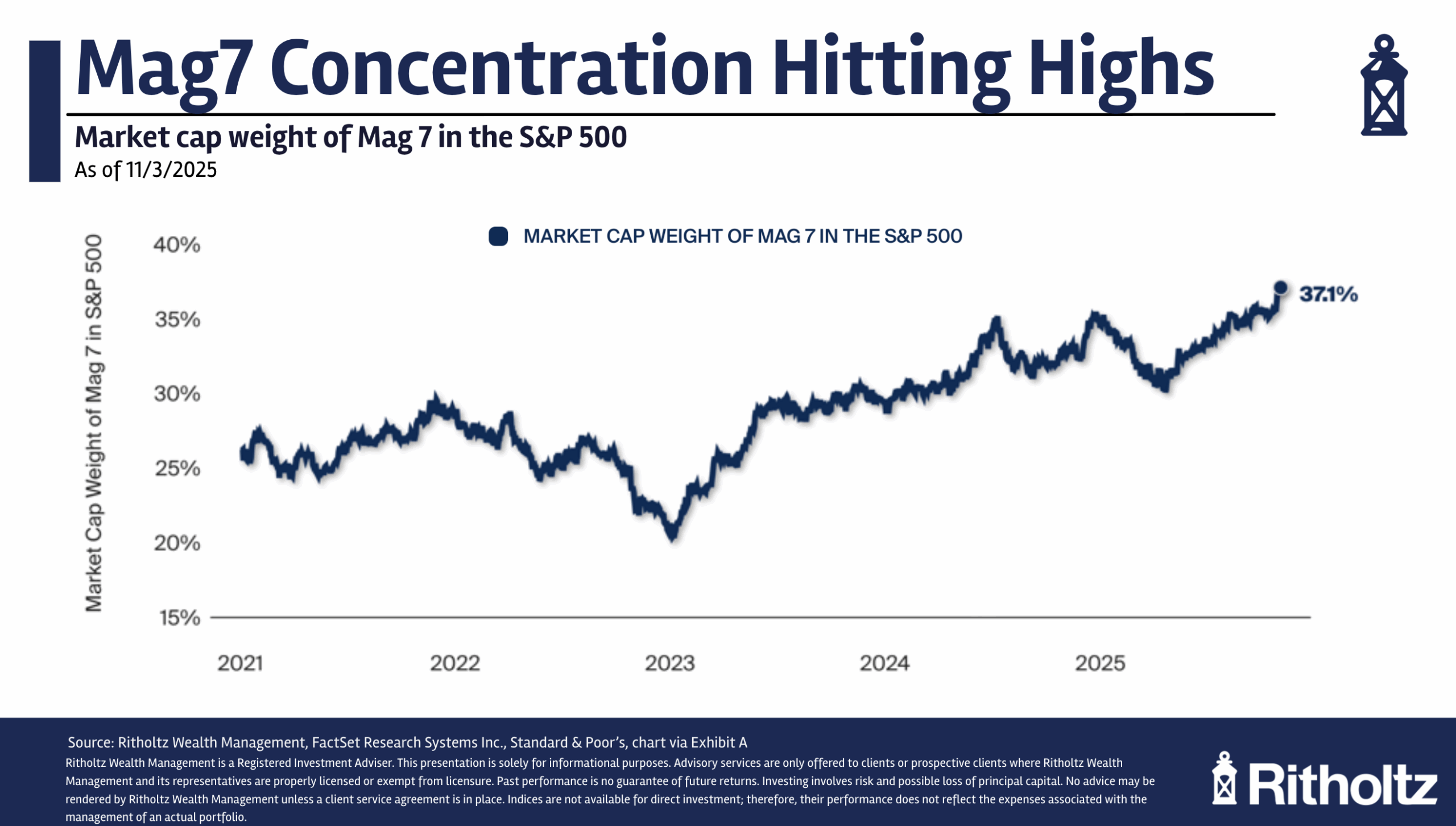

It appears we’ve entered the brand new regular of inventory market focus:

Not less than for now.

One of many causes for that is that fundamentals are matching the inventory value positive aspects:

Nvidia is now the largest firm within the U.S. inventory market however the elementary progress has exceeded the worth progress for the reason that launch of ChatGPT.

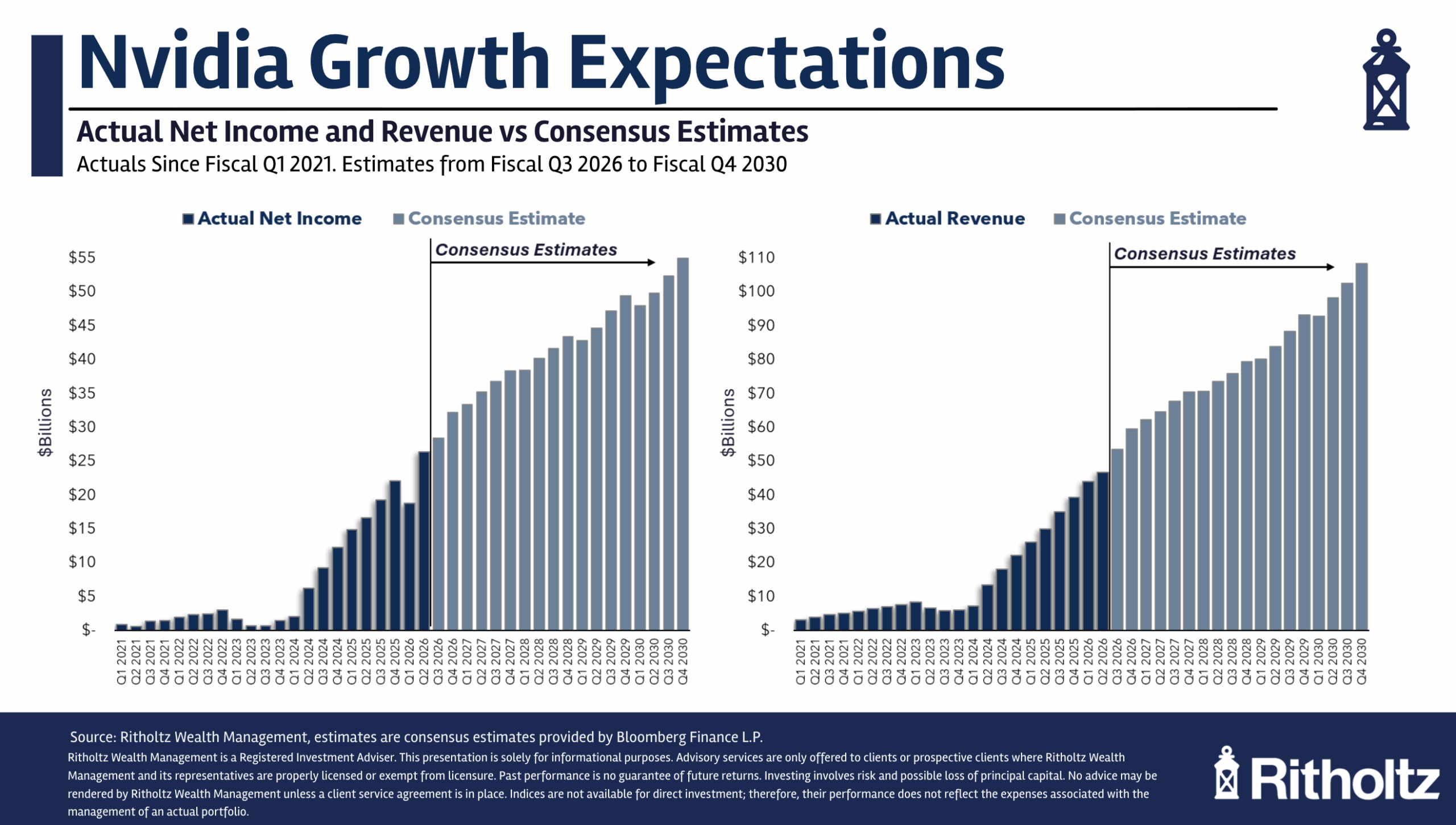

Analysts anticipate the expansion to proceed:

Is it attainable for a $5 trillion firm to develop at these insane ranges for this lengthy? We will see.

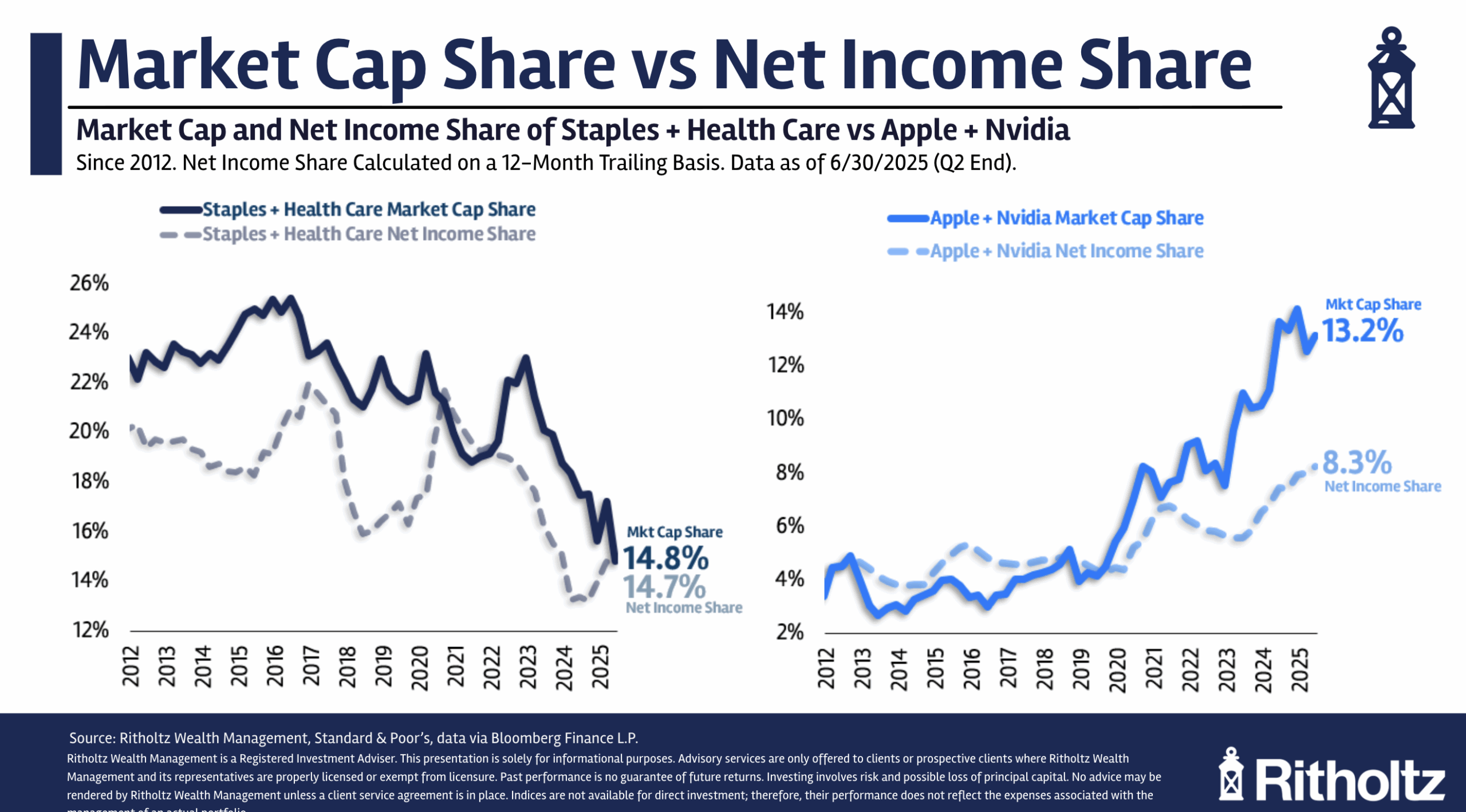

Right here’s an actual face-blower for you:

Apple and Nvidia alone at the moment are price almost as a lot because the well being care and shopper staples sectors mixed.

Right here’s one other one for you — the market cap of the Magazine 7 shares is now the identical dimension because the vitality, supplies, shopper staples, well being care, financials, utilities and actual property sectors mixed.

There have been cases of inventory market focus prior to now. However we’ve by no means had firms this environment friendly earlier than.

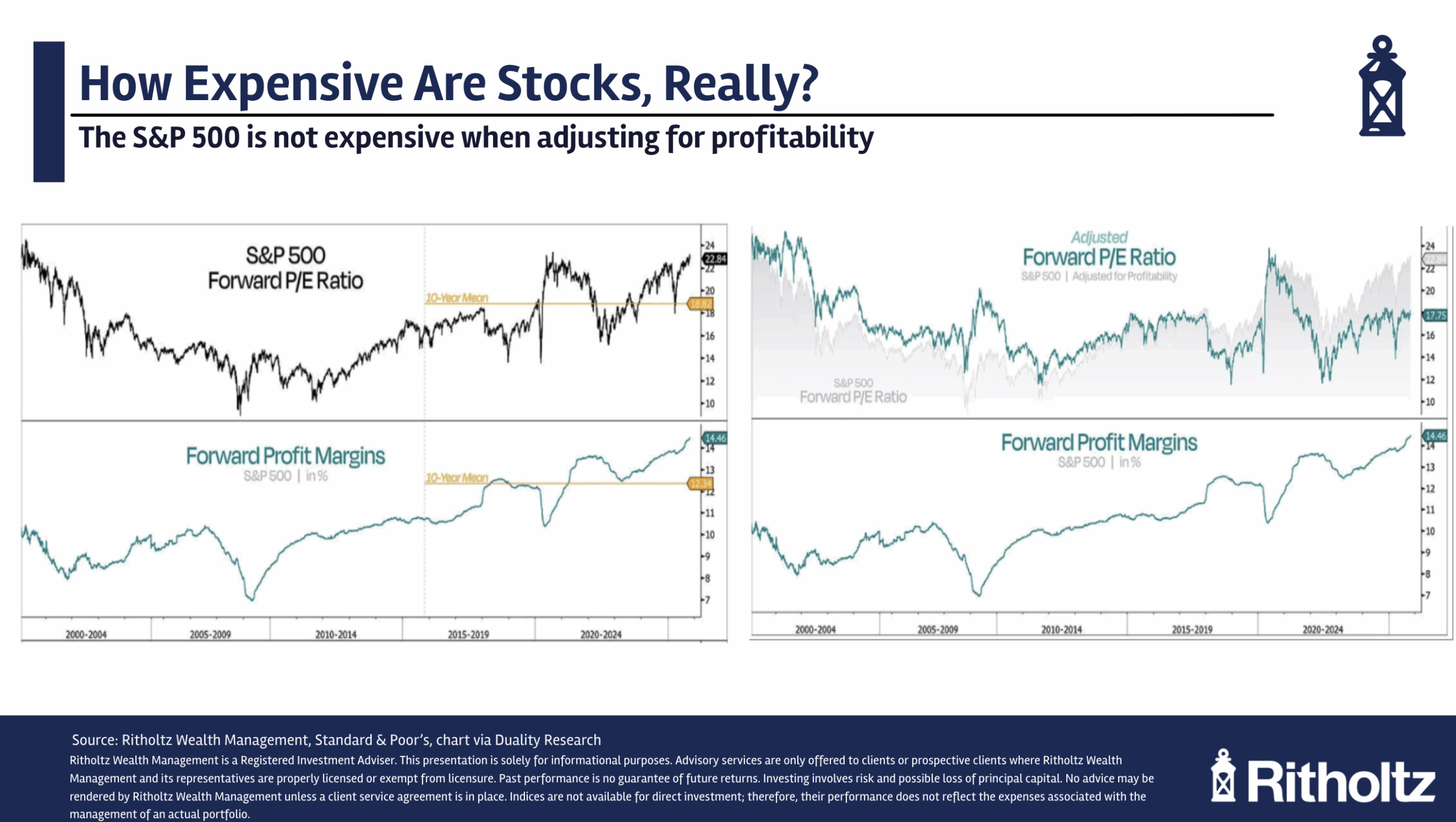

When you take this effectivity into consideration by adjusting valuations for the modifications in margins, the market doesn’t seem as costly as you would possibly assume:

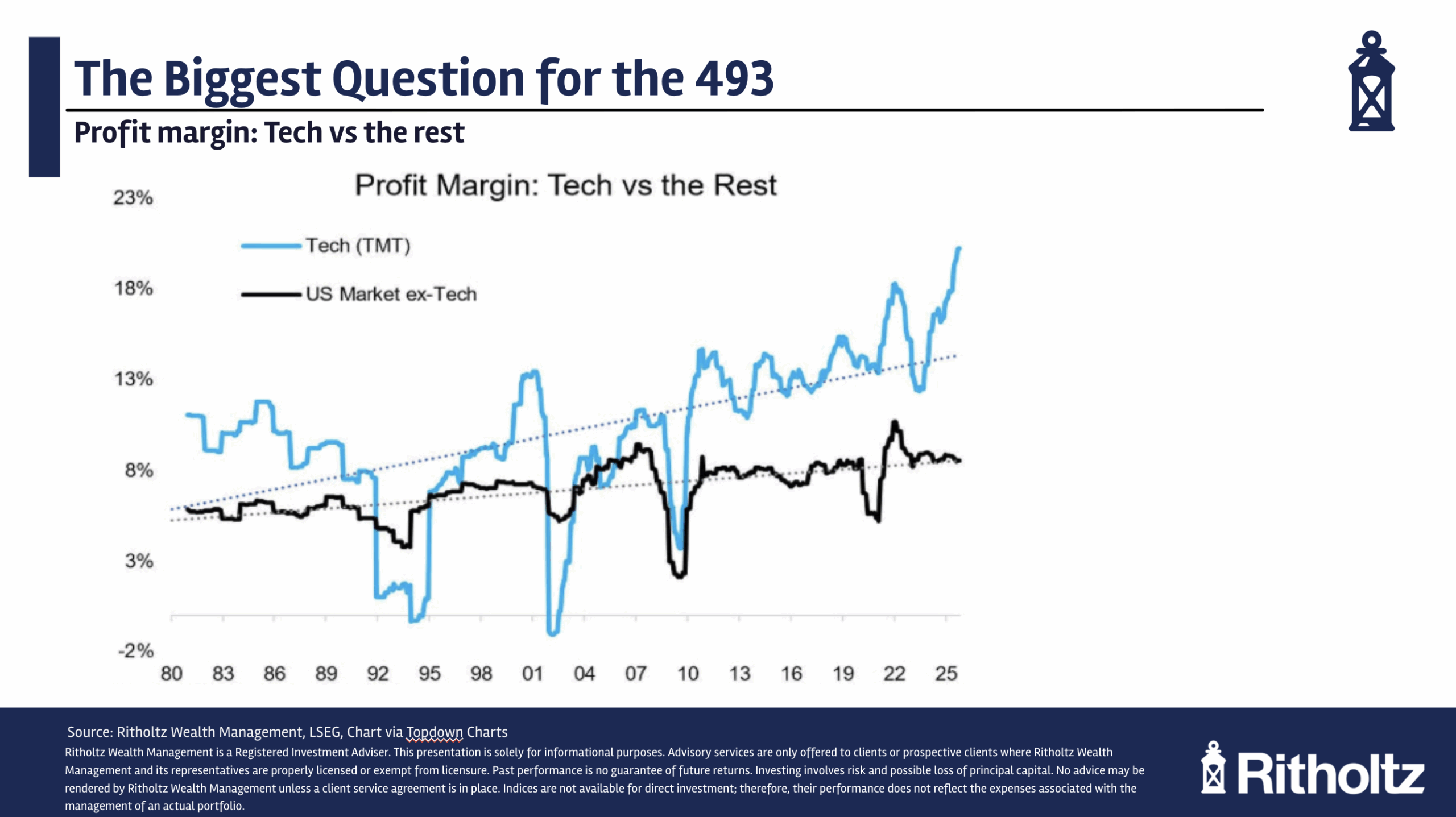

One of many largest questions of the AI increase is how a lot the opposite firms that aren’t making these investments will profit.

Outdoors of tech, the margins are a lot smaller:

Will AI enhance productiveness sufficient for a few of these different firms to extend their margins? That will be one thing.

And at last — the query everybody needs to know — will this finish badly for these big firms?

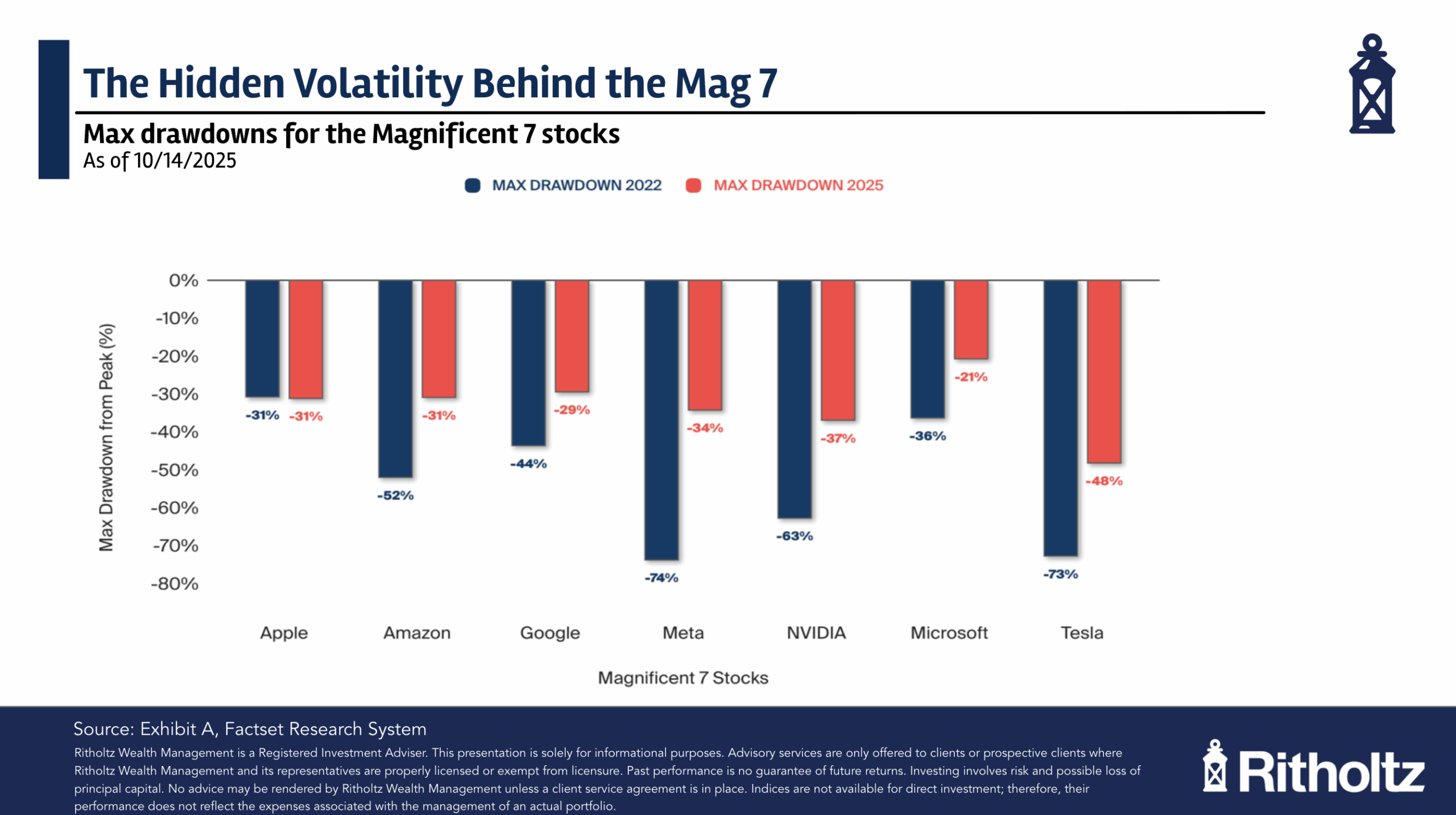

The Magazine 7 is not any stranger to crashes this decade:

When the expectations get out of whack will we see some or all of those shares crash?

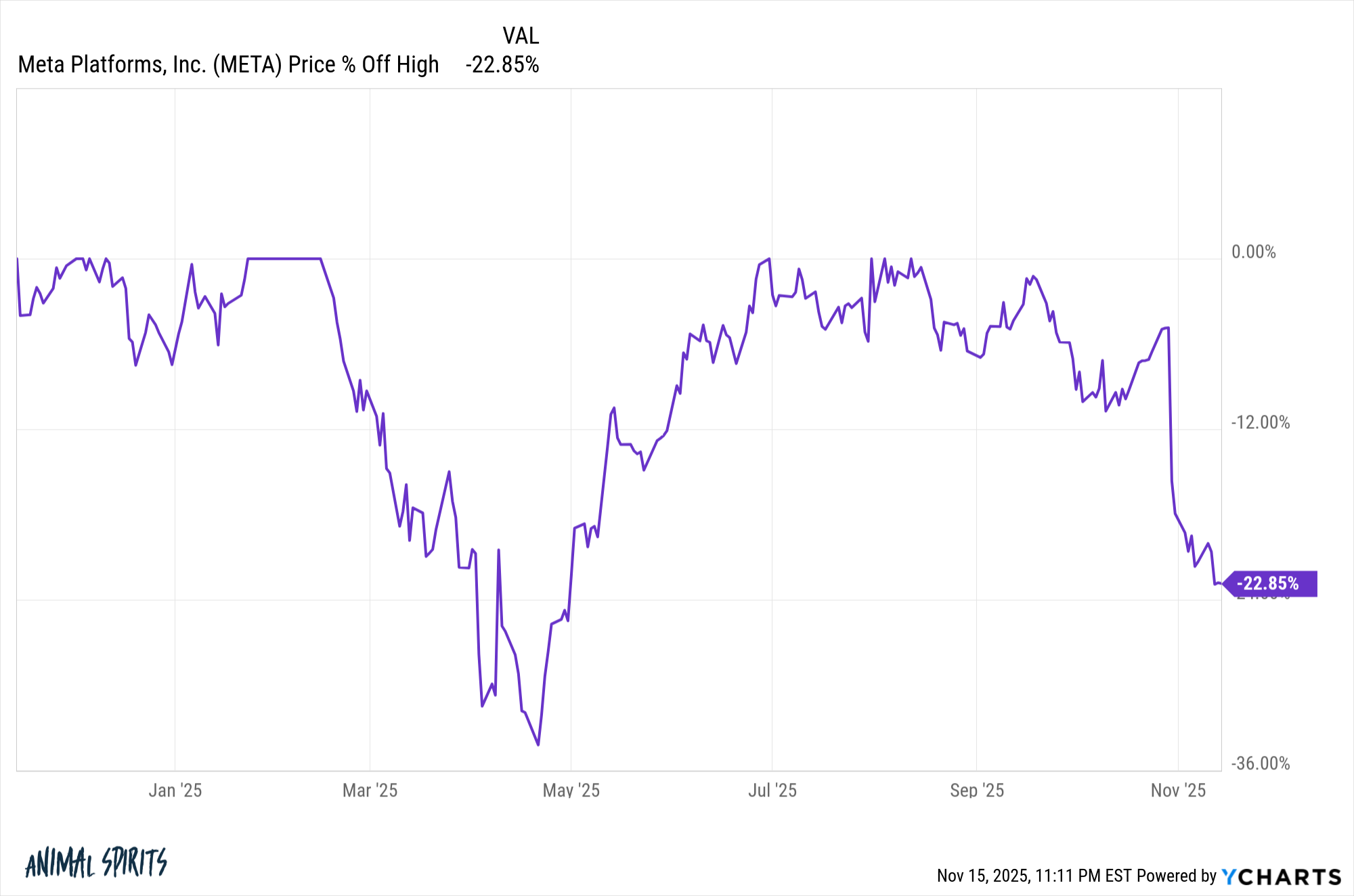

And what does a crash seem like? A 20% decline is nothing. Meta is down greater than 20% from the highs proper now:

Are we taking a look at a 40% crash? 50% or extra?

Would an AI bubble popping provide an exquisite shopping for alternative as a result of these firms are nonetheless higher at what they do than everybody else?

Or what if these firms see a payoff ahead of we expect and the large crash by no means comes?

I’ve three phrases to sum up my conclusion on the matter:

I. Don’t. Know.

If anybody tells you they understand how this can play out they’ve a horrible case of hubris or simply need their funding stance to be confirmed proper.

I stay open to a variety of outcomes on the matter.

Additional studying:

The Largest Danger & The Largest Alternative