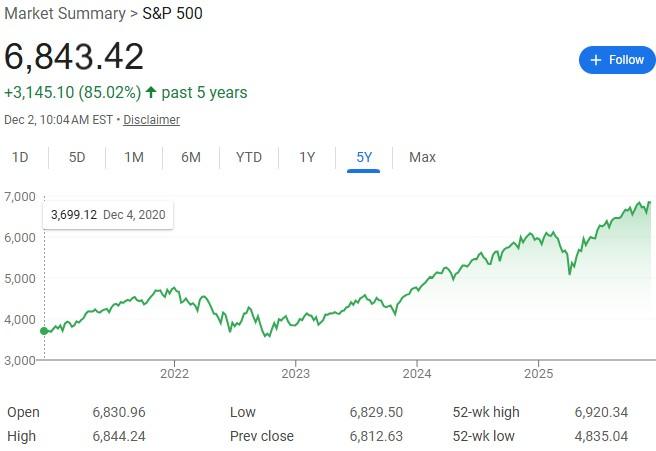

It’s simple to assume the inventory market is overvalued. There are such a lot of measures that time in that course.

The only one is the Cyclically Adjusted PE Ratio (CAPE Ratio). It’s the value to earnings ratio for the S&P 500 and proper now it’s over 40. The imply ratio is a bit over 17 and the max it’s ever been, December 1999, was 44.19.

The CAPE is a helpful measure for figuring out if the market is overvalued however the market can stay overvalued for a very long time. It’s been over the common since 2009, when it dipped below in the course of the Nice Recession.

Additionally, bear in mind that there’s all the time a purpose to promote and the media wants flashy headlines to maintain folks studying. So, you’ll learn loads of “AI is a bubble” and “a recession is across the nook” on a regular basis. That’s to not say it’s not true this time, however a damaged clock is true twice a day.

However for those who’re involved that the inventory market is overvalued and also you’re anxious to do one thingwhat are you able to try this’s each accountable and rational?

Desk of Contents

- Take a Breath

- Overview Your Monetary Plan

- Reassess Your Emergency Fund

- Rebalance Your Portfolio

- Make Charitable Donations

- Do Much less, Not Extra

Take a Breath

When you’re feeling anxious concerning the market, let me share a number of statistics that ought to assist:

- As I discussed earlier, the S&P 500 CAPE Ratio has been excessive for 16 years. It’s been “overvalued” for 16 years, even via all of the beneficial properties and drops.

- Corrections occur typically. Each 3-5 years, there’s a bear market within the S&P 500. (20% drop)

- A few of the greatest days within the inventory market are throughout bear markets.

The purpose is that this – don’t attempt to time the market. You’ll be able to’t predict the highest.

Sure, it would go down however then it would return up.

So long as you don’t want the cash in the mean time, you’ll be OK.

Overview Your Monetary Plan

When you haven’t reviewed and up to date your monetary plan not too long ago, now is an efficient time.

When you don’t have a monetary plan, now is an efficient time to construct one and also you don’t even want a monetary planner. Right here’s information to constructing a monetary plan with no monetary planner.

It’s necessary to replace your plan each time you might have main life occasions, corresponding to while you get married, have children, purchase a home, and so on. However there shall be durations in your life when there are not any main occasions. In these instances, you wish to assessment your plan yearly.

And bear in mind to assessment the time horizons of all of your accounts. Something you don’t want for ten years gained’t seemingly be affected by immediately’s market valuations. Something money you want inside the subsequent three years shouldn’t be within the inventory market, they need to be in secure investments like CDs, like these:

When you’re involved concerning the state of the markets, use this time to replace your monetary plan. It might probably inform what you do subsequent.

Reassess Your Emergency Fund

The inventory market could also be roaring however your private monetary scenario could also be completely different. It might be a very good time to reassess your emergency fund and see if it’s one thing you want to bulk up.

If that’s the case, it could be prudent so that you can take into account boosting it up at a time when the market is up in order that your fund will meet your wants sooner or later.

In regular instances, you could be snug with a 3-6 month emergency fund. If you’re in a extra tenuous job scenario, you could want to have one which’s 6-12 months of bills. Solely you recognize your scenario and the seemingly future eventualities, so regulate it accordingly.

When you promote belongings with beneficial properties, put aside some money for taxes. In a really perfect world, you would attempt to discover belongings with losses to offset the beneficial properties so it’s a tax impartial occasion.

Rebalance Your Portfolio

In your monetary plan, you’ll have established an asset allocation to your investments. As a primary stage, this allocation is a proportion of shares and bonds that may enable you to obtain your targets.

The S&P 500 is up over 16% year-to-date and Vanguard’s Complete Bond Market Index (BND) is up simply 3%, there’s a very good probability your allocation is now not matching your targets.

You need to rebalance your portfolio every year or each time your allocations are over 5% outdoors of your targets. When you began the yr with a 90% inventory, 10% bond portfolio, you’re now 91% shares and 9% bonds (assuming 1% and three% returns). You don’t set off the proportion threshold however you possibly can nonetheless regulate.

There are two methods you are able to do this.

- You’ll be able to promote what’s above your goal (shares) and purchase what’s under your goal (bonds).

- Allocation future contributions to the asset under targets till it’s again in line.

The primary manner will seemingly set off tax penalties, so the second manner is most well-liked if you are able to do it.

Both manner, for those who’re involved concerning the inventory market being overvalued, placing extra into bonds will regulate your allocation again to your targets and assuage your fears about investing into an overvalued market.

Make Charitable Donations

You’ll be able to donate appreciated inventory and it’s an enormous tax profit.

Once you donate appreciated inventory, you get to assert the market worth as a tax deduction for those who itemize your deductions. It’s manner higher than promoting the inventory and donating the proceeds, because you’ll need to pay capital beneficial properties tax on the appreciated quantity.

When you don’t wish to donate recognize inventory to a selected charity proper now, you possibly can all the time donate it to a donor suggested fund. Then, over a time frame, you possibly can have the fund make donations in your behalf. You get the deduction instantly, you pay no capital beneficial properties, and might dole out the donations over a number of years.

Lastly, you probably have some losses in your portfolio, now could be a very good time to make the most of tax loss harvesting.

Do Much less, Not Extra

The most effective funding portfolios are those that don’t get messed with. Our brains work in a struggle or flight mentality, each of which demand motion.

With investing, inaction can typically be the most effective method. Overview your plan, regulate your belongings if obligatory, and ensure you’re protected with a funded emergency fund. Money you want within the subsequent three years ought to be in money or different secure investments and switch off the information. 🫠