Chart Child Matt has this nice chart on his weblog about sector returns for the S&P 500 this decade:

Right here’s Matt on the numbers:

I knew Tech has carried this decade, however I used to be nonetheless shocked after I ran the numbers.

61.5% of the S&P 500’s 131.9% return has come from Tech.

No different sector even comes shut.

Loop in Comm Providers and that’s 78.4% of the 131.9% total achieve within the S&P 500 coming from simply two sectors.

Energy legal guidelines within the inventory market strike once more.

Tech inventory returns appear to defy logic however a majority of these shares have a historical past of gigantic strikes — each up and down.

The scale of the positive aspects and losses are staggering if you dig into the information.

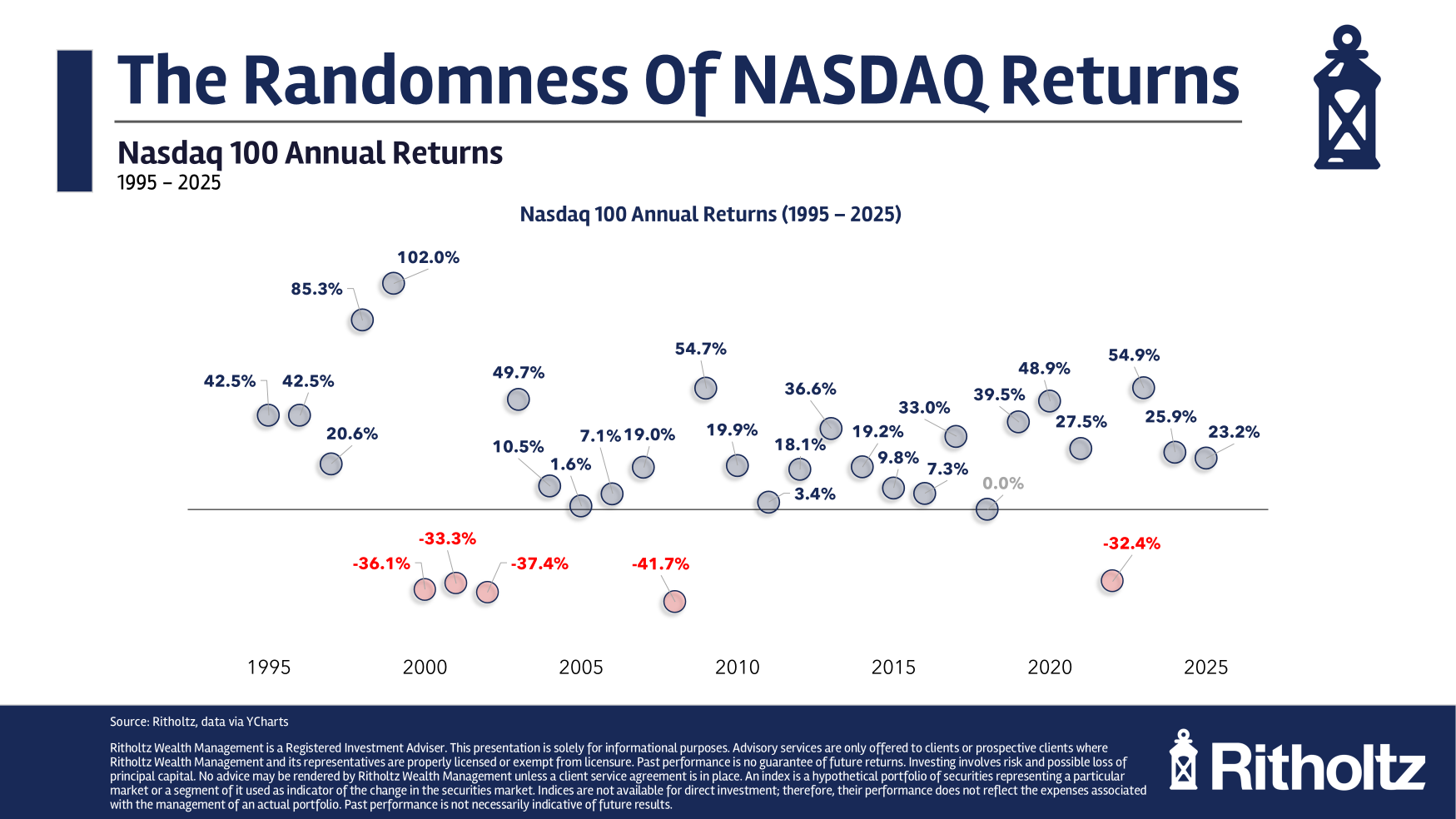

Listed below are the calendar 12 months returns for the Nasdaq 100 since 1995:

Just a few issues stand out from this chart.

First, there have been much more positive aspects than losses. Previously 31 years, positive aspects outnumber losses by a ratio of 26 to five. Meaning the Nasdaq 100 has been up in 84% of these years.

The positive aspects are typically giant to fairly giant.

In 1 out of each 4 years, positive aspects have been 40% or extra. Practically half of the years since 1995 have seen positive aspects of 20% or larger.

Losses are few and much between however after they occur they’re no joke.

You’ll discover there are simply 5 crimson numbers for the down years on the chart. Each single a type of losses was -30% or worse.

These have been the 5 down years since 1995:

- 2000: -36.1%

- 2001: -33.3%

- 2002: -37.4%

- 2008: -41.7%

- 2022: -32.4%

Remarkably, each down 12 months for the previous 3 a long time has been a gargantuan loss. In distinction, the S&P 500 has had only one down 12 months with losses of 30% or extra (in 2008 when it fell 37%).

It’s additionally loopy that after the dot-com bubble ended there have been three years in a row of losses in extra of 30%.

The max drawdown for the S&P 500 was -57% whereas the Nasdaq 100 dropped greater than 80% following the bursting of the dot-com bubble and the Nice Monetary Disaster.

There have been far greater booms and busts within the Nasdaq 100 however traders have been rewarded for these dangers.

These are the annual returns since 1995:

- Nasdaq 100 +15.0%

- S&P 500 +11.1%

No ache, no achieve.

The large query is that this: Will the following down 12 months, at any time when it occurs, be this dangerous?

We will see…

Additional Studying:

How A lot Will the Inventory Market Fall in 2026?

1The Nasdaq 100 isn’t all tech shares however they make up aroudn 70% of the index proper now for those who embrace communication companies.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.