Investing in mutual funds can really feel complicated for a lot of new traders. Returns look enticing on paper, however each return comes with a stage of danger. Some funds develop steadily. Some funds transfer sharply up and down. Some funds take way more danger than others to ship the identical return.

Due to this, it turns into tough to guage which fund is actually higher.

That is the place the Sharpe ratio in mutual funds turns into extraordinarily helpful. It is without doubt one of the easiest instruments that tells you whether or not the return you might be getting is definitely worth the danger you’re taking. You do not want huge finance information or complicated formulation to grasp it. When you get the fundamentals, it turns into a really useful indicator for selecting the best fund.

On this article, we cowl the which means, method, calculation technique, interpretation, and sensible makes use of of the Sharpe ratio.

What’s Sharpe Ratio in Mutual Funds?

The Sharpe ratio is a measure that compares the return of a mutual fund with the danger the fund takes to generate that return. It solutions one fundamental query:

“How a lot return did the fund give for each unit of danger taken?”

If the Sharpe ratio worth is excessive, the fund delivered higher returns for the extent of danger taken. If the Sharpe ratio worth is low, the fund was both just too unstable or it didn’t generate sturdy sufficient returns relative to the danger undertaken.

Think about two mutual funds: Fund A and Fund B.

Each earn 12% returns in a yr. At first look, they give the impression of being equally good. However their behaviour all year long could be very totally different.

Fund A: Regular and Predictable

- It grows slowly via the yr.

- It doesn’t present sharp jumps.

- It avoids deep drops.

- The general motion feels regular.

Fund B: Uneven and Traumatic

- Some months present massive beneficial properties.

- Different months present heavy losses.

- The worth jumps round usually.

- The expertise feels worrying.

Since each funds delivered 12% return, at a look chances are you’ll consider that each funds are equal as their last numbers match. However one fund clearly managed danger higher.

To straight evaluate these funds, we want a quantity that displays each return and danger concurrently. That is precisely why we use the Sharpe ratio in mutual funds – to grasp how a lot danger every fund took to earn its return.

Easy put,

Increased Sharpe ratio worth = higher risk-adjusted efficiency

Decrease Sharpe ratio worth = extra danger taken for every unit of return

Utilizing this concept, the Sharpe ratio helps evaluate Fund A and Fund B regardless that they’ve the identical return, visualising a spot that uncooked returns couldn’t seize. This offers the investor a easy option to reply:

- Which fund used danger extra effectively?

- Which fund rewarded the investor with out excessive volatility?

- Which fund managed the journey properly, not simply the vacation spot?

Sharpe ratio therefore converts the fund’s “journey” right into a single quantity.

Understanding Sharpe Ratio Calculation

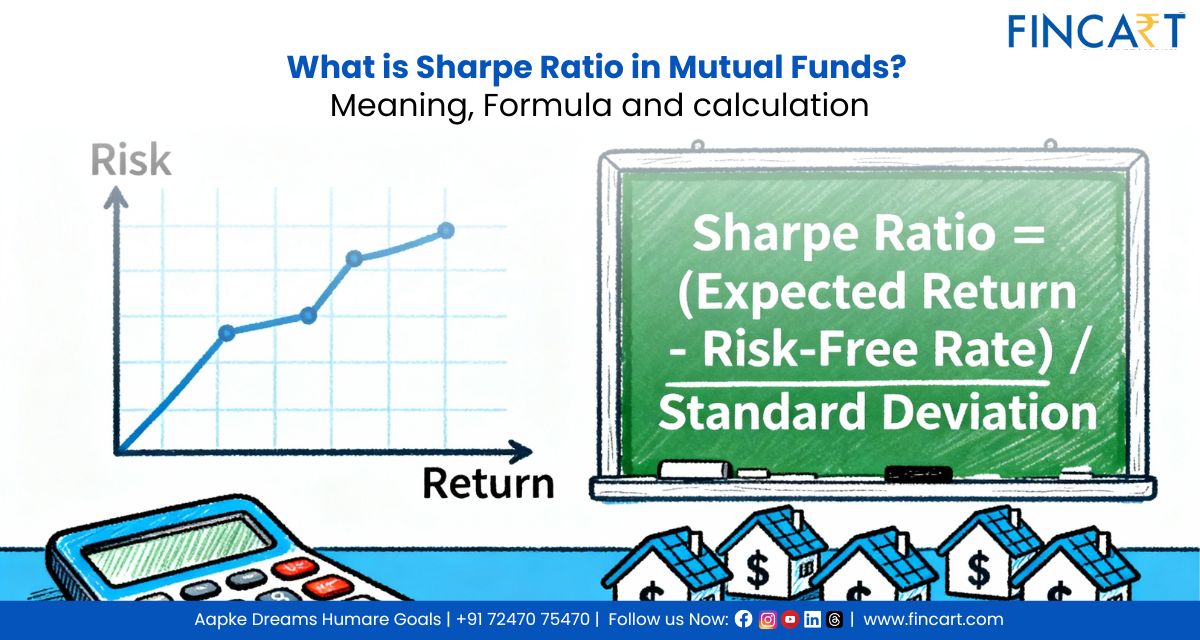

Sharpe ratio in mutual funds is given by the method:

Sharpe Ratio = (Fund Return − Danger-free Return) ÷ Commonplace Deviation

Fund Return

That is the return given by the mutual fund for which you might be calculating the Sharpe ratio, over a selected time interval. Sharpe ratio is usually calculated for the long run, like at the least 1 yr.

Danger-Free Return

That is the return you’d get with out taking any danger. For instance, cash saved in authorities treasury payments or mounted deposits is taken into account virtually risk-free.

- In India, the risk-free charge is usually represented by the yield on the Authorities of India’s 10 yr G-Sec (Authorities Safety) bond, as these are thought of the most secure funding with minimal default danger, serving as a baseline for different investments. Whereas a exact present quantity isn’t static, it’s across the 7% mark.

The Sharpe Ratio subtracts this from the fund return as a result of it solely desires to measure the additional reward you get for taking market danger.

Commonplace Deviation (Danger)

Commonplace deviation measures the volatility, i.e. how a lot the fund’s returns transfer up and down. That is merely the danger related to the fund.

The Sharpe ratio divides the additional return by this danger quantity. This solutions the query:

“How a lot reward did I get for the quantity of ups and downs I skilled?”

The best way to Interpret Sharpe Ratio

The Sharpe ratio in mutual funds turns into helpful solely when its which means is obvious. The quantity itself could look small, however even a small change can sign an enormous distinction in risk-adjusted efficiency. Right here’s the right way to perceive the Sharpe ratio worth:

- Beneath 1: Alerts that the fund shouldn’t be giving sufficient return for the danger taken.

- Between 1 and a couple of: Typically seen as acceptable to good.

- Above 2: Thought of superb, displaying sturdy risk-adjusted efficiency.

- 3 and above: Considered as wonderful, however is extraordinarily uncommon in mutual funds, particularly over lengthy intervals. Nevertheless, such a Sharpe ratio could seem in brief snapshots throughout uncommon market phases.

Two funds could present related returns, however their Sharpe ratios can reveal which one delivers these returns in a extra secure and environment friendly approach. This makes the Sharpe ratio a helpful information for choosing funds that steadiness development with optimally managed danger, slightly than chasing excessive returns with out actually understanding the volatility behind them.

Frequent Errors Traders Make with Sharpe Ratio

Many traders use the Sharpe ratio however misunderstand the way it works. These errors can result in unsuitable fund decisions.

Frequent errors embody:

- Checking solely the most recent ratio and ignoring older information.

- Reviewing the ratio for just one yr as an alternative of long-term tendencies.

- Evaluating funds from totally different classes, resembling fairness and debt.

- Believing {that a} larger Sharpe ratio alone means a greater fund.

- Utilizing information from totally different time intervals, which supplies deceptive outcomes.

- Ignoring how market situations change the ratio over time.

- Skipping correct steerage from a mutual fund advisor, which will increase confusion.

Holding these factors in thoughts helps traders use the Sharpe ratio appropriately and keep away from false indicators.

Limitations of Sharpe Ratio

Sharpe ratio is useful, however like some other monetary metric, it has its personal limitations. It can’t decide each a part of a fund’s efficiency.

Key limitations embody:

- It depends solely on previous information, which can not mirror future outcomes.

- It doesn’t present how a fund behaves throughout excessive market occasions.

- It treats all ups and downs in returns the identical, even when some volatility could also be innocent.

- Completely different time intervals can produce very totally different Sharpe values.

- It could favour funds with fewer short-term actions, even when they provide decrease long-term development.

- It ought to by no means be used alone. Traders want different instruments like portfolio allocation checks, class comparisons, and consistency evaluation.

Figuring out these limits helps traders use the Sharpe ratio in mutual funds properly as an alternative of

relying on it blindly.

When Ought to You Use the Sharpe Ratio?

Sharpe ratio turns into highly effective when utilized in the proper conditions. It helps traders clearly quantify and perceive whether or not the returns justify the extent of danger.

It’s most helpful:

- When evaluating two related funds in the identical class.

- When checking how secure a fund’s efficiency has been over time.

- When reviewing long-term outcomes as an alternative of short-term spikes.

- When constructing a portfolio and needing a measure of danger effectivity.

- When evaluating total steadiness in a multi-fund portfolio.

Sharpe ratio in mutual funds gives readability in these conditions by linking return and volatility in a single quantity.

Conclusion

Sharpe ratio connects return with danger in a easy approach. It helps traders keep away from chasing excessive returns with out understanding the volatility behind them. When used appropriately, the Sharpe ratio in mutual funds helps smarter resolution making and higher portfolio decisions.

It isn’t good, but it surely is a superb place to begin for anybody who desires to steadiness development and stability. Traders who mix the Sharpe ratio with long-term information, class analysis, and advisor assist make extra assured funding selections.

FAQs for Sharpe Ratio

Q: What’s the Sharpe ratio in mutual funds in easy phrases?

A: It exhibits how a lot return a fund offers for the extent of danger it takes. A better worth means the fund manages danger higher whereas delivering returns.

Q: Does the next Sharpe ratio imply the fund is safer?

A: Not precisely. It means the fund is extra environment friendly with danger, not risk-free. All market-linked funds carry some stage of uncertainty.

Q: Can the Sharpe ratio change over time?

A: Sure. It adjustments with returns, market actions, and fund volatility. This is the reason long-term evaluation works higher than just one yr.

Q: Can the Sharpe ratio be used throughout all fund classes?

A: No. It really works finest when evaluating funds throughout the identical class. Evaluating fairness with debt, or hybrid with sector funds, may give deceptive indicators.

Q: The place can traders discover the Sharpe ratio for mutual funds?

A: Sharpe ratio is out there on most publicly accessible fund analysis platforms. Web sites like AMC fund pages, standard funding apps, and information portals often present it underneath the fund’s “Danger Measures” or “Efficiency” part.