In keeping with The Wall Road Journal, there are extra 401k millionaires than ever:

The 401(okay) millionaire membership is rising.

Regular saving by many People and a 3rd consecutive 12 months of huge beneficial properties for U.S. shares have swollen account balances. As 2025 involves an in depth, many particular person buyers are discovering vacation cheer in statements displaying they’ve crossed the $1 million milestone.

As of the third quarter, there have been 654,000 401(okay) millionaires on the brokerage Constancy, the best stage in information going again to the early 2000s. Round 3.2% of greater than three million accounts tracked by advantages supplier Alight had balances above $1 million as of the third quarter, double the determine on the finish of 2022. At T. Rowe Value, roughly 2.6% of members had balances above $1 million, up from 1.3% on the finish of 2022.

That’s a comparatively small quantity relative to the full however spectacular nonetheless contemplating most individuals change jobs, produce other funding accounts, don’t keep in the identical 401k plan without end, and so forth.

It additionally is sensible in a long-lasting bull market.

After all, like many house-rich millionaires, you possibly can’t precisely spend down your 401k until you’re retired or keen to pay the taxes and penalties. Most of this new wealth cohort are referred to as “reasonable millionaires,” with property starting from $1 million to $5 million.

UBS estimates these reasonable millionaires have quadrupled since 2000 to 52 million this 12 months. One thousand reasonable millionaires have been added each single day within the U.S. in 2024:

I feel we should always have fun this rising variety of on a regular basis millionaires. This can be a constructive growth.

However there’s a distinction between wealthy and RICH:

“In style tradition nonetheless thinks of millionaires by way of Scrooge McDuck or the top-hatted icon of Monopoly,” wrote Paul Donovan, chief economist at UBS’s wealth-management observe, in a observe to shoppers this 12 months. “The brand new greenback millionaires have damaged a psychological wealth threshold, however their earnings and spending is that of center class households.”

Spending like a “stereotypical millionaire” in all probability requires not less than $5 million, he mentioned.

Honest sufficient.

Right here’s the factor although — you don’t develop into a millionaire by spending cash like a millionaire!

You develop into a millionaire by saving and investing, not spending! Wealth is a scarcity of spending.

This isn’t a brand new idea.

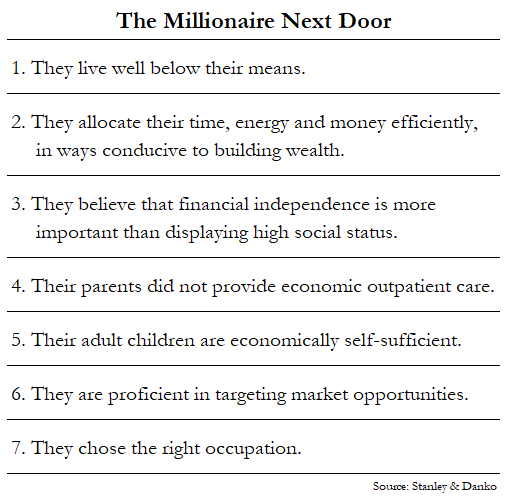

The Millionaire Subsequent Door got here out in 1996. These are the attributes of most reasonable millionaires:

Being a millionaire doesn’t imply you spend $1 million. It means you save $1 million.

For most individuals, changing into a millionaire requires sacrifice, laborious work and endurance.

Certain, there are individuals who win the metaphorical lottery by hypothesis, household cash or luck. They’ve an obscene quantity of wealth and so they spend obscene quantities of it.

However most individuals construct their wealth over the course of a few years by saving, investing and compounding.

And one of many causes persons are capable of compound their capital by endurance is as a result of tax-deferred retirement plans make it tough so that you can entry the cash. It’s a function, not a bug.

Spending your cash must be a part of any wholesome monetary plan.

However most individuals received’t develop into any type of millionaire in the event that they don’t save first.

Michael and I talked about 401k millionaires, reasonable millionaires, cash vs. that means and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Max Out Your 401k

Now right here’s what I’ve been studying currently:

Books:

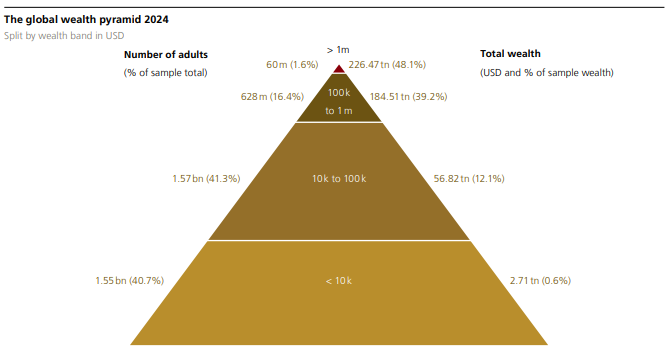

1UBS additionally exhibits that 60 million households (1.6% of the worldwide inhabitants) maintain practically 50% of the wealth on the earth. The highest 18% owns 87% of the wealth.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.