A reader asks:

I’ve one thing of an existential query for you. I’m quick approaching retirement age with a not-to-brag degree of wealth. Most consultants (together with my advisor) would say it’s sufficient cash for monetary independence. Meaning my spouse and I don’t have to work anymore. We will do what we would like once we need if we need to. However that sounds boring. What am I imagined to do play golf every single day? I like working. It provides me a way of goal. I don’t need to sit on my butt all day doing nothing. I’ve extra enjoyable rising our nest egg than spending it down. Is there one thing fallacious with me? Is it doable to by some means rewire my mind to get pleasure from our cash or get off the hamster wheel?

Most private finance consultants will let you know monetary independence is the one factor that issues.

You spend lower than you earn. Stay under your means. Create a giant pile of cash. And after getting that huge pile of cash you are able to do no matter you need, everytime you need with no restrictions.

The issue is nobody is there that can assist you outline what it’s you need to do, particularly when work and monetary independence are your most important priorities.

This can be a first-world downside however one thing many retirees will probably be coping with within the years forward.

One of many causes retirement might be such a problem for some individuals is as a result of it’s nonetheless a comparatively new idea. Up till the twentieth century or so the retirement plan for almost all of the inhabitants was you labored till you died.

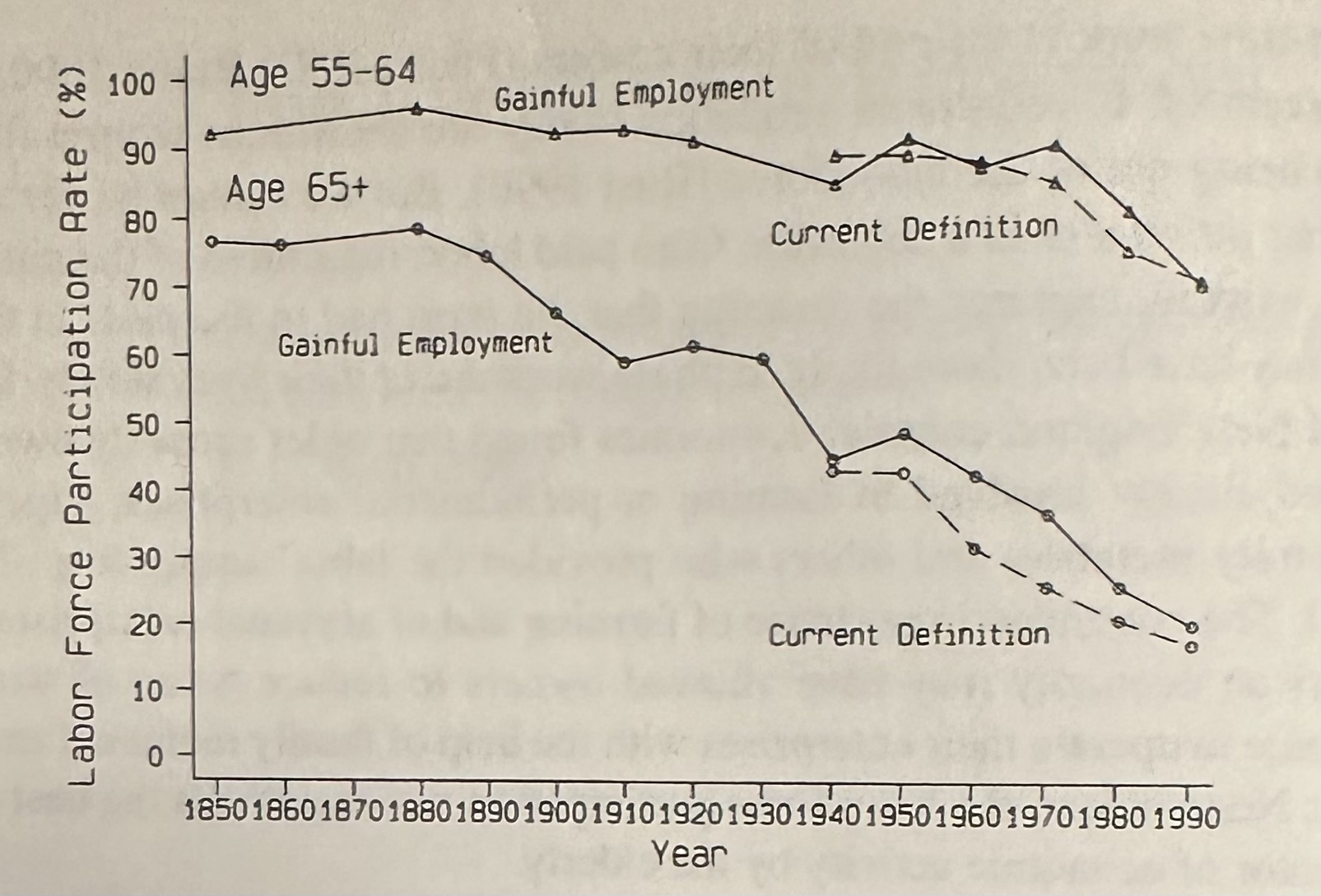

Lower than 3% of the inhabitants was 65 or older in 1850. It was simply 7% in 1940. At the moment it’s nearer to twenty% of the inhabitants. By 2050 it’s projected that just about 25% of the U.S. inhabitants will probably be in or coming into retirement age.

In 1880 greater than three-quarters of males older than 64 had been nonetheless within the labor pressure (and 81% of all 70 yr olds).

Most individuals merely couldn’t afford retirement. For many who did retire, half of them lived with their kids.

If you happen to had been 20 years previous in 1880 you may anticipate to spend lower than 6% of your life in retirement (2.3 years). If you happen to had been 20 in 1990, you possibly can anticipate to spend as much as one-third of your life in retirement.1

That a lot leisure time continues to be comparatively new.

Some individuals spend their total lives working in jobs they don’t get pleasure from with the hope that sooner or later they’ll retire, play golf all day and loosen up within the solar.

However others discover goal and satisfaction of their work. Relationships have the flexibility to make you happier and many individuals forge friendships on the workplace. Work may preserve you motivated.

Researchers tracked workers from Shell Oil who retired at ages 55, 60 and 65 over a 30 yr interval from the early-Seventies by the early-2000s. They found the individuals who retired early at age 55 had double the mortality fee of those that retired at 65.

A part of the rationale some individuals retire earlier is as a result of their well being degrades. However additionally they discovered that the dearth of social and cognitive engagement performed a task as effectively. I’ve heard loads of tales over my years in wealth administration of people that misplaced their means as soon as they retired and felt like that they had no goal anymore.

Working longer can have its advantages, even if you’re financially impartial.

Clearly, working an excessive amount of will also be a detriment if it causes an excessive amount of stress or forces you to overlook out on extra essential stuff.

Work might be a part of your monetary indepence. Like different facets of your monetary plan, you simply want some guidelines in place to information your actions so it doesn’t change into all-consuming.

Listed below are some work guidelines I’d institute on this scenario:

- The no assholes rule. Solely work with individuals you want and respect.

- The no stress rule. Don’t preserve working if it stresses you out on a regular basis. You’re not rich in case your work causes fixed fear and nervousness.

- The no rule. Monetary independence ought to make it simpler to say no to invitatations, tasks and occasions you don’t need to do. If you’re youthful generally you need to suck it up. That shouldn’t be the case if you’re working by selection.

- The no regrets rule. Don’t preserve working if it makes you miss out on household stuff. Nobody ever says I want I’d have labored longer hours on their deathbed.

Are you able to rewire your mind this late in life? Most likely not.

Retirement doesn’t must be 18 holes and sitting on the seaside all day. You possibly can nonetheless discover methods to maintain your mind energetic. The standard retirement dream shouldn’t be for everybody.

However it’s best to search for methods to introduce some extra stability in your life.

Work on the stuff you get pleasure from after which discover different methods to spend your time.

I talked about this query on this week’s Ask the Compound:

Brian Jacobs from Aptus Capital joined us on the present this week to debate questions on options-based ETFs, buffer ETFs and extra.

Additional Studying:

How you can be Happier at Work

1These stats are from The Evolution of Retirement by Dora Costa.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will probably be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.