I got here throughout two new instruments for wanting on the historic inflation of the varied parts that make up the typical.

Jesse Livermore created a software at Philosophical Economics that permits you to examine 300 completely different items and companies to the inflation charge over time.

As an example, that is the worth of eggs versus the private expenditures value index since 1959:

Surprisingly, the long term value has grown at a decrease charge than PCE (2.4% vs. 3.2%). However have a look at all the value shocks on the charts when there are provide issues with eggs. It shoots greater however then shortly falls again to or under development.1

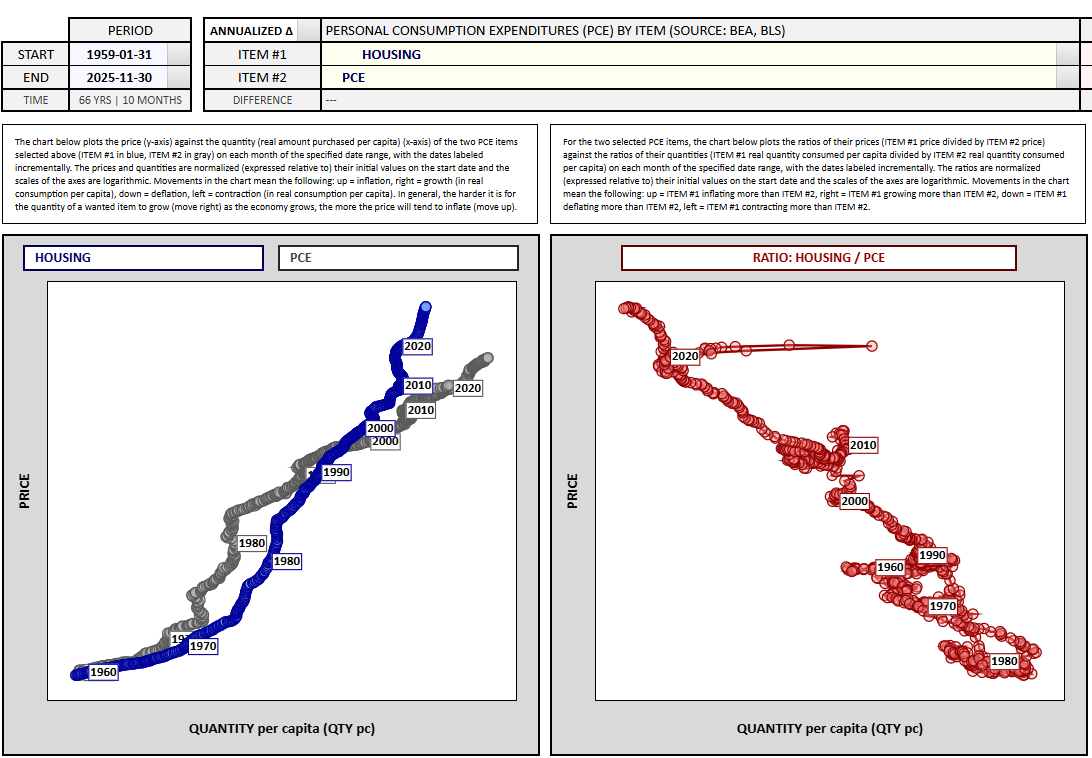

Right here’s housing over the long term:

The long-term development charge for housing is barely above inflation — 3.78% vs. 3.24% since 1959.

Nevertheless, there’s a caveat right here. The calculation for housing within the inflation charge considers each lease inflation and imputed lease (how a lot owners assume they’d pay to lease their home) so it doesn’t essentially measure the price of shopping for a house.

What Ought to I Spend has an inflation calculator that permits you to examine the worth of products again in 1970 to the worth at present together with what the worth would appear like had it tracked the inflation charge.

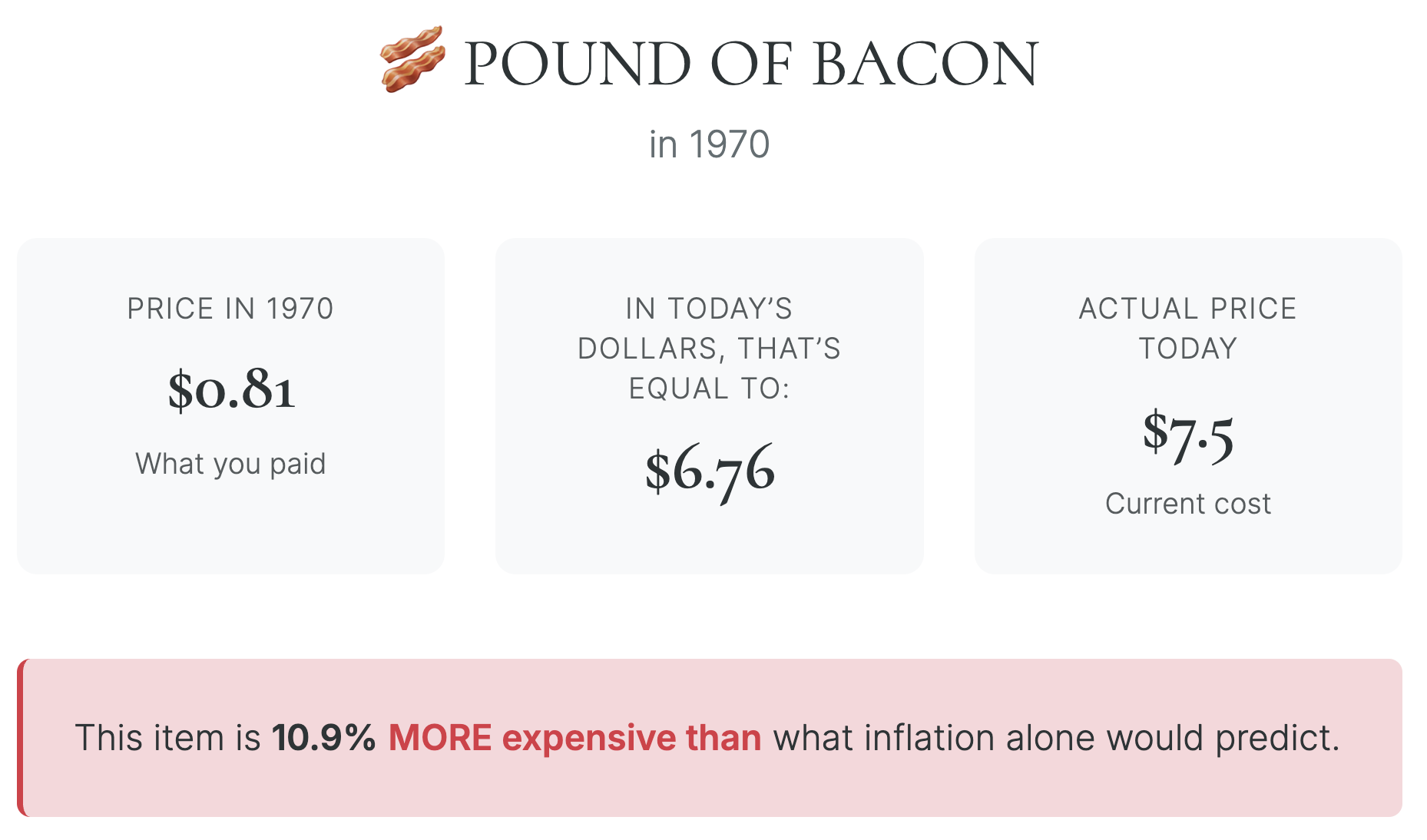

For instance, right here’s bacon:

It price 81 cents for a pound of bacon in 1970. Had that value merely tracked the inflation charge it will be $6.76 at present. The typical price is definitely $7.50, that means the worth grew quicker than inflation.

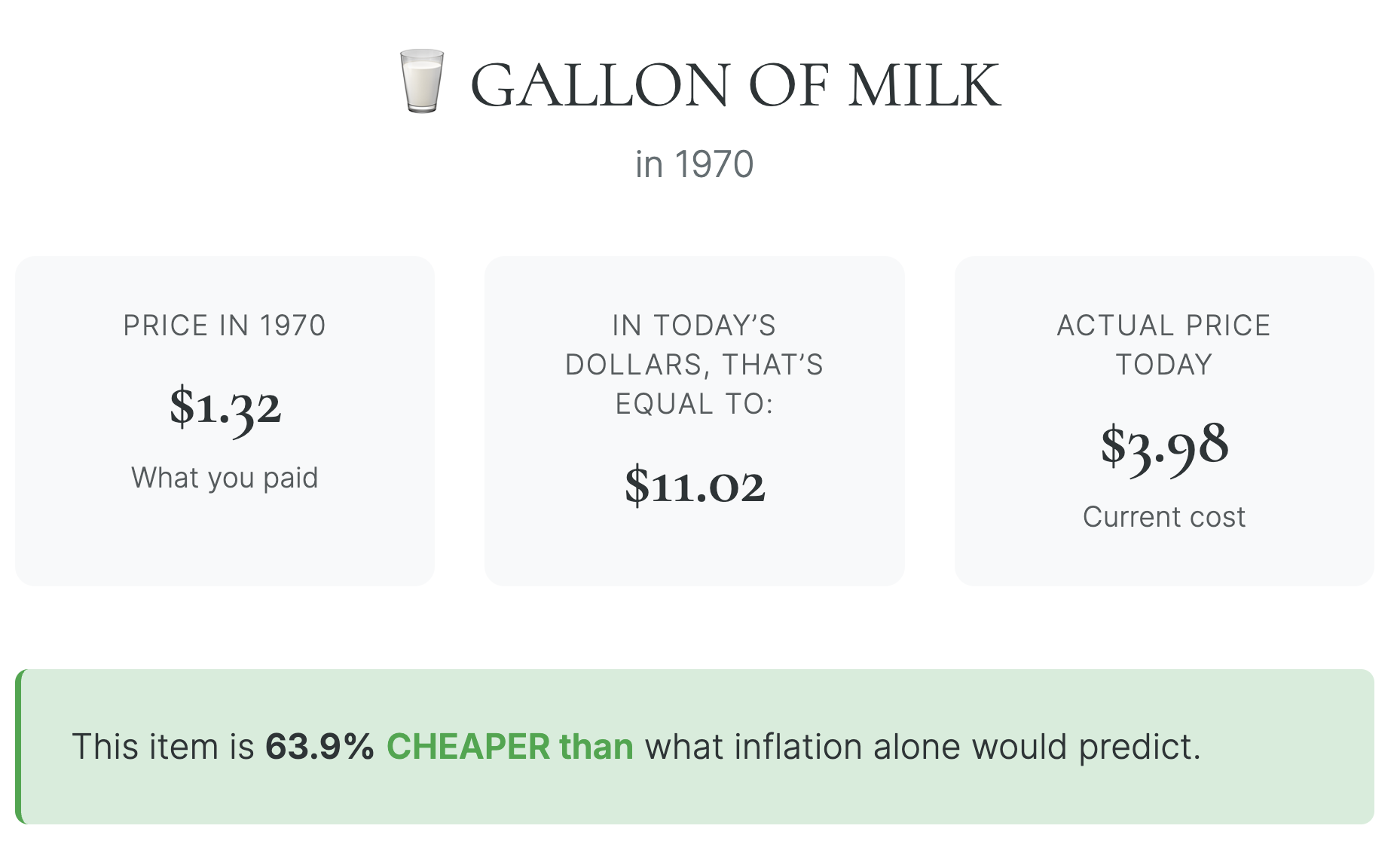

The typical gallon of milk is the other:

Milk costs have grown a lot slower than total inflation.

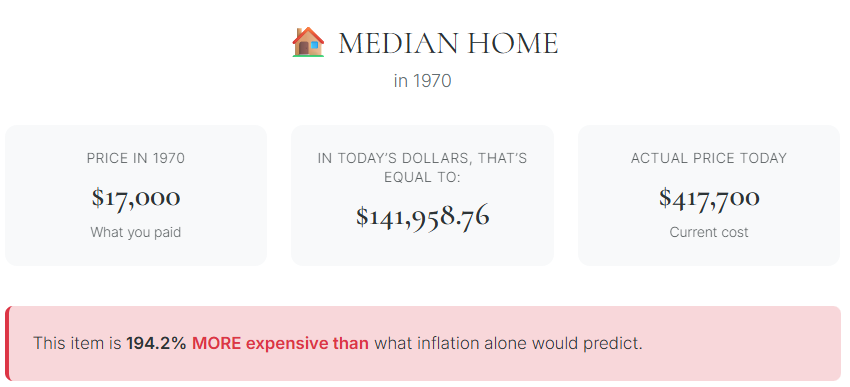

Now have a look at the price to purchase a median dwelling:

This one makes intuitive sense.

Housing is much more costly at present than it was previously, even whenever you account for inflation.

Nevertheless, there’s some context mandatory right here. Again within the day, when homes had been extra reasonably priced, in addition they had far fewer facilities.

No open idea ground plans. No quartz counter tops. No chrome steel home equipment or 3-car garages or mud rooms. Most homes lacked a few of the fundamentals we now take as a right too.

I’ve written about this earlier than but it surely’s price revisiting:

The U.S. Census places out an annual report on traits of recent housing. Try the variations between now and the early-Nineteen Seventies:

-

- In 1973, 49% of properties had no air con. Now simply 7% of homes haven’t any AC.

- In 1973, 40% of properties had 1.5 loos or fewer. Right now simply 4% have fewer than 1.5 loos.

- In 1973, 64% of homes had 3 bedrooms whereas 23% had 4 bedrooms or extra. Now 42% of homes have 3 bedrooms whereas 47% include 4 bedrooms or extra.

- In 1973, the median home had 1,525 sq. ft of area. Right now it’s nearer to 2,500 sq. ft.

- In 1973, the typical dimension of a U.S. family had 3 individuals dwelling underneath one roof. That common is right down to 2.5 residents per home.

Homes had been smaller again then. Extra individuals underneath one roof needed to share loos and bedrooms. Properties are greater and nicer now and the upper costs replicate the upper high quality. That doesn’t clarify the complete value surge but it surely’s a part of it.

The land can be getting costlier.

Look, I’m not right here to present you a contrarian tackle housing prices. They’re undoubtedly excessive.

However this instance is without doubt one of the causes calculating the long-term charge of inflation might be difficult (and why nobody actually believes the reported knowledge).

Economists attempt to embody hedonic changes for high quality enhancements but it surely’s an inexact science.

One of many downsides of getting a better way of life is that it prices extra. Greater housing prices even have a societal price. Everybody wants a roof over their head and plenty of younger individuals need to purchase a house proper now however can’t afford it.

It might be good if we may discover affordable methods to incentivize extra constructing of larger, nicer properties at present.

Michael and I talked about housing, inflation and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The best way to Repair the Housing Market

Now right here’s what I’ve been studying these days:

Books:

1These charts may be a bit of laborious to learn, so click on on the hyperlink or simply right-click the graph and hit open picture in new tab.

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will probably be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.