A reader asks:

May you speak about tips on how to use momentum indicators and cease losses to revenue from an AI bubble? Having been an investor throughout the 1990’s this feels just like the early innings of a bubble, if that is one. I believe there could also be a comparatively low threat method to revenue with out choosing particular person winners or time the highest by utilizing momentum indicators and utilizing trailing cease loss orders on broadly-based, passively managed ETFs.

Within the spring of 2006, Meb Faber printed a analysis paper titled A Quantitative Method to Tactical Asset Allocation.

The thought was to make use of a 10-month transferring common to dictate your allocation between threat property (shares) and money (T-bills).

The foundations have been easy. At month finish:

- If the present worth is bigger than the 10-month transferring common, keep invested in shares.

- If the present worth is lower than the 10-month transferring common, put money into money.

In case you’re in an uptrend, you purchase or keep invested. In case you’re in a downtrend, you promote or keep in money.

The thought behind the technique is to dampen the volatility and the chance of extreme market drawdowns in threat property.

The timing of the paper couldn’t have been higher. A bit of greater than a 12 months later, the inventory market peaked on the onset of the Nice Monetary Disaster. The S&P 500 fell practically 60%.

So how did Faber’s guidelines work? Extremely effectively.

Meb up to date his paper a number of years later to indicate how the backtest carried out in the actual world:

The technique didn’t get out on the actual high as a result of it’s good to look ahead to a downtrend to take maintain earlier than getting a sign nevertheless it missed the vast majority of the carnage.1

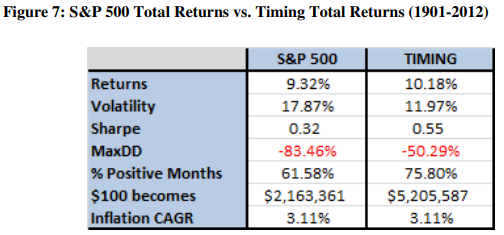

These have been the long-term return profiles for development following versus purchase and maintain:

Pattern following didn’t utterly take drawdowns off the desk, nevertheless it did dampen volatility considerably in these 110+ years of knowledge.

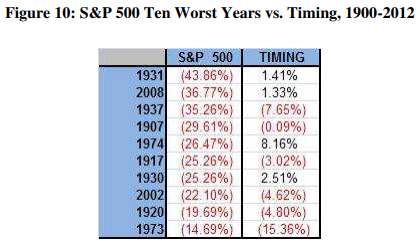

Now take a look at the efficiency of the worst years within the inventory market versus the development technique:

The sort of technique is designed to shine within the worst inventory market environments.

There’s nothing magical about 10 months or a month-to-month indicator on these items however the level is you wish to have a time-frame that permits you to higher outline uptrends and downtrends.

Dangerous issues occur extra usually in downtrending markets as a result of traders are inclined to panic extra freely once they’re shedding cash. This is the reason each the perfect and the worst days happen throughout bear markets.

Downtrends pave the best way for a broader set of attainable outcomes, and never all the time in a great way.

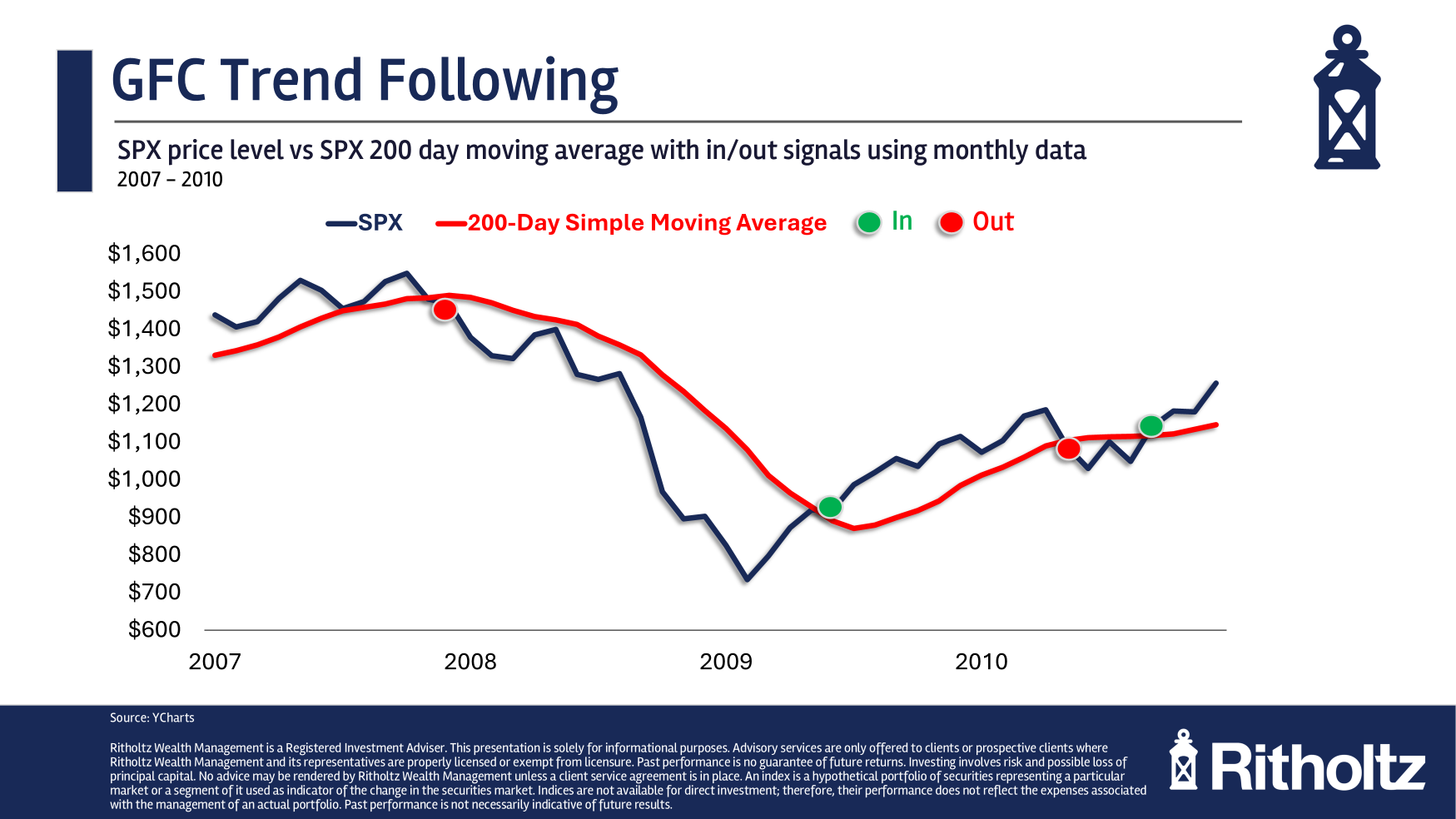

Right here’s a take a look at utilizing a easy 200-day transferring common on a month-end foundation throughout the 2008 monetary disaster:

The promote sign was triggered 6% or so beneath the height which was superb timing. You then obtained again in roughly 20% off the lows. That’s fairly good contemplating the dimensions and size of the 2007-2009 crash.

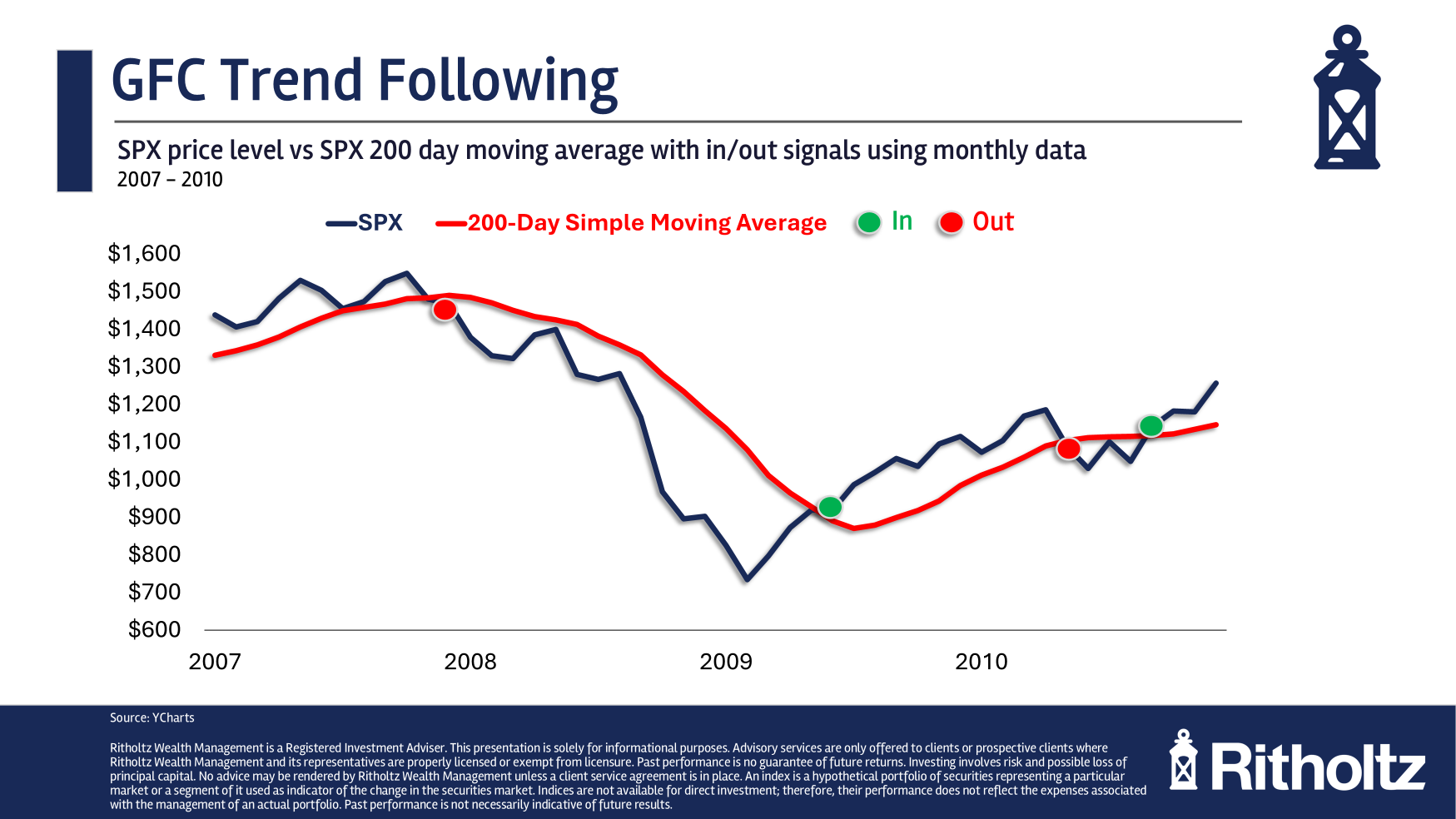

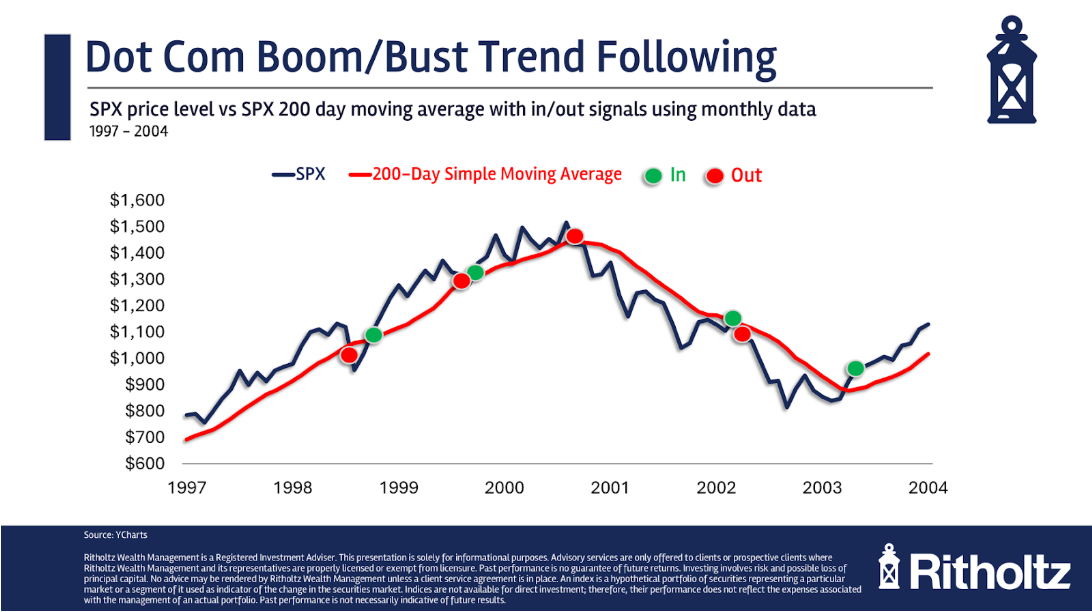

Now listed here are the indicators throughout the dot-com bubble:

You’ll be able to see there have been some false positives alongside the best way to the height of the dot-com bubble. You bought and obtained proper again in throughout the 1998 volatility. There was a whipsaw once more in 1999 when the transferring common triggered a promote sign adopted shortly by a purchase sign.

However then there was a month-end promote sign simply 6% beneath the 2000 peak that saved you out of the vast majority of the 50% crash. Another fast whipsaw in 2002 however once more a development following system helped you survive a extreme downturn.

So why would you ever put money into the rest?

Properly, development following is a superb hedge towards extreme market downturns. However extreme market downturns don’t occur that usually. Crashes are uncommon.

Drawdowns don’t all the time occur in waterfall style. If there’s a flash crash scenario a development following technique gained’t prevent. And in uneven markets you may get whipsawed.

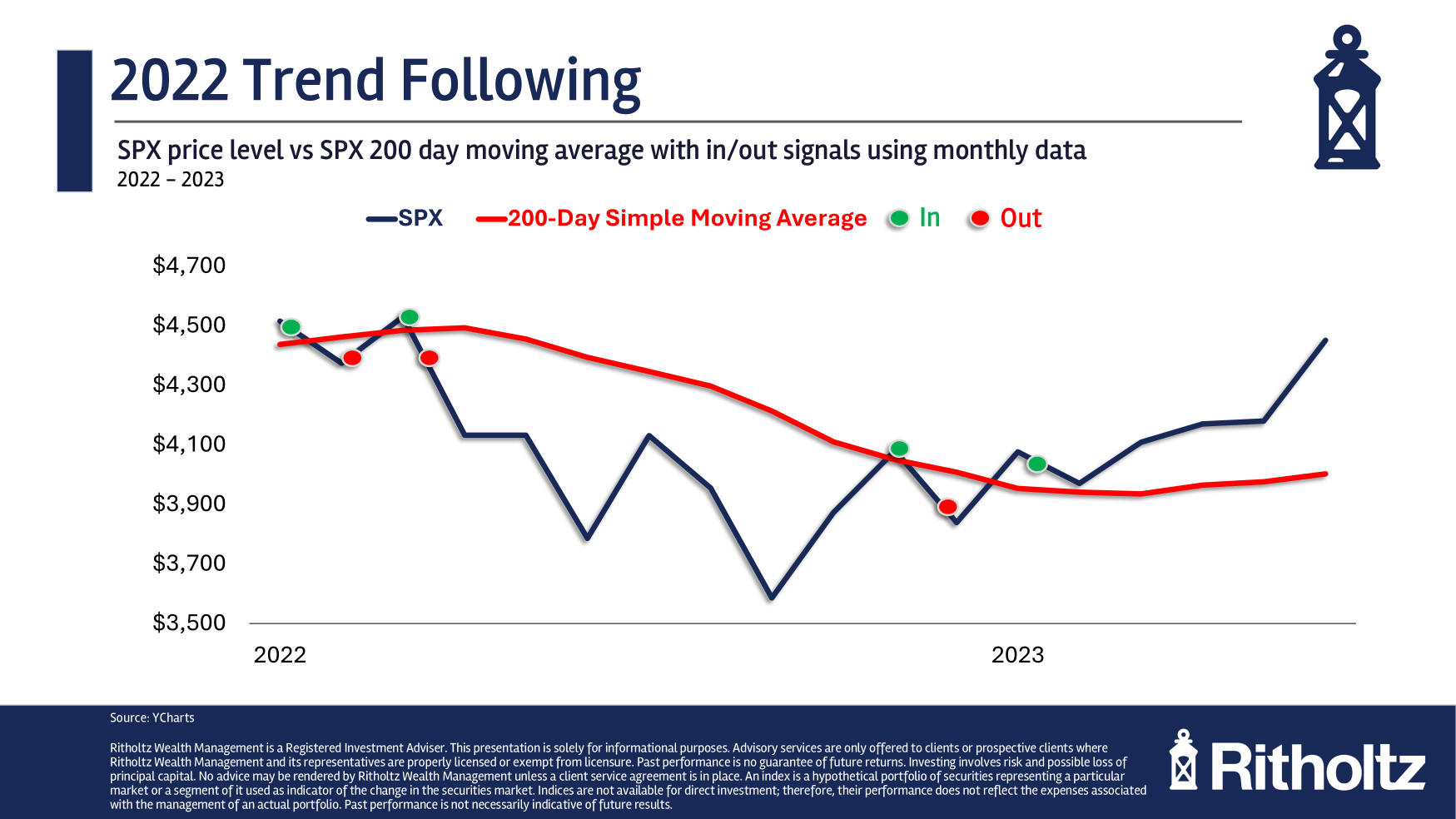

Have a look at the 2022 bear market:

You purchased excessive, bought low, purchased greater after which bought low once more. You continue to missed an honest quantity of the drawdown however these whipsaws can check your endurance.

You possibly can see a down 10% month, promote and see that adopted by an up 10% month the place you purchase after the achieve. Now, you’ve simply eaten all the losses and missed out on all of the positive factors in a brief window of time.

Right here’s the factor a few development technique — it’s a must to observe the principles for it to work. No wavering. No feelings concerned. You’ll be able to’t purchase and promote while you really feel prefer it as a result of nobody is aware of whether or not a 15% correction will flip right into a 50% decline or not. More often than not 20% down doesn’t flip into 40% down however nobody is aware of that within the second.

Pattern following is an insurance coverage technique the place typically you’re pressured to pay the premium with out the safety. More often than not while you set off a promote the inventory market gained’t utterly fall off the bed however you don’t purchase insurance coverage on your own home hoping it burns down.

Generally the inventory market does burn down, however these are uncommon occurrences.

You even have to contemplate taxes. While you set off a promote sign you might be pressured to pay short-term capital positive factors. Or after a protracted bull market you might be pressured to pay long-term capital positive factors. That eats into your returns. Pattern following works significantly better in a tax-deferred account than a taxable brokerage.

Bull markets are one other optimistic for this technique.

Most hedging methods present draw back volatility safety with no upside. The fantastic thing about development following is that it stays invested so long as the inventory market stays in an uptrend. And when the uptrend breaks, there’s an off-ramp.

The sort of technique isn’t for everybody. I’ve had loads of conversations with individuals through the years who merely don’t need or want a volatility/behavioral launch valve.

Others need one thing that may permit them to stay with the remainder of their long-term plan. That’s why I believe development following is a pleasant complement to a longer-term buy-hold-and-rebalance asset allocation.

These methods can act in another way in several environments and at completely different factors within the cycle.

The potential for diminished volatility is sweet, nevertheless it’s the diversification advantages that helped me perceive the purpose of development following in a portfolio.

I don’t know if development following will shield you when the subsequent large downturn hits.

However that is the sort of technique the place it’s good to perceive the trade-offs earlier than investing.

If you wish to be taught extra about how we do that for shoppers, attain out right here.

I did a deep dive into this query on this week’s Ask the Compound:

Invoice Candy joined me as effectively to debate questions on Roth IRAs earlier than retirement, shopping for your dream house, capital loss carryforwards, 529 plans and shopping for a trip house for property planning causes.

Additional Studying:

My Evolution on Asset Allocation

1It’s additionally price noting that the development technique underperformed within the Nineteen Nineties bull market by a decently vast margin. It is best to count on that with a technique like this.