Latest Federal Commerce Fee information reveals customers reported dropping practically $12.5 billion to identification fraud in 2024. This is a rise of over 25% from 2023.

Whereas the sharp improve in monetary fraud might be alarming, there are steps that you would be able to take to reduce your danger of turning into a sufferer. Our information for do-it-yourself identification theft safety is a good place to begin and the first step is figuring out easy methods to freeze (and unfreeze) your credit score report.

Right here’s how credit score freezes work, easy methods to place one, and what it might (and may’t) do that can assist you shield your credit standing.

Desk of Contents

- What Is a Credit score Freeze?

- How Does a Credit score Freeze Work?

- The right way to Freeze Your Credit score Report

- The right way to Freeze Your Credit score Report with Experian

- The right way to Freeze Your Credit score Report with Equifax

- The right way to Freeze Your Credit score Report with TransUnion

- The right way to Freeze Your Minor Youngster’s Credit score Report

- The right way to Unfreeze Your Credit score Report

- Unfreezing Your Credit score Report On-line or By Cellphone

- Unfreezing Your Credit score Report by Mail

- Credit score Freeze vs. Fraud Alert

- FAQs

- Last Ideas

What Is a Credit score Freeze?

Put merely, a credit score freeze (typically referred to as a safety freeze) is a block positioned by the credit score bureau (at your request), limiting who can entry your credit score report. This might help to forestall unscrupulous events from making use of for credit score in your identify, which might compromise your credit score historical past.

Whether or not you’re simply starting to construct or rebuild your credit score or you have already got loads of credit score information together with a great credit score rating, the very last thing you need is for fraudsters to have the ability to destroy your arduous work.

A number of credit score rating apps might help you monitor your credit score. However typically, that’s not sufficient, and it’s good to place a freeze in your report.

How Does a Credit score Freeze Work?

A credit score freeze restricts corporations or people from accessing your credit score file, stopping them from pulling a tough credit score verify and approving credit score in your identify. This consists of each legit and fraudulent makes an attempt.

Whereas a credit score freeze will prohibit arduous credit score checks, it doesn’t prohibit tender credit score checks.

Onerous credit score checks are utilized by lenders to evaluate your creditworthiness and may have an effect on your credit score rating. Smooth credit score checks don’t impression your rating and are generally used when you’re making use of to lease an house or when an organization desires to pre-approve you for a bank card.

Extra particularly, freezing your credit score report shouldn’t impression the next entities from entry to your credit score report:

- Present lenders you’ve beforehand approved

- Landlords and rental corporations

- Employers

- Debt assortment businesses working to gather a debt

- Youngster assist businesses

- Bank card corporations providing prescreened gives

✨ Associated: What Is a 609 Letter and The right way to File a Credit score Report Dispute

The right way to Freeze Your Credit score Report

In the event you’re serious about freezing your credit score report, you’ll must contact every of the three credit score bureaus: Experian, Equifax, and Transunion. In the event you request a freeze on-line or by cellphone, it’s required that the businesses freeze your credit score inside one enterprise day. In the event you request it by mail, it should be frozen inside three enterprise days.

Freezing your credit score stories with the three main credit score bureaus is free. Under are instructions for every bureau.

The right way to Freeze Your Credit score Report with Experian

You may freeze your Experian credit score report utilizing one among three totally different strategies:

- On-line: Open a free Experian account on-line. Go to the Experian Assist Heart. Click on on the Handle Safety Freeze field. Click on the Frozen button. Or you can begin by visiting this hyperlink.

- By Cellphone: Name Experian at 888-397-3742 and request a safety freeze.

- By Mail: Mail a safety freeze request to the next tackle:

Experian Safety Freeze

P.O. Field 9554

Allen, TX 75013

Any written requests to freeze your credit score ought to comprise the next info:

- Your Social Safety quantity

- Addresses for the previous two years

- Birthdate

- Full identify

- A duplicate of a government-issued ID

- A duplicate of a utility invoice or financial institution assertion verifying your tackle

The right way to Freeze Your Credit score Report with Equifax

Equifax lets you request a credit score report freeze utilizing one of many following strategies:

- On-line: Register for a free Equifax account right here. Then, when you log in, you will notice an choice within the left sidebar beneath the “Your Identification” part for “Freeze.” Observe the steps to freeze your Equifax credit score report (it’s quick, takes only a few minutes).

- By Cellphone: Name Equifax at 800-685-1111 and request a safety freeze.

- By Mail: Use Equifax’s Safety Freeze type to request a safety freeze by mail.

The right way to Freeze Your Credit score Report with TransUnion

TransUnion additionally gives 3 ways to freeze your credit score report.

- On-line: Open a free account with TransUnionsignal into your account, and comply with the steps for a safety freeze.

- By Cellphone: Name TransUnion at 888-909-8872 and request a credit score report freeze.

- By Mail: Ship a written request together with your identify, tackle, and Social Safety quantity to:

TransUnion

P.O. Field 160

Woodlyn, PA 19094

See TransUnion’s credit score freeze FAQs for extra info on requesting a credit score freeze to your TransUnion credit score report.

The right way to Freeze Your Minor Youngster’s Credit score Report

If in case you have motive to consider your minor little one has a credit score report and need it to be frozen, you’ll typically have to do that by mail.

The right way to Unfreeze Your Credit score Report

If you’re making use of for credit score, you’ll must unfreeze your credit score report so your new lender can view it. You may request that your credit score stories be unfrozen at any time, and there are not any closing dates for freezing or unfreezing them.

Nonetheless, it’s essential to know that, relying in your contact methodology, freezing or unfreezing your credit score report might not occur immediately. You’ll want to do that a number of enterprise days earlier than the lender pulls your credit score.

Unfreezing Your Credit score Report On-line or By Cellphone

In the event you contact Experian, Equifax, or TransUnion on-line or by cellphone and request a credit score unfreeze, it’ll happen instantly. That is the quickest option to full both motion. A credit score freeze is beneficial if you happen to suspect the potential of credit score fraud within the close to future, e.g., if you happen to’ve had your pockets containing your ID and bank cards stolen.

Typically, when unfreezing your credit score on-line your credit score should be unfrozen throughout the hour. You’ll additionally be capable to set a timeframe for when your credit score might be robotically re-frozen.

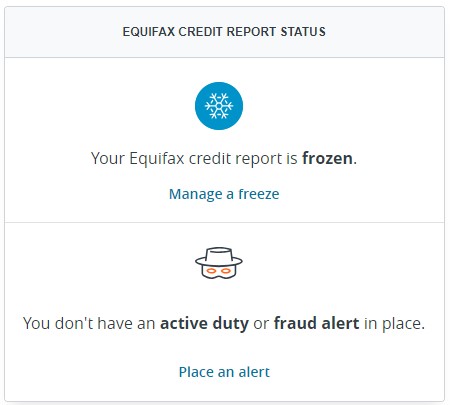

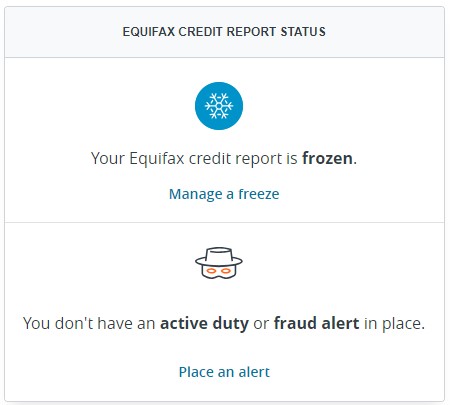

For the web choice, simply log again into your account and you need to see a option to Handle your freeze. That is what it seems to be like for Equifax:

Click on on “Handle a freeze” and you’ll quickly raise a safety freeze or completely take away a safety freeze. If you choose “quickly raise,” you may set a timeframe (say, two days) for which the freeze is lifted. Completely eradicating it is usually an choice however I feel it’s higher to only do a brief one.

Unfreezing Your Credit score Report by Mail

You may also request a credit score unfreeze by mail with all three main credit score bureaus utilizing the identical addresses you probably did for mailing in a credit score freeze request.

Nonetheless, requesting a credit score report “thaw” by mail can take fairly a while. As soon as the credit score bureau receives your letter, processing can take as much as three days. In different phrases, this isn’t the strategy to make use of if you happen to’re in a rush to have your credit score report unfrozen.

On the lookout for extra methods to maintain your credit score report protected? Take a look at this DIY Identification Theft Safety System. It gives nice concepts on easy methods to stop thieves from accessing your private info.

✨ Associated: 12 Methods to Test Your Credit score Rating for Free

Credit score Freeze vs. Fraud Alert

Individuals typically confuse Fraud alerts with credit score freezes. Whereas fraud alerts provide some safety towards identification theft, it’s totally different from a credit score freeze in two methods:

- In contrast to a credit score freeze, you place a fraud alert for a specified interval (sometimes one yr).

- Fraud alerts don’t “lock” your credit score bureau the best way a credit score freeze will

A fraud alert is useful in case you have been the sufferer of fraud or identification theft up to now, which can improve the danger of reoccurrence. A fraud alert warns collectors to take further precautions to confirm your identification once they obtain a credit score software in your identify.

Most fraud alerts will stay in your credit score report for one yr, however you may request an prolonged fraud alert to be positioned in your credit score report. See the FTC web site for extra info on prolonged fraud alerts and different credit score freeze info.

FAQs

Anybody can freeze their credit score. It’s turning into a well-liked identification theft prevention tactic so long as you don’t thoughts the occasional headache of unfreezing your stories to use for credit score.

You could contemplate freezing your credit score report if you happen to’re involved about the potential of identification theft or fraudulent credit score functions.

You shouldn’t freeze your credit score if you happen to plan to use for a mortgage, mortgage, or bank card within the close to future.

A credit score report freeze is open-ended – it lasts till you unfreeze it. And you’ll have it final so long as you need. You may freeze or unfreeze your credit score with the three main credit score bureaus at any time.

You may freeze your minor little one’s credit score report, though you is probably not ready to take action after the kid turns 16.

Last Ideas

A credit score freeze can shield you from credit score fraud by permitting you to restrict who can entry your credit score report. It may be positioned at any time and is open-ended, so you may take away a credit score freeze everytime you need. A credit score freeze prevents events from performing a tough credit score verify in your file, however tender credit score checks can nonetheless be pulled for issues like lease functions and bank card pre-approvals.

To request a credit score freeze (or unfreeze), it’s good to contact every of the three main credit score bureaus instantly, however you are able to do so on-line, by cellphone, or by common mail.

Lastly, we don’t advocate that you simply freeze your credit score report if you happen to plan to use for a mortgage or bank card within the close to future.