The One Large Stunning Invoice Act (OBBBA), signed into legislation on July 4, 2025, largely serves to increase and modestly broaden a number of provisions of the 2017 Tax Cuts and Jobs Act (TCJA), offering advisors and their purchasers with a clearer tax planning panorama heading into 2026. Whereas lots of the most impactful provisions – reminiscent of the improved State And Native Tax (SALT) deduction and new below-the-line deductions for ideas and additional time – are already in impact for 2025, OBBBA nonetheless introduces a number of nuanced planning alternatives with looming year-end deadlines, providing advisors a chance to assist quite a lot of purchasers earlier than the top of 2025.

One main alternative stems from OBBBA’s modifications to charitable contribution guidelines. Starting in 2026, itemized charitable deductions can be lowered by a 0.5%-of-AGI flooring, and high-income taxpayers within the 37% bracket may even see a 2/37 haircut on all itemized deductions. Excessive-income purchasers could profit from frontloading charitable giving into 2025 to keep away from these new limitations, doubtlessly utilizing Donor Suggested Funds (DAFs) to protect flexibility in future grantmaking. Concurrently, beginning in 2026, a brand new above-the-line charitable deduction of as much as $1,000 (single) or $2,000 (joint) will develop into accessible to non-itemizers. This introduces a planning wrinkle for purchasers close to the itemizing threshold, who could wish to lump non-charitable deductions like SALT and mortgage curiosity into 2025, whereas preserving smaller charitable presents for future standard-deduction years.

One other time-sensitive technique applies to staff with Incentive Inventory Choice (ISOs) compensation. In 2026, the phaseout threshold for the AMT exemption will drop, whereas the SALT deduction cap will rise to $40,000, growing the danger of triggering AMT for ISO workouts. This narrows the window for purchasers with unexercised ISOs to behave in 2025 to keep away from or cut back AMT publicity. Particularly for purchasers whose ISO workouts would land them within the 2026 “bump zone” – the place marginal tax charges on extra AMT revenue can attain 42% – it might make sense to speed up workouts into 2025, the place they might lead to no or decrease AMT.

OBBBA additionally expands 529 plan distribution guidelines to incorporate as much as $20,000 of Okay–12-related bills and credentialing prices like coursework required for CFP certification, efficient for distributions made after July 4, 2025. Importantly, funds can be utilized to reimburse bills incurred at any level throughout 2025, so long as the distribution is made earlier than year-end. This creates a one-time alternative for purchasers with eligible 529 balances to reimburse themselves for beforehand ineligible instructional bills from earlier within the 12 months.

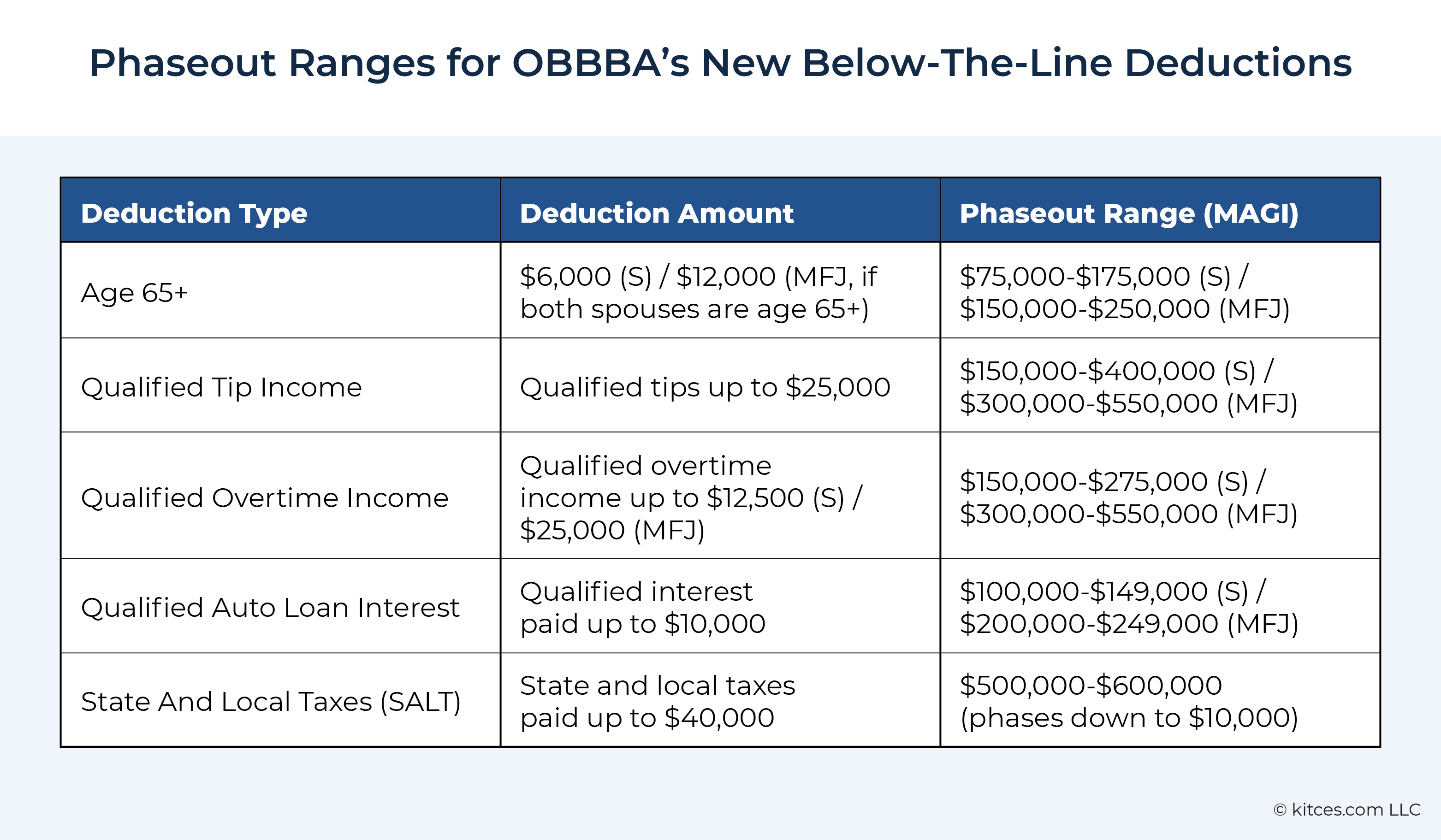

Moreover, the introduction of a number of short-term below-the-line deductions for seniors, tip earners, additional time employees, and auto mortgage curiosity creates a brand new layer of complexity for Roth conversion and withdrawal methods between 2025 and 2028. Every deduction phases out over particular (however separate) revenue thresholds, which means pre-tax revenue from withdrawals or conversions might unintentionally cut back or eradicate a number of deductions. Advisors can revisit current Roth conversion plans in gentle of those phaseouts, recognizing that even modest conversions could produce ‘magnified’ marginal charges resulting from misplaced deductions. Efficient coordination between tax software program and the advisor’s planning instruments can be essential to mannequin the true price of conversions throughout this window.

For self-employed professionals in Specified Service Trades or Companies (SSTBs) – together with monetary advisors – the shifting phaseout ranges for the Certified Enterprise Revenue (QBI) deduction create one more one-time planning alternative. Although OBBBA retains a lot of the QBI deduction in its earlier kind below TCJA, it widens the SSTB phaseout vary in 2026. Consequently, SSTB house owners whose revenue falls throughout the present 2025 phaseout vary could wish to defer revenue into 2026, the place the spike in marginal tax charges on revenue by way of the phaseout vary can be extra gradual. Conversely, these whose revenue already exceeds the 2025 phaseout limits however might fall throughout the expanded 2026 vary could profit from accelerating revenue into 2025 to keep away from a spike in marginal revenue subsequent 12 months.

Lastly, OBBBA accelerates the expiration of sure power credit initially launched by the Inflation Discount Act. Whereas some deadlines – reminiscent of these for electrical car credit – have already handed, there’s nonetheless time earlier than December 31, 2025, to finish qualifying energy-efficient residence enhancements and obtain as much as $3,200 in tax credit. Smaller tasks like new doorways or home windows – and even scheduling a house power audit – should be possible inside this slender timeframe and will help purchasers cut back each their taxes and utility prices.

Finally, whereas OBBBA would not utterly overhaul the tax code, it does introduce a sequence of slender however significant planning alternatives for a variety of purchasers. Serving to purchasers plan and execute year-end tax methods is an annual alternative for advisors to indicate their worth, however with OBBBA’s new provisions, advisors have the prospect to create much more tangible tax financial savings earlier than the calendar flips to 2026!

Learn Extra…