I’ve all the time been a glass-is-half-full form of individual.

I don’t fear an excessive amount of about issues exterior of my management. I attempt to not get caught within the gloom-and-doom vortex so many individuals have been sucked into because the 2008 monetary disaster and the arrival of social media.

That doesn’t imply I’m naive to the truth that issues are dangerous for lots of people as of late.

Every part’s costly. There has by no means been a worse time to be a first-time homebuyer. And the wealthy hold getting richer as wealth inequality threatens to tear society aside on the seams.

All over the place you look as of late the media reminds you we’re residing in a Okay-shaped economic system:

The thought right here is that wealthy persons are the one ones doing nicely within the economic system as we speak. They personal all of the property. They spend all the cash. They get to have all of the enjoyable and everybody else is struggling.

Right here’s a narrative from The Wall Road Journal on this topic:

Right here’s the reason:

Traders’ rosy emotions about having much more cash–at the very least on paper–are powering spending on restaurant meals, business-class airline tickets, house enchancment and extra, preserving the broader economic system buzzing.

It’s a really totally different story for everybody else. People with giant funding portfolios really feel markedly higher concerning the economic system than those that don’t personal shares.

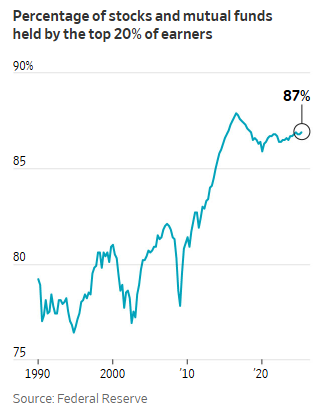

Simply have a look at how concentrated shares are within the palms of the rich:

Shares are costly. Homes are costly. Borrowing charges are costly. Meals is dear. Daycare is dear. Healthcare is dear.

I perceive why many individuals are irritated with the present atmosphere. It doesn’t appear honest that wealthy folks ought to be capable to benefit from the economic system whereas so many others are struggling.

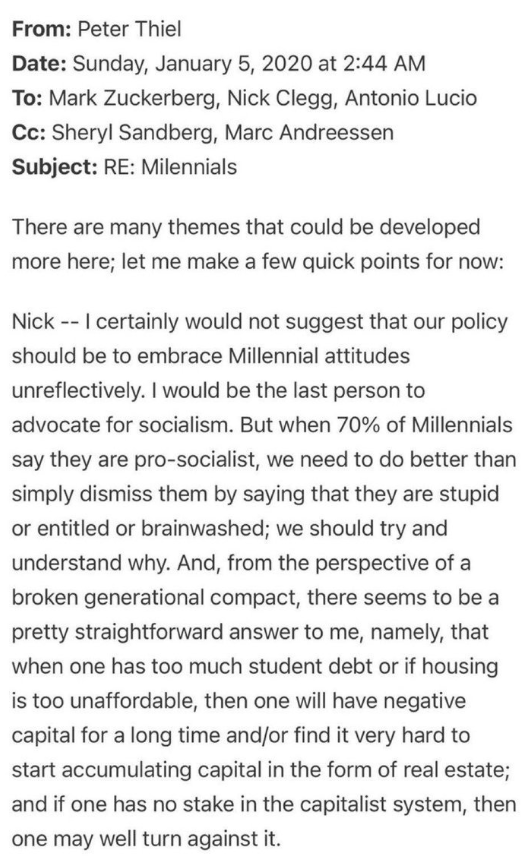

An outdated e mail from Peter Thiel surfaced this week that explains why so many younger persons are fed up with the present system:

It is a honest level. If you happen to don’t get to take part within the upside of the system you’re going to struggle in opposition to the system.

But it surely’s not utterly correct. It’s extra based mostly on vibes than details. I’m not naive to the truth that the present atmosphere is troublesome for some folks. Nevertheless, what if issues aren’t as dangerous as they seem?

Let’s have a look.

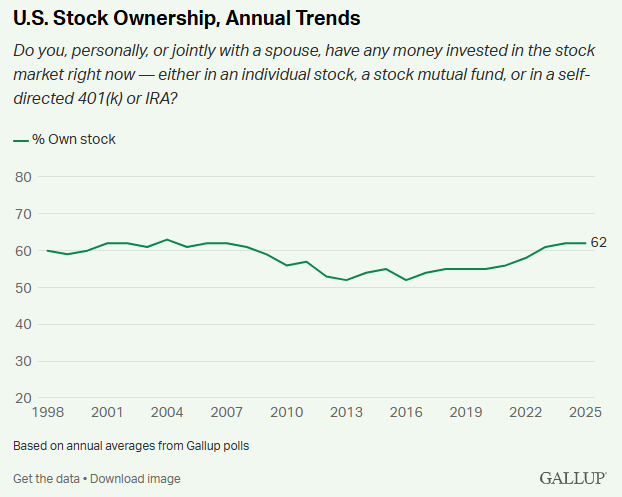

Sure wealthy folks personal nearly all of the inventory market. However practically two-thirds of all households now personal shares in some trend:

Within the early-Nineteen Eighties lower than 20% of People invested within the inventory market. There are far more folks benefiting from shares going up now!

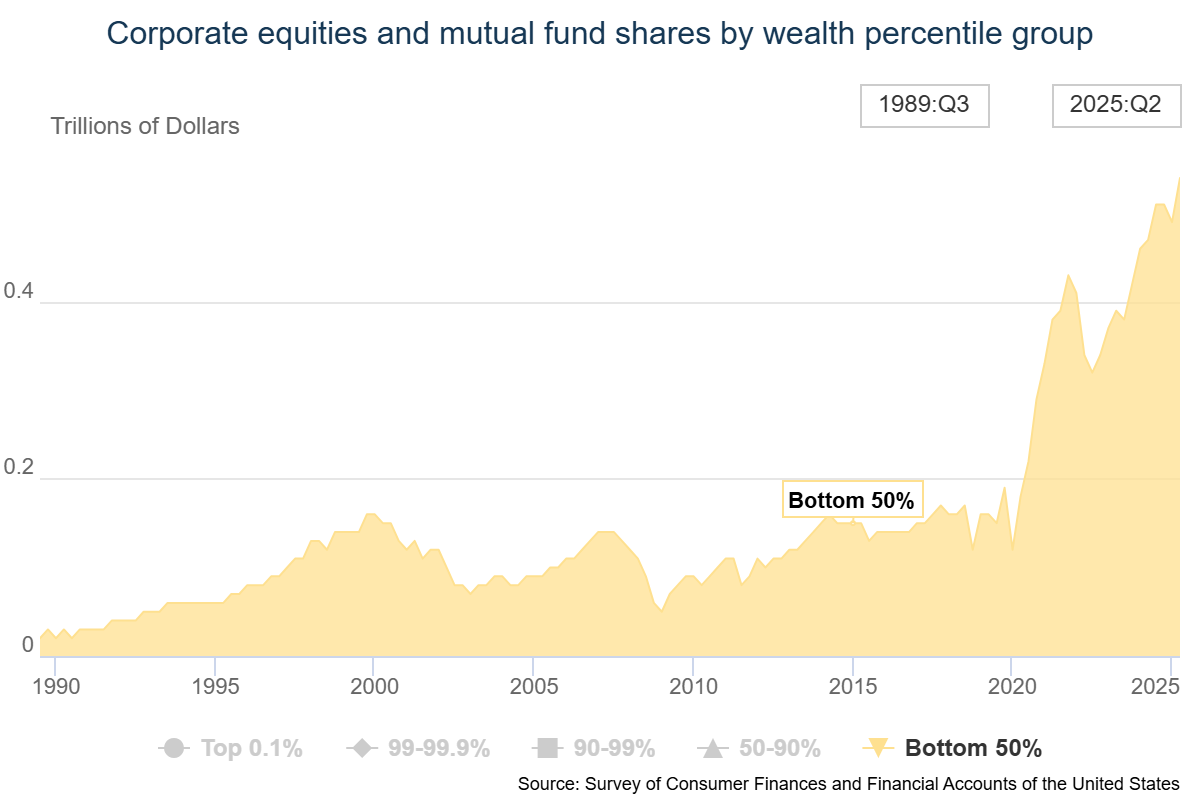

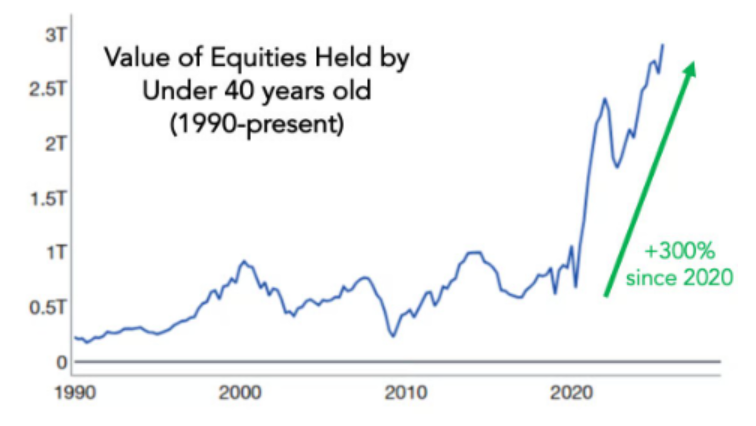

And it’s not simply wealthy folks. The underside 50% have seen the worth of their inventory holdings enhance by 350% since 2020:

Is it nonetheless a really low share of the entire? Sure however this enchancment is price celebrating. Extra persons are concerned within the best wealth creation car ever invented.

There are loads of structural causes households invested much less within the inventory market again within the day. However a part of it was child boomers went to highschool, obtained married purchased a home and then purchased some shares later in life.

For a lot of younger folks that has reversed. Housing is costlier in order that they’re shopping for shares now and (hopefully) a home afterward.

Listed below are some stats I’ve written about earlier than which can be price highlighting:

- 54% of People with incomes between $30k and $80k now have a taxable brokerage account and half of them have entered the inventory market up to now 5 years.

- Robinhood has one thing like 25 million prospects. For half of them, it’s the primary brokerage account they’ve ever opened.

- Practically 40% of 25-year-olds now have funding accounts up from simply 6% in 2015.

- Households with incomes under the median now account for one-third of JP Morgan prospects transferring cash into funding accounts up from 20% within the 2010s.

We’ve gone from housing being your largest funding to the inventory market. Simply have a look at the rise in inventory holdings for folks underneath 40:

In the event that they stick it out these younger persons are going to be a lot wealthier due to it from the compounding advantages of investing earlier. Plus investments within the inventory market are extra diversified, extra liquid and provide higher flexibility than proudly owning a house.

In fact, there are psychic advantages to proudly owning your property. These items don’t all the time boil right down to numbers.

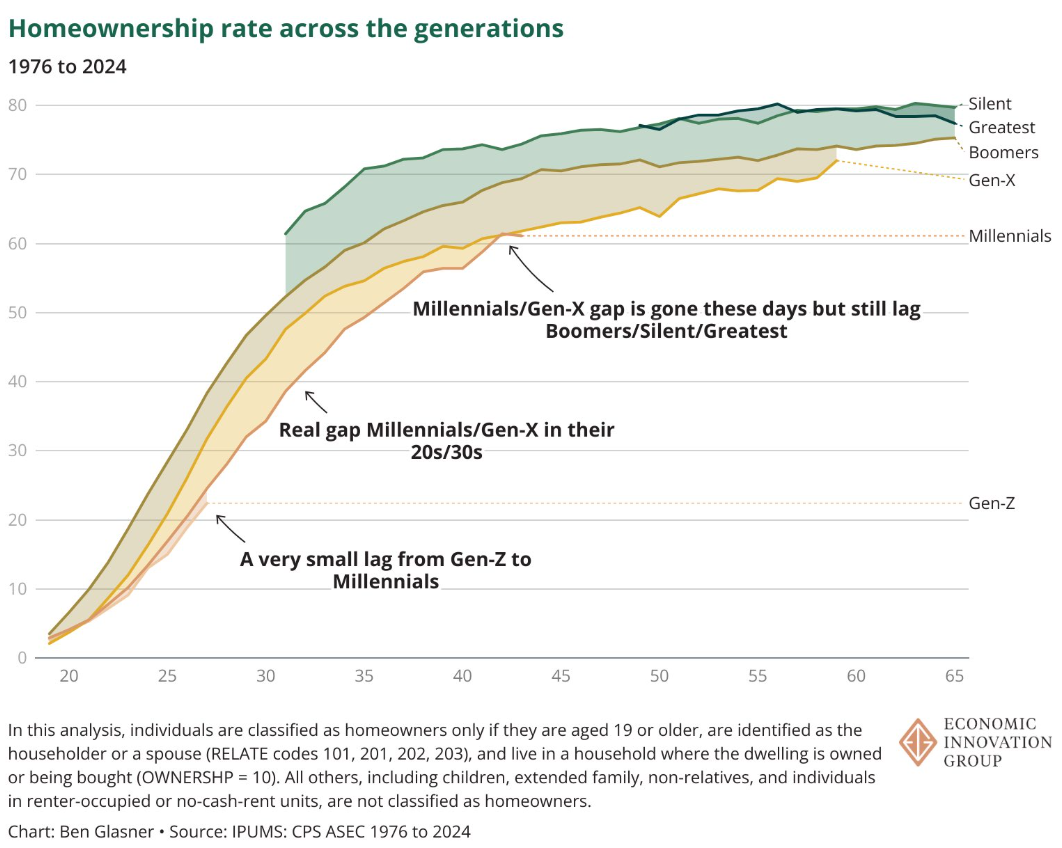

However whereas as we speak is a wretched atmosphere to be a first-time homebuyer, younger persons are nonetheless changing into owners. It’s just a bit slower than earlier generations:

It’s nonetheless going up and to the correct simply at a slower tempo.

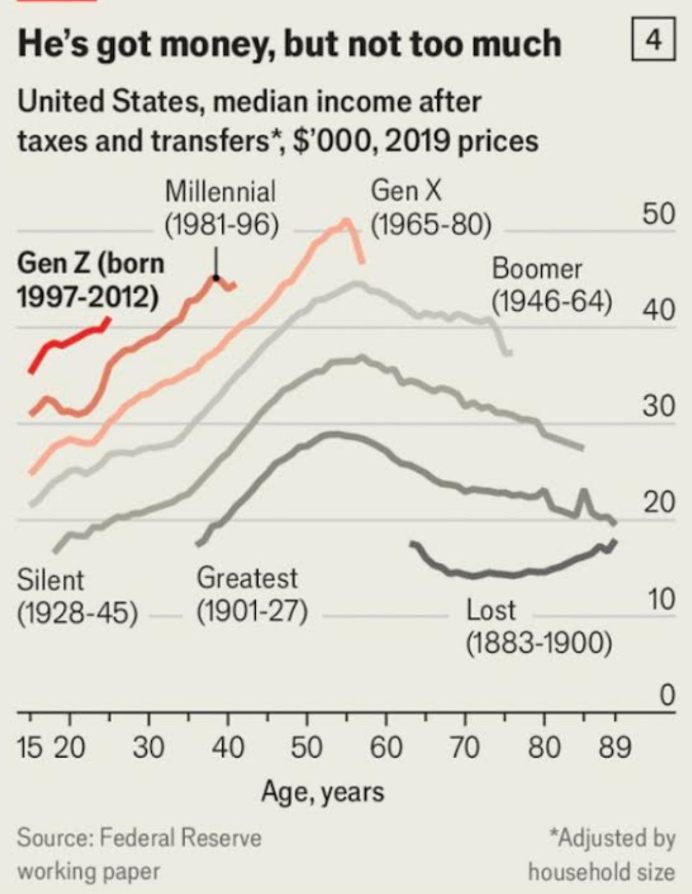

And I’m assured many younger persons are going to have the ability to afford a house sooner or later. Why? They earn more money than earlier generations did even after accounting for inflation:

Does this imply every little thing is simple for younger folks as we speak?

In fact not.

Life is costlier. Luxuries have grow to be requirements.

It’s arduous to get forward whenever you’re paying off pupil loans. Youngsters are costly and daycare prices are outrageous. New autos now value $50k. The median house sells for practically half 1,000,000 {dollars}.

Life continues to be arduous for many individuals and it all the time will probably be. I’m not blind to this truth. Nobody likes to listen to issues are higher in mixture than their private expertise.

However possibly issues are higher than you learn within the information and on social media.

Folks hate the economic system proper now and it’s doing fairly nicely. How are folks going to really feel once we go into an precise recession?

Michael and I went on Plain English with Derek Thompson this week to speak concerning the plight of younger folks, the housing market, AI and extra:

And we hit on the Okay-shaped economic system on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Are Younger Folks Screwed?

Now right here’s what I’ve been studying these days:

Books: