My morning prepare WFH reads:

• Is $200 Million the New $100 Million in Luxurious Actual Property? A surge of ultra-rich patrons has pushed asking costs to new extremes, but many headline-grabbing megamansions languish in the marketplace or commerce for a fraction of their debut numbers. (Wall Road Journal)

• Crypto World Wipes Out $1 Trillion as Bitcoin Plunges Anew. The good crypto crash of 2025 entered a brand new section on Wednesday, as Bitcoin plunged to its lowest degree in seven months, extending the greater than $1 trillion wipeout throughout the digital‑asset world. The biggest cryptocurrency fell to as little as $88,522, with the most recent rout hitting traders huge and small — from retail dip‑patrons to digital‑asset treasury corporations whose inventory premiums are vanishing. (Bloomberg) see additionally The Crypto Trades That Amplified Features Are Now Turbocharging Losses: Bitcoin’s steep fall highlights the expansion of dangerous bets provided by Wall Road and crypto corporations alike. (Wall Road Journal)

• Inventory Markets Are Spooked by Fed Fee-Minimize Doubts. It’s Too Early to Panic. How rapidly issues can change. Markets have swung from euphoria to fright within the area of barely per week nevertheless it’s not clear that the elemental dynamics of the U.S. economic system or company earnings have altered all that a lot. (Barron’s)

• 10 Issues We Can Be taught From Warren Buffett That Have Nothing to Do With Cash: Life classes from the Oracle of Omaha as he retires as Berkshire Hathaway’s CEO. (Morningstar)

• Hedge Funds Name This Psychologist When Their Merchants Begin Shedding: Dave Popple is tasked with discovering who can minimize it for hypercompetitive multimanager funds. (Wall Road Journal)

• Janet Yellen Says the US Is Undermining Its Financial Success: The previous Treasury secretary warns that Trump’s assaults on the rule of legislation, the Fed and universities threaten the foundations of American prosperity. (Bloomberg)

• New York Lacked an Inexpensive Housing Portal. So These Youngsters Made One. Two “kids of the pandemic” did one thing the grown-ups who run town have by no means managed to do. (New York Occasions)

• The working industrial advanced: I fell in love with the world’s easiest sport. Then the Instagram advertisements began flooding in. (Enterprise Insider)

• Steve Bannon suggested Jeffrey Epstein for years on methods to rehab his popularity, texts present: Pair devised responses to public outrage about Epstein’s felony historical past, his therapy by the justice system and his friendships with highly effective folks. (The Guardian)

• It’s the NBA’s Most Devastating Play—and It Begins With a Missed Shot: No one within the NBA is best at gobbling up rebounds than Steven Adams. So the Houston Rockets have turned missed photographs into a part of a spectacular assault. (Wall Road Journal)

You should definitely take a look at our particular dwell episode of Masters in Enterprise Dwell from the Financial Membership of New York, with Nobel laureate Richard Thaler, and his colleague from the Sales space College of Enterprise, Alex Imas, Professor of Behavioral Science, Economics and Utilized AI; we talk about the brand new version of their ebook “The Winner’s Curse.”

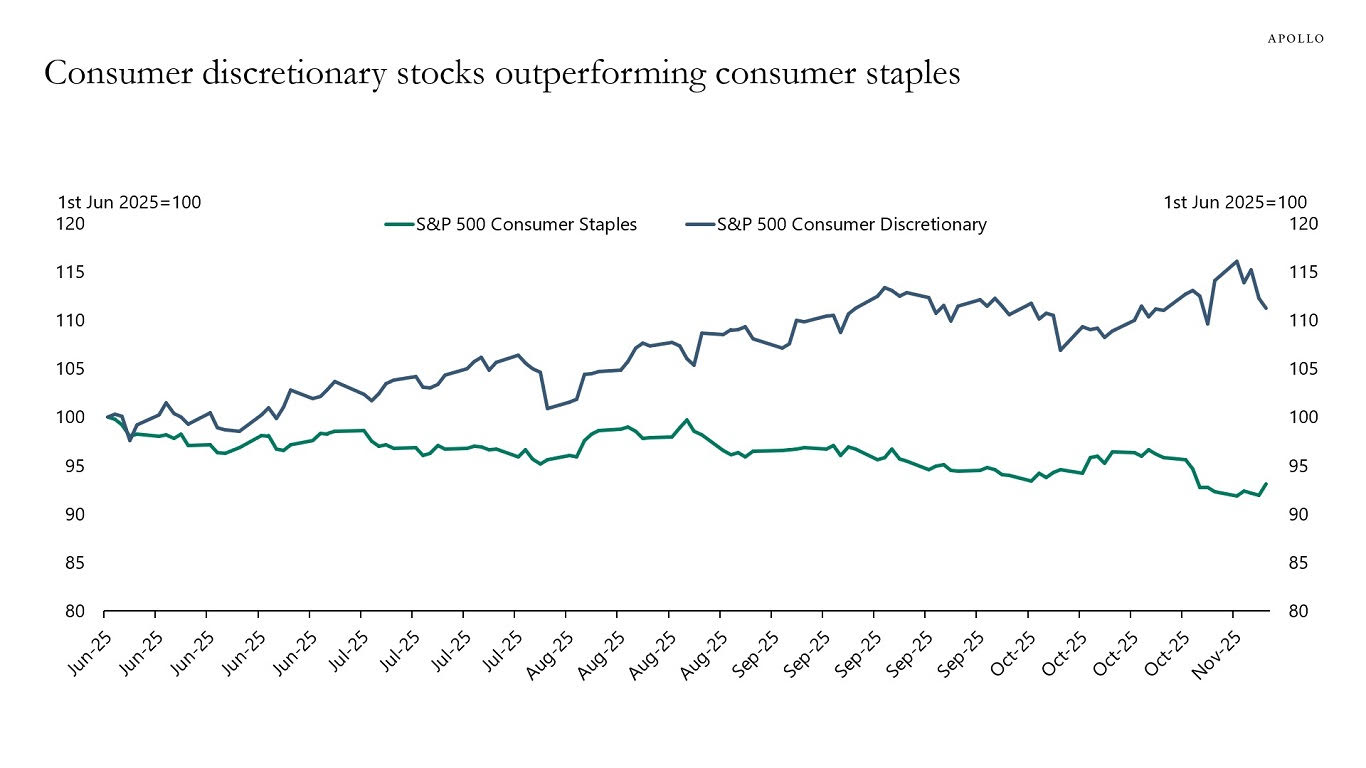

This energy of higher-income family stability sheets relative to lower-income stability sheets is the rationale why shopper discretionary shares in latest months have been outperforming shopper staples

Supply: Apollo

Join our reads-only mailing record right here.