Spencer Jakab at The Wall Road Journal makes the case that we might use an extended bear market:

He explains:

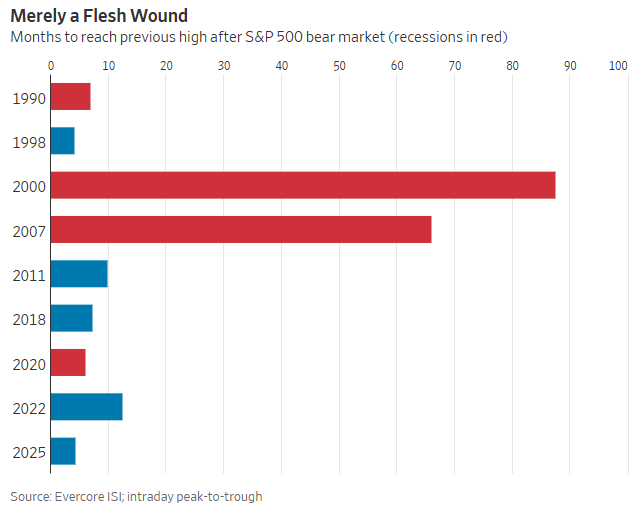

The typical time to succeed in the earlier excessive when a bear market was accompanied by a recession was 81 months. It took simply 21 and not using a recession. Over the previous 16 years, downturns have lasted lower than eight months earlier than the outdated excessive was reached.

Hardly anybody youthful than 40 now even had a 401(ok) in the course of the 2007-09 wipeout. Most Wall Road professionals hadn’t graduated from faculty but.

Bear markets are academic, however the tuition is a doozy.

This chart exhibits how shortly markets have recovered from current downturns:

So whereas buyers have lived via loads of volatility and downturns, the magnitude of these downturns has been tame. For these buyers who haven’t skilled an extended bear market, they could possibly be in for a impolite awakening.

William Bernstein and Edward McQuarrie lately wrote a chunk that echoes these sentiments:

Greater than a technology in the past, monetary historian Peter Bernstein (sadly, no relation to Invoice) wrote about buyers’ “reminiscence banks,” the market expertise that accumulates of their hippocampi over their investing lives and molds their funding technique. As he put it, trying again on the Nineteen Nineties: “Many of the new members out there had no reminiscence of what a bear market was like.”

Most buyers ought to have had their reminiscence banks erased primarily based on the present bull market run.

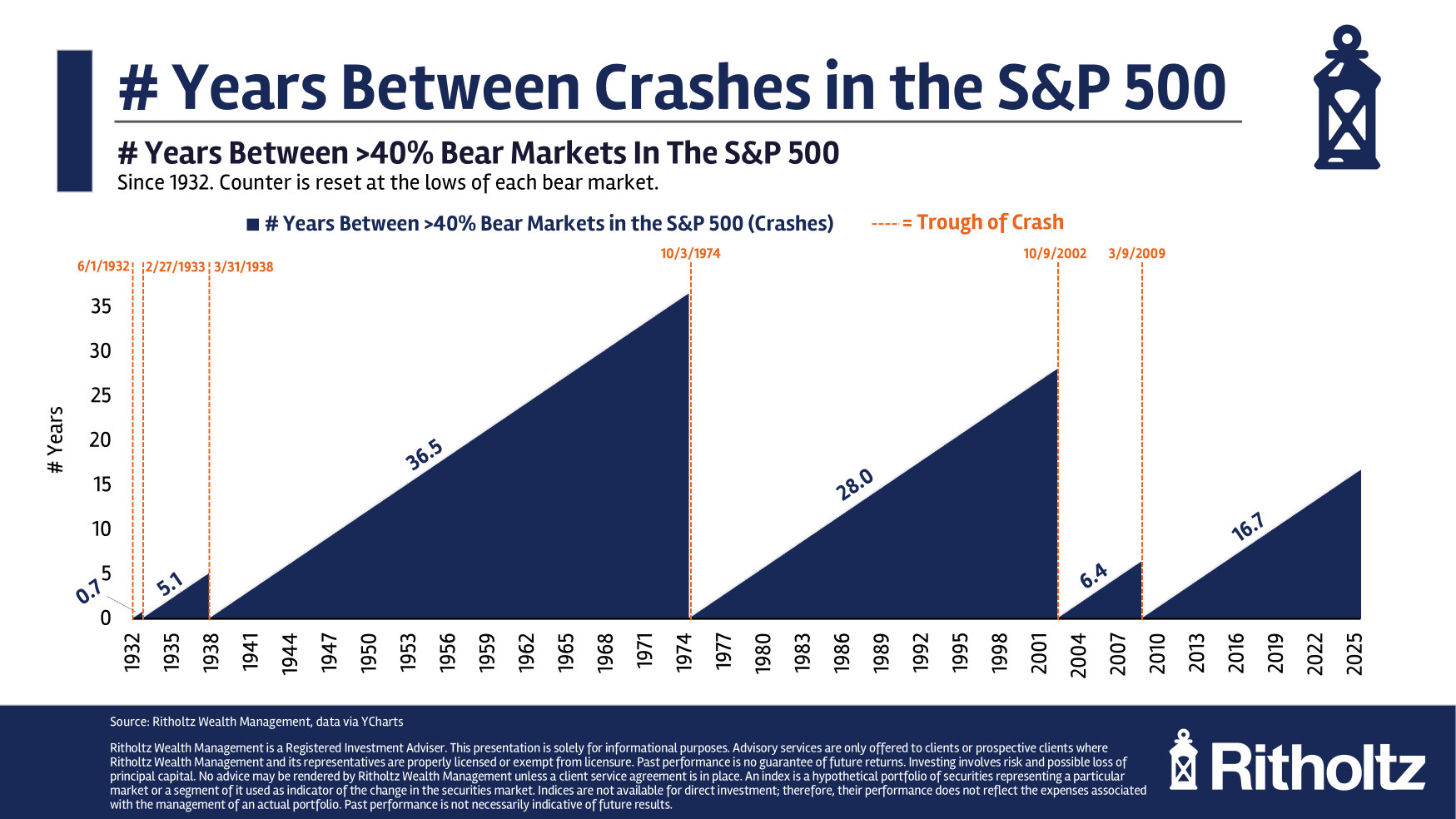

I’m going to imagine a drawdown of 40% or worse is the definition of a market crash. By that definition, it’s been a while for the reason that final crash. That is completely regular primarily based on historic information:

There have been multiple-decade-long stretches and not using a crash. There have been no lengthy bear markets between the Nice Despair and the Nice Inflation of the Seventies. There was one other lengthy interval of relative calm from the Seventies via the dot-com bubble with no market crashes.

That was adopted by an actual jolt to the system with two crashes in lower than a decade.

We’ve had a handful of bear markets however no crashes with an prolonged period for the reason that 2008 disaster.

There at the moment are extra younger individuals invested within the inventory market than ever earlier than. Absolutely, an extended bear market can be tough for these new buyers to deal with. Nevertheless it’s not simply new buyers I’d be involved about on this state of affairs.

I vividly keep in mind the Nice Monetary Disaster.

I began a brand new job the day after my honeymoon ended in the summertime of 2007. The banking disaster was already underway by that time. Managing cash via that disaster was tutorial for me but additionally nerve-racking.

However from a private perspective investing was comparatively simple.

I didn’t have a lot cash. My inventory market investments have been down 50-60% by the underside but it surely was a comparatively small sum of money. I simply needed to maintain shoveling my contributions into the market at fire-sale costs. Human capital trumped the crash.

The individuals I noticed freaking out and making errors weren’t younger individuals however these with extra seasoned portfolios. Why? They’d extra money to lose!

I do know loads of retirees who’re fearful a few inventory market crash. This might be a brand new factor for middle-aged individuals like myself too.

I’ve much more cash in my portfolio now than in 2008. Even when the proportion decline was decrease than it was in 2008, the greenback losses can be way more painful from a 40% crash.

Shedding 40% of your cash when you’ve gotten $100k is $40k. Shedding 40% of your cash when you’ve gotten $1 million is $400k. That is an apparent assertion however seeing that a lot cash evaporate will be extremely painful.

There at the moment are loads of rich buyers who’ve by no means had this a lot cash at stake earlier than.

Pay attention, I’d slightly not reside via a nasty recession and lengthy bear market. However I do know these dangers exist. The market will crash sooner or later. Possibly it comes again comparatively shortly however that’s not assured.

That’s why I diversify. I don’t use leverage in my portfolio. I don’t have concentrated positions.

The secret in an extended bear market is surviving, each mentally and financially, to reside one other day within the markets.

Predicting a market crash is kind of unimaginable however it’s a must to put together for one as a result of it’ll occur finally.

Michael and I talked about lengthy bear markets and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Going All-In on MSTR

Now right here’s what I’ve been studying recently:

Books: