I’ve by no means shared this story earlier than, however since we’re at a milestone, I would as properly…

February 2000: I used to be working as a strategist for a brokerage agency. My buddy Anthony had a world clientele, all deeply invested in US tech corporations. His largest consumer was flying in from the Center East for a mixture New York Metropolis purchasing journey/portfolio overview.

His largest place? Cisco (CSCO). Tens of millions of shares value 10s of hundreds of thousands of {dollars}…

I didn’t cowl the corporate (I used to be not an analyst). However I had views on the networking and telecom sector; I believed the whole lot within the “George Gilder Telecosm” was a catastrophe ready to occur. Gilder’s (costly) publication accurately recognized budding expertise tendencies, but in addition possessed terrible timing. When his telecoms portfolio plummeted by about 90%, he had the nerve to really say, “I don’t do worth.” 1

However I digress.

Prepping for the assembly, I reached out to Paul Sagawa of Alliance Bernstein. Within the Nineteen Nineties, Sagawa was the axe on Cisco; for almost 20 years, he accurately recognized the upside for the networking agency. However by 1999, Sagawa modified his tune. Cisco had turn out to be an enormous market chief however was more and more shifting in the direction of vendor financing. Within the late Eighties, lower than 5% of Cisco’s purchasers used the corporate’s personal financing arm; a decade later, it was 90+%. “Purchase our beneficial cutting-edge expertise, we solely want your flimsy, VC-backed start-up to signal a promise to pay for it (ultimately).”

Sagawa accurately noticed this as a budding catastrophe.

The market isn’t form to inventory bulls after they reverse course and switch bearish.2 All through 1999, he went from a inventory analyst famous person to a persona non grata. His fall from grace was vindicated twelve months later, however earlier than the deluge, he was considerably of an outcast.

My agency was not even a Bernstein consumer; I took an opportunity and referred to as the quantity listed on his most up-to-date CSCO analysis. To my shock, he not solely answered the decision but in addition took the time to clarify the scenario to me for an hour. Sagawa supplied the exhausting knowledge and particulars for me to debate the draw back of Cisco with Anthony’s consumer, loaded with all of the ammunition wanted.

On the assembly, I began with the broadest overview: The inventory was up ~3,700% since its IPO. The Sheik sat impassively as he took all of it in. I drilled down into the small print, the seller financing, the altering expertise panorama. I didn’t really feel like I used to be making any headway, and didn’t need to badger him. The very last thing I stated was “You’ve made immense returns on this title, and we’re years into this bull market; my finest guess is there’s extra draw back threat than upside potential within the high-flying names – and Cisco is the poster little one.”

I’m not salesman; I gave it my finest shot, however didn’t count on a lot. I stated my thanks and left.

I used to be stunned a number of months later when Anthony got here into my workplace with a bit thank-you reward for the hassle. “The sheik offered half, he’s thrilled with us.” On the time, Cisco had already fallen 35% on its solution to dropping ~90%.

I had written concerning the Fortune Cisco cowl repeatedly – in 2000, then once more years later. It’s now a cautionary chapter in How To not Make investments.

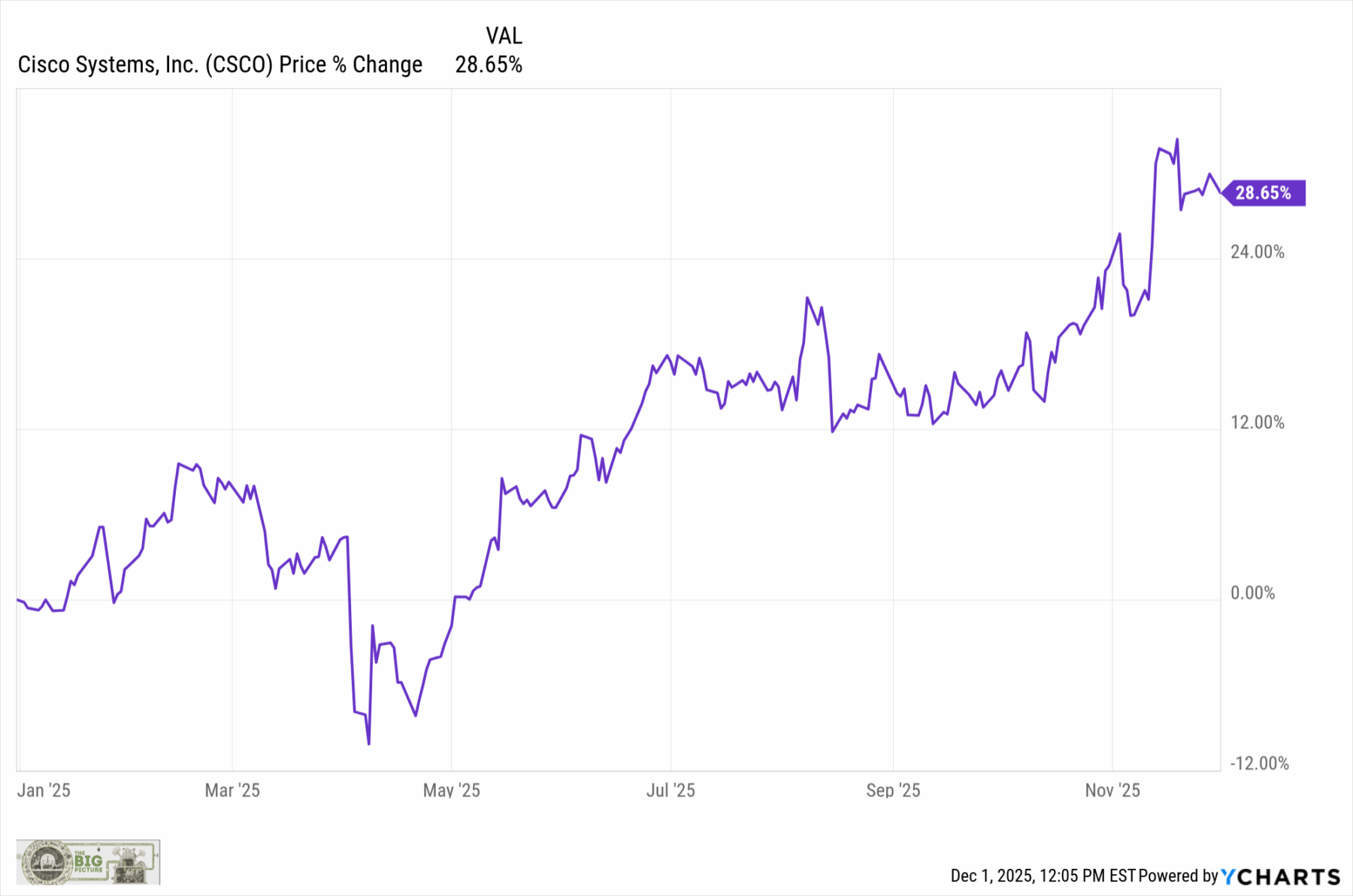

Right here we’re, 25 years later, and CSCO has perked up. Quantum computing, AI, and Cybersecurity have the inventory rallying 28.9% this yr. It has not fairly reached $80.06, the dotcom peak in March 2000, however it’s lastly above the extent the place that notorious cowl story (“Regardless of how you chop it, you’ve received to personal Cisco”) got here out.

The important thing lesson is that media protection – of any inventory, asset class, or funding – ought to by no means be an alternative choice to your individual pondering.

Supply:

There’s One thing About Cisco

By Andy Serwer, Irene Gashurov, Angela Key

FORTUNE Journal, Could 15, 2000

Beforehand:

2000: “Regardless of how you chop it, you’ve received to personal Cisco” (Could 15, 2023)

Can Anybody Catch Nokia? (October 26, 2022)

Why the Apple Retailer Will Fail (Could 20, 2021)

No one Is aware of Nuthin’ (Could 5, 2016)

How Information Appears to be like When Its Previous (October 29, 2021)

Predictions and Forecasts

__________

1. “A lot of the corporations listed have misplaced at the very least 90 % of their worth over the previous two years, in the event that they’re even in enterprise anymore.” –Wired

2. I skilled this firsthand with EMC…

~~~

I talk about the difficulty with the CSCO cowl in How To not Make investments: The concepts, numbers, and behaviors that destroy wealth―and tips on how to keep away from them.”

Its on sale at Amazon Cyber Monday Deal: $18.01