A reader asks:

Do you suppose we’ll lastly see housing costs fall in 2026? Redfin says there are far more sellers than consumers and other people with 3% mortgages can solely maintain on for therefore lengthy. I do know costs don’t fall fairly often however it looks as if a softening labor market blended with sky-high costs may lastly make it occur. What say you Ben?

In the event you had instructed me again in early-2022 that mortgage charges would go from sub-3% all the best way as much as 8% and keep above 6% for 3+ years I’d have assumed housing costs would have fallen by now.

Nope.

Costs simply maintain going up.

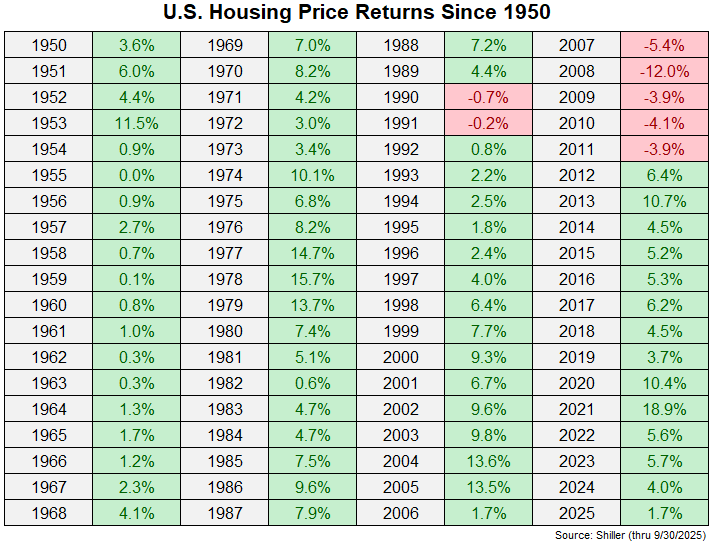

In response to Robert Shiller’s housing information, costs have been up 6% in 2023, 4% in 2024 and almost 2% (to this point) in 2025.

Nonetheless, I believe you might make the case that consumers are lastly combating again just a little and saying sufficient is sufficient.

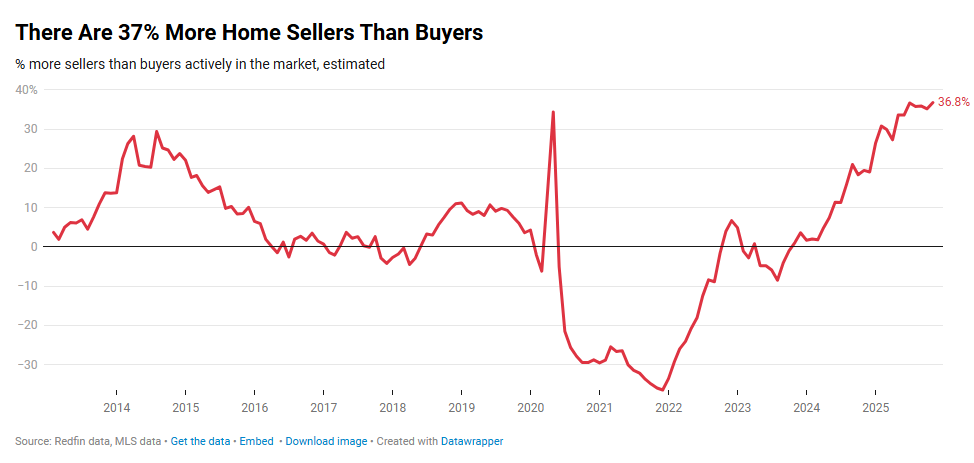

Redfin information estimates sellers outnumber consumers by a considerable margin:

The Wall Road Journal says homebuilders are struggling to dump new properties even supposing they’re providing a lot decrease mortgage charges:

America’s greatest builders are struggling to promote properties even after they provide consumers a 4% mortgage. Their expertise suggests price cuts alone gained’t be sufficient to spice up weak gross sales within the wider housing market.

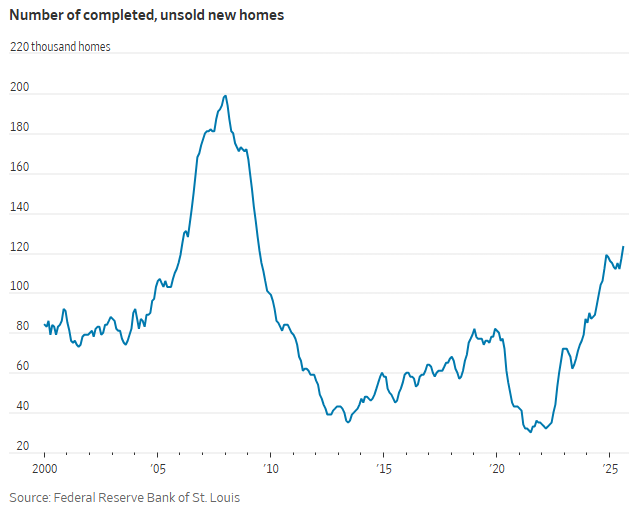

The variety of accomplished however unsold new properties has reached ranges final seen in the summertime of 2009, information from the Federal Reserve Financial institution of St. Louis reveals. On the finish of final yr, builders have been assured that gross sales would get better in 2025 and constructed tens of 1000’s of models to have sufficient provide for the spring-buying season. However demand didn’t decide up, and extra properties sat unsold.

The variety of new, unsold properties is climbing quick:

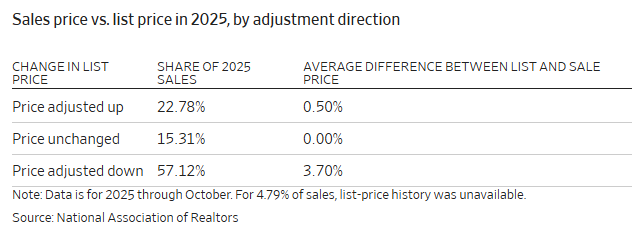

And the homes which are promoting at the moment are seeing markdowns. NAR information reveals that just about 60% of homes bought in 2025 got here with not less than one value minimize.

So why aren’t housing costs falling extra?

One motive is nationwide housing costs merely don’t fall that usually:

Costs have fallen on a nominal foundation simply 7 instances out of the previous 76 years. And people 7 down years have been clustered into two distinct monetary crises — the financial savings and mortgage disaster of the early-Nineteen Nineties and the Nice Monetary Disaster.

And whereas costs crashed greater than 25% within the 2008 debacle, the 1990 downturn was a drawdown of just a little greater than 2%.

There have been 11 recessions on this 76 yr time-frame since 1950 so even when there’s a recession it’s extremely unlikely that dwelling costs will fall.

Housing costs don’t fall on a sustained foundation that a lot. In the event you’re holding out hope for a crash, you is likely to be ready a really very long time.

HOWEVER, that is nationwide costs.

Everybody is aware of housing is native. In sure components of the nation, housing costs are already falling.

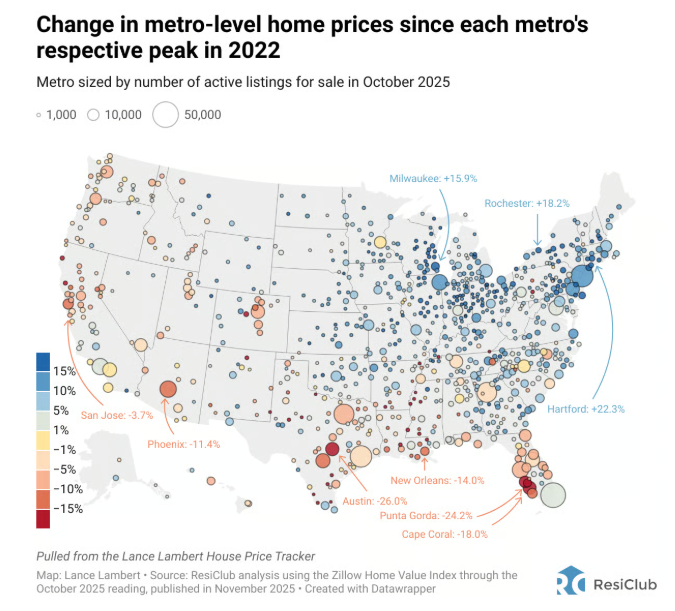

Lance Lambert reveals that there are components of the nation the place median dwelling costs are dropping, considerably in some instances:

Housing markets within the south are seeing some decent-sized housing value corrections. Locations like Austin (-26%), Cape Coral (-18%) and New Orleans (-14%) are sitting on double-digit downturns.

It’s additionally true that the areas with the largest value declines skilled the largest value booms earlier within the decade. From 2020 by the summer season of 2022, housing costs rose by round 70% in each Austin and Cape Coral. But it surely’s excellent news a few of the excesses are being labored off in these areas.

Some sanity has re-entered the market in sure locations.

This decade has been unpredictable in some ways so I’m undecided it even is sensible to make this sort of forecast over a one yr interval.

My base case could be housing costs will most likely stagnate to permit incomes to play catch-up however a minor downturn in costs wouldn’t shock me if mortgage charges keep above 6%.

Falling mortgage charges may unlock demand from consumers sitting on the sidelines. However what if these borrowing charges are falling as a result of the economic system is slowing or going right into a recession?

Even when there may be some kind of correction within the near-term it’s arduous to make the case for an all-out crash.

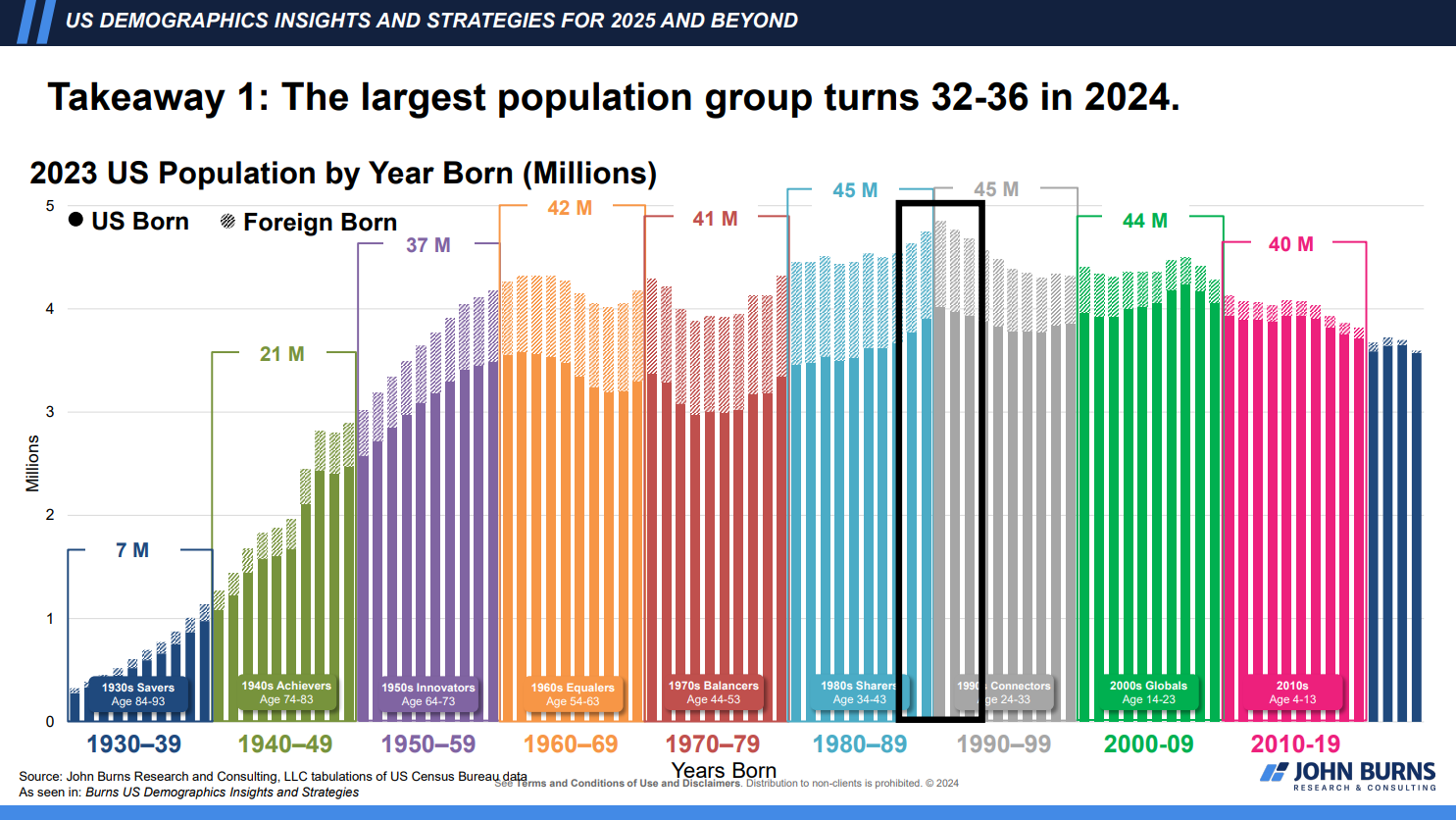

You continue to have a demographic tailwind in relation to housing demand the place the largest age bracket within the U.S. is of their prime homebuying years:

It wouldn’t shock me to see costs fall as a result of they rose so quick however I’d be shocked if housing costs crashed.

I went in-depth on this query on the most recent version of Ask the Compound:

Invoice Candy joined me for our two hundredth episode (!) to reply questions on the fantastic thing about Roth IRAs for early retirement, how Gen Z saves, find out how to deal with the dangers of retirement planning and the way servicemembers ought to handle their cash.

Additional Studying:

4 Questions Concerning the Housing Market