Again in 2019 I penned a eulogy for the 60/40 portfolio:

The 60/40 portfolio handed away on October 16, 2019, from problems of low rates of interest and a foul case of Fed manipulation. That is the twenty seventh time 60/40 has died previously decade however enemies market timing, day merchants, and various investments are hopeful it can stick this time round.

I couldn’t assist it. The monetary media saved saying it useless 12 months after 12 months.

Low bond yields made it exceedingly tough for buyers looking for balanced portfolios.

Once I wrote my eulogy the 10-year Treasury yielded round 1.5%. It might go even decrease through the early days of the pandemic bottoming out under 0.5%.

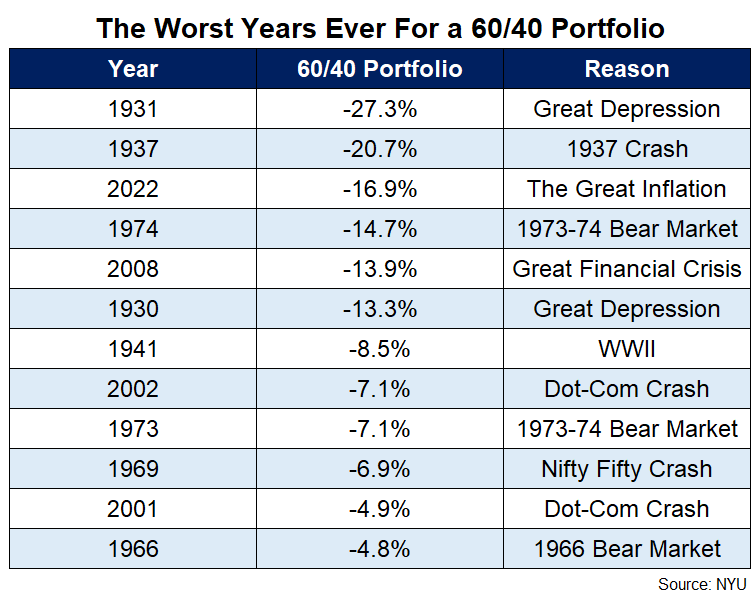

Then rates of interest went screaming larger from the ground to five% or so. In 2022, it really did really feel just like the 60/40 portfolio was useless. It received hit by a truck in one of many worst years ever for the mixture of shares and bonds.

The excellent news is short-term Treasuries and money stepped in to assist on the mounted earnings facet of issues however I perceive why so many buyers grew to become hesitant to personal bonds after that massacre.

When you invested in a complete bond market fund you skilled the worst mounted earnings returns on top quality bonds in historical past.

Within the 2010s when bond yields have been so low buyers have been being pushed out on the chance curve but in addition pushed out on the complexity curve. There’s a notion amongst sure wealth managers that you simply want alternate options, leverage, non-public investments, and many others. to succeed.

I’m not fully against these sorts of investments. They aren’t proper for lots of buyers however for many who perceive how they work and spend money on an inexpensive approach some of these investments can work.

However introducing extra complexity into your portfolio could make it a lot more durable to handle. The charges are larger, they’re extra illiquid, it’s more durable to rebalance, and there isn’t almost as a lot transparency. It’s a must to know what you’re doing if you enterprise outdoors of straightforward portfolios and even then you definitely may not be happy with the outcomes.

Having stated that, the bond market bloodbath of 2022 left mounted earnings buyers with principal losses but in addition a lot larger yields. Bonds will not be knocking it out of the park as a result of bonds are boring investments. However since 2022 the upper yields have led to sluggish and regular positive factors.

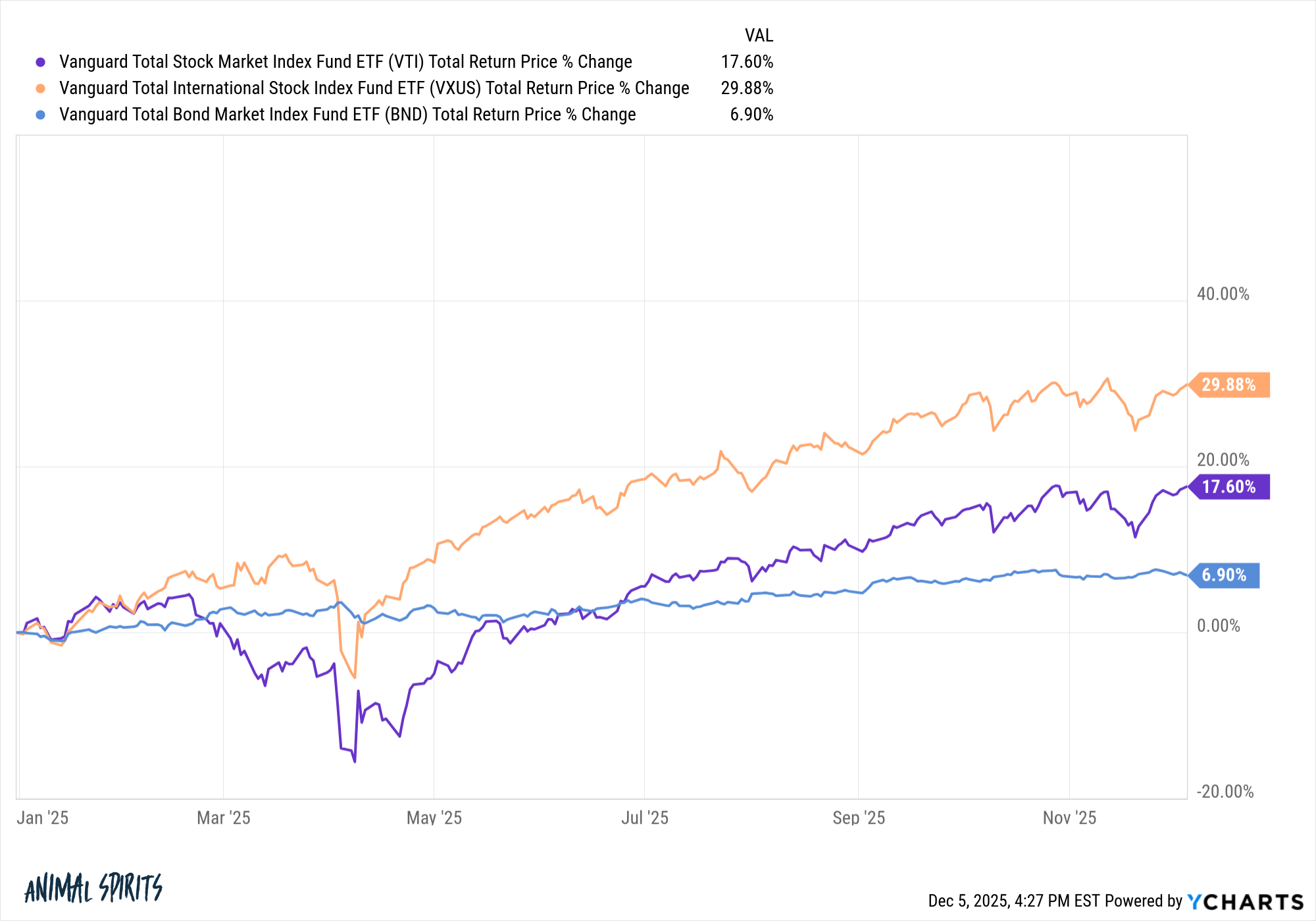

And when you take a look at one thing like a easy 3-fund Vanguard portfolio boring is having a fairly darn good 12 months in 2025 and that features bonds:

Worldwide shares are up 30%. U.S. shares are up nearly 20%. However take a look at bonds — up nearly 7%! That’s an incredible 12 months for mounted earnings.

Put it altogether and a 60/40 three fund portfolio1 is up almost 16% in 2025. That’s fairly good.

This portfolio is up 7.8% per 12 months within the 2020s. That quantity contains the worst bond market crash in historical past.2

The 60/40 portfolio was not useless, simply dormant for a 12 months or two.

Boring remains to be stunning in terms of investing.

Michael and I talked about plain vanilla portfolios and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

A Eulogy for the 60/40 Portfolio

Now right here’s what I’ve been studying these days:

Books:

140% U.S. shares, 20% worldwide shares and 40% bonds.

2This portfolio was down 16% in 2022.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.