The housing market was very inexpensive with low mortgage charges within the 2010s.

The housing market was comparatively inexpensive in 2020 and 2021 with generationally low mortgage charges in 2020 and 2021.

Since 2022 the housing market has turn into extraordinarily unaffordable with a lot increased mortgage charges.

The ramifications of this transfer appear apparent. Many younger persons are out of luck in the event that they don’t have assist from household cash. A lot of owners with 3% mortgages on homes that price loads lower than present values really feel caught. Housing exercise stays weak relative to historic requirements.

There are additionally unintended penalties of excessive housing prices.

New paper from researchers on the College of Chicago and Northwestern dug into the info on how unaffordable housing prices are altering the conduct of younger individuals. There have been three large shifts within the knowledge:

1. Consumption: They spend extra relative to their wealth.

2. Effort: They scale back their effort at work.

3. Funding: They tackle riskier investments.

I’m undecided how they will precisely observe effort at work however 1 and three each make sense to me.

If you happen to don’t want to save lots of for a down fee or the entire different ancillary housing prices (closing prices, insurance coverage, property taxes, and so on.) you may have the power to spend extra elsewhere. And should you’re not going to put money into a home it is smart that younger individuals would shift extra of their financial savings into the inventory market and crypto.

The loopy factor is, until we do one thing concerning the lack of housing provide on this nation, issues may get a lot worse.

The Monetary Instances appeared on the home price-to-income ratio in London, the UK and the US:

These ratios have clearly gotten worse over time however take a look at how far more costly it’s within the UK than the US.1

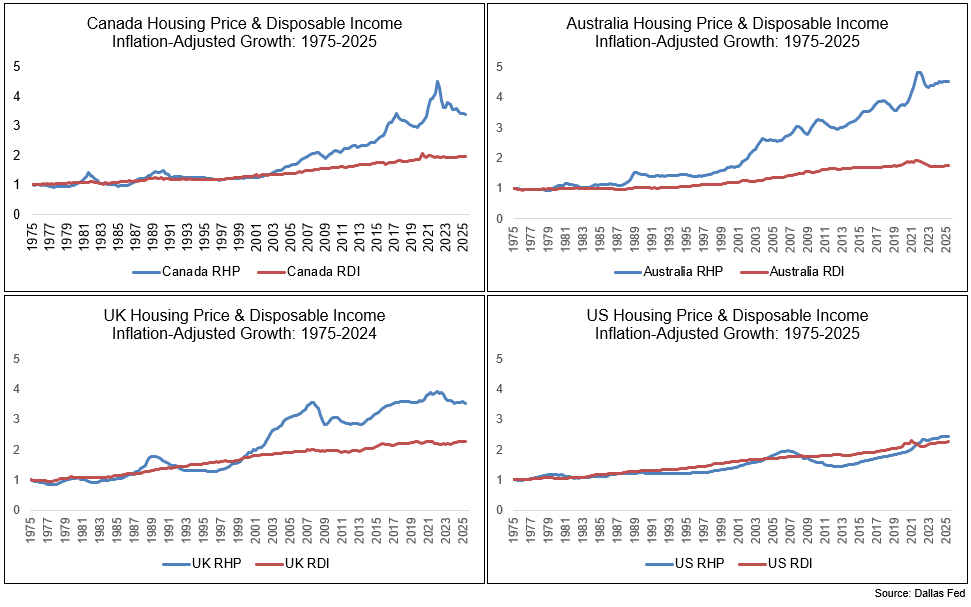

I observe housing knowledge from the Dallas Federal Reserve on varied nations relating to housing costs vs. revenue development.

If you happen to examine the USA to different developed nations just like the UK, Australia and Canada, issues don’t look so unhealthy right here (on a relative foundation):

(RHP = Actual Housing Costs, RDI = Actual Disposable Revenue)

On an inflation-adjusted foundation, incomes have kind of stored up with housing costs in America because the Seventies.

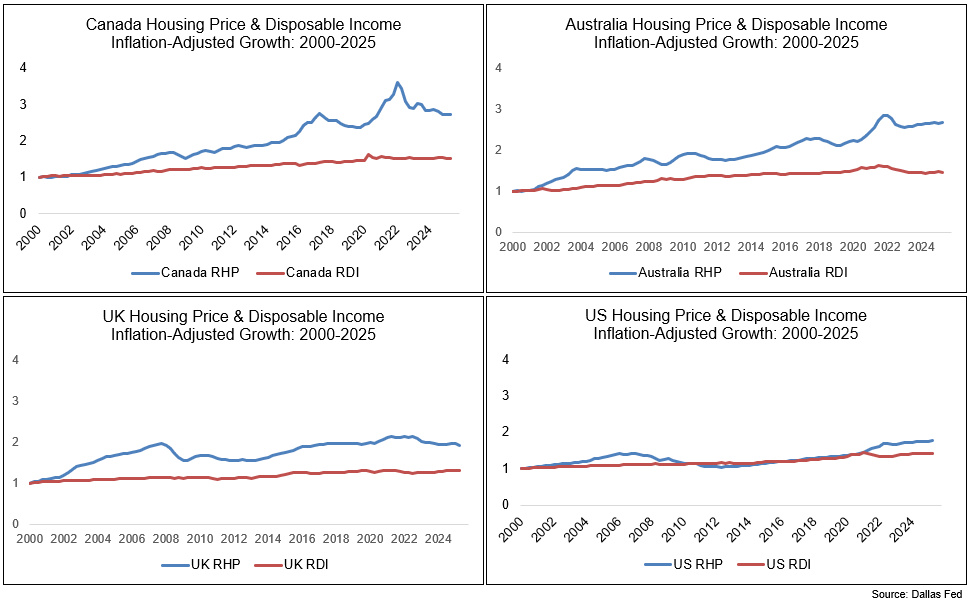

Right here’s the info since 2000:

It gained’t make you are feeling any higher as a teen within the U.S. to know that it’s even more durable for individuals to afford properties in different nations across the globe.

However these numbers assist put issues into perspective that issues can at all times worsen.

If the federal government doesn’t make this a precedence the housing affordability disaster probably will worsen within the coming years.

Additional Studying:

When Does Housing Grow to be THE Concern?

Michael and I spoke with Logan Mohtashami from Housing Wire concerning the present state of the housing market and far more on Animal Spirits lately:

1It’s vital to notice that a few of this hole might be defined by the truth that incomes have risen a lot quicker within the US than the UK in latest a long time. See right here.

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will likely be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.