I’m a sucker for historic monetary returns.

It doesn’t essentially make it any simpler to forecast the long run however historic market knowledge will help you higher perceive the potential dangers and rewards for numerous asset courses and methods.

Lengthy-term returns are the one ones that matter, in spite of everything.

Jim Reid and his group at Deutsche Financial institution have a implausible report referred to as The Final Information to Lengthy-Time period Investing that has tons of nice return knowledge for nerds like me. They’ve knowledge on monetary markets going again 200+ years for some international locations.

Let’s dig in.

I’ll begin with the dangers. A number of weeks in the past I wrote about why I don’t suppose we are able to have one other Nice Melancholy. In that 3-year window the U.S. inventory market fell roughly 86%.

These ranges of losses have occurred in quite a lot of international locations across the globe, lasting for many years at a time in some situations:

That’s why they name it a threat premium not a reward premium.

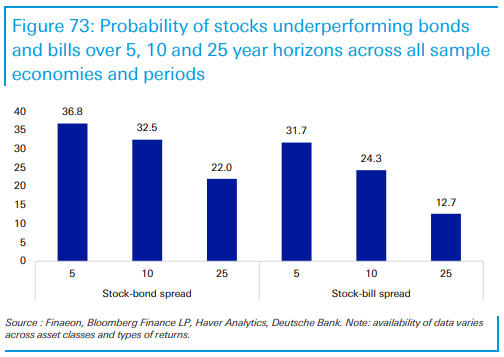

It’s additionally fascinating to have a look at quantity of occasions shares have underperformed bonds or money over time. This exhibits the proportion of time their world dataset of developed international locations have underperformed bonds and money over 5, 10 and 25 12 months time frames:

It occurs extra typically than you suppose.

Proudly owning shares isn’t at all times straightforward.

OK, that’s the glass-is-half-empty stuff that must be proven to offer some stability.

Now let’s take a look at the great things.

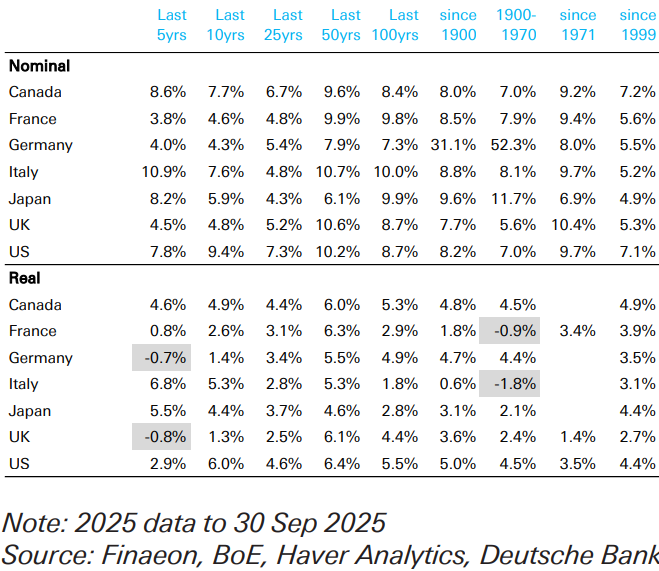

These are the nominal and inflation-adjusted G-7 nation returns over numerous time frames for 60/40 portfolios:

The nominal returns are increased than I might have guessed for a lot of of those international locations.

In fact, you need to take a look at these outcomes on a nominal foundation — particularly the returns within the first half of the twentieth century — to get an apples-to-apples comparability.

Nonetheless, over the previous 50 years you’re taking a look at a spread of actual annual returns from 4.6% to six.4% (6.1% to 10.7% nominal). That’s fairly good for a balanced portfolio.

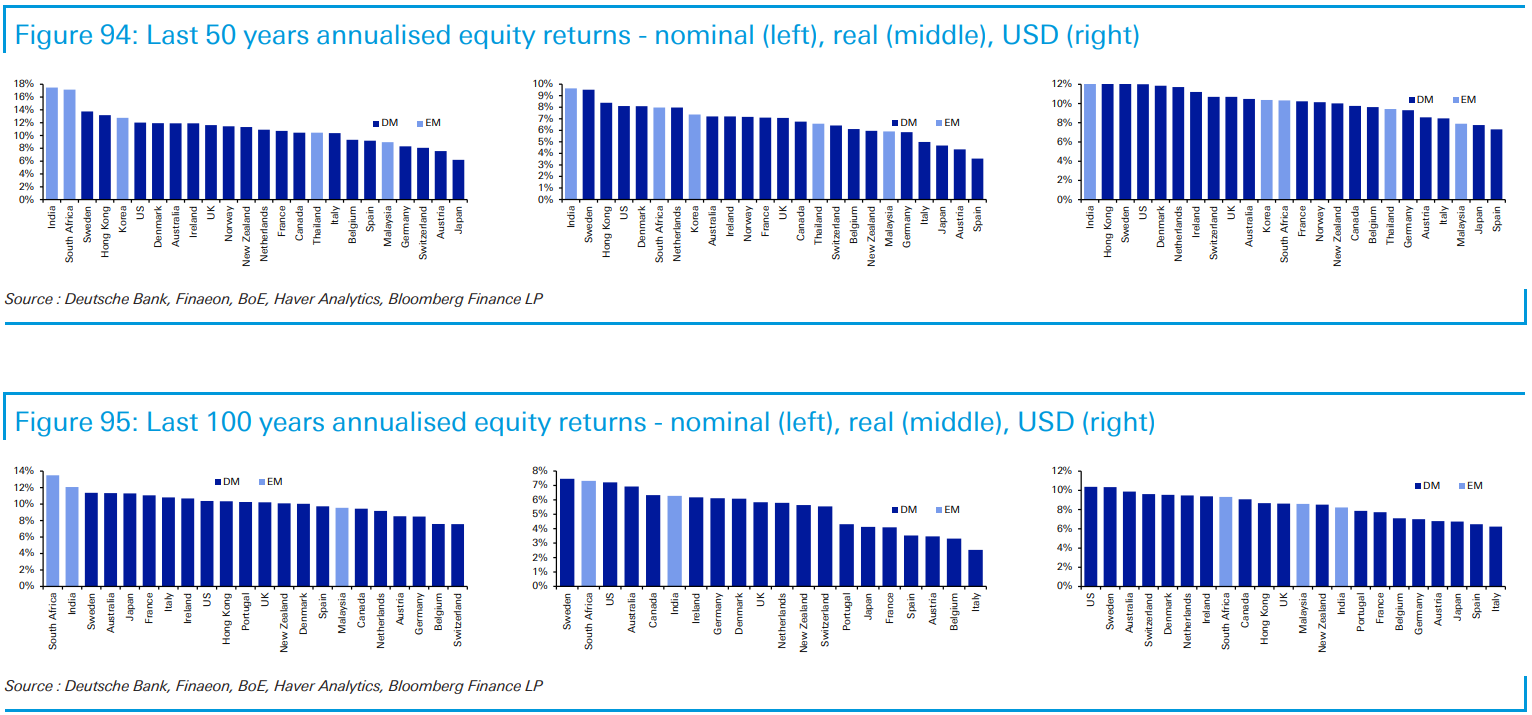

The following chart exhibits annual inventory market returns over the previous 50 and 100 years, this time inclusive of some rising market international locations:

A variety of unhealthy stuff has occurred to the world up to now 50-100 years – wars, famine, pandemics, pure disasters, depressions, power shocks, and so on.

But inventory markets across the globe have gone up. This says quite a bit concerning the human spirit and our capacity to innovate and enhance.

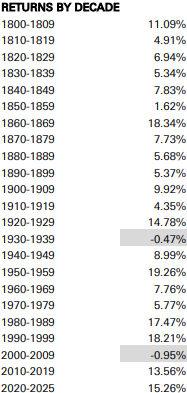

Reid additionally took U.S. inventory market returns all the way in which again to 1800:

I’ve by no means seen returns by decade taken again this far. Remarkably, there have solely been 20 years with detrimental returns out of 23 in whole.

It’s additionally notable that 5 of the 8 double-digit many years have occurred since 1950 (which has additionally occurred in 5 of the previous 8 many years).

Lengthy-term monetary returns have been fairly robust irrespective of the way you take a look at it.

Does this imply these returns will proceed going ahead?

It definitely doesn’t really feel like innovation is slowing. Nobody predicted the affect AI would have on the markets or economic system this decade. ChatGPT seemingly got here out of nowhere however that’s largely how these items occurs all through historical past.

Individuals fear concerning the present state of the world. Then we innovate, repair some issues, create new ones and the cycle begins another time.

So far as AI is worried, there are numerous proponents who assume synthetic intelligence will supercharge financial progress by making most duties extra environment friendly. That’s definitely attainable, though if the robots substitute a lot of the jobs we nonetheless want somebody to spend cash.

Nonetheless, there’s a rising consensus from others that AI will merely hold us on our present trajectory of progress. That is one thing AI researcher Andrej Karpathy talked about on the Dwarkesh podcast:

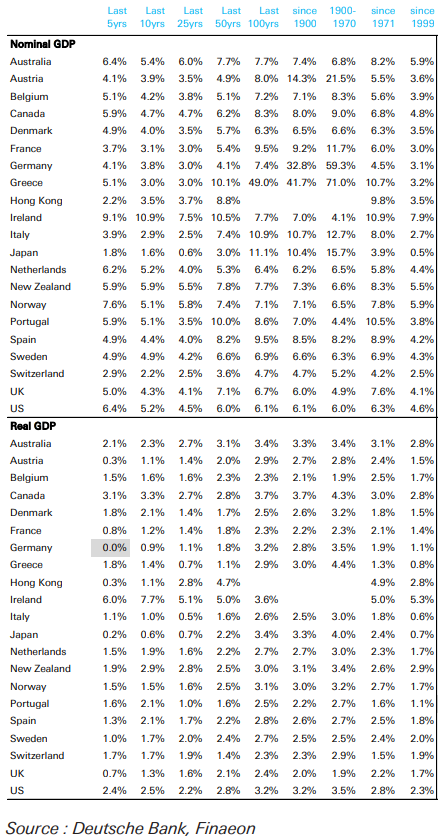

Deutsche Financial institution additionally exhibits historic nominal and actual GDP progress for various international locations over totally different durations:

Take a look at the actual GDP progress going again to 1999 when the Web actually took off. Progress is round 2% regardless of the creation of a know-how that has made us all extra environment friendly in quite a few methods. That’s decrease than the expansion over the previous 100 years.

This is smart when you think about the sheer dimension of the world economic system. Timber don’t develop to the sky. However we nonetheless want the economic system to develop to ensure that the inventory market to develop over time.

I’m assured that may occur over the long-term, although there shall be some ache within the short-term to get there.

Additional Studying:

30 Years