The beginning of a brand new yr is an efficient time to recap the earlier yr and plan for the present and future years. My spouse and I simply did the annual monetary evaluation for our family. I’m sharing the template we use and the place we get the information.

Internet Price

The whole internet price represents all monetary assets obtainable at a cut-off date. We break it down into two classes: liquid investments (“paper belongings”) and actual property. The worth for actual property is internet of any mortgage balances. We embrace residence fairness in complete internet price as a result of it’s an obtainable monetary useful resource. We love our residence, however when essential, we are able to promote and purchase a cheaper residence or use the proceeds to fund assisted dwelling. We use the historic buy value as the worth for actual property. It’s also possible to use the property tax evaluation worth or an affordable estimate.

We additional break down liquid investments between taxable investments and retirement accounts. You may add a 3rd class to interrupt out Conventional versus Roth accounts when you’d like.

We get these values from Constancy’s Full View, which aggregates each Constancy and non-Constancy accounts. I up to date my put up Constancy Full View + Evaluation: Monitor Your Portfolio Throughout All Accounts with Constancy’s newest consumer interface, also called the New Full View. The New Full View doesn’t have all of the options of the Outdated Full View, however it nonetheless works for our goal.

We spherical to the 2 most important digits in these numbers. $1.3 million or $250k is sweet sufficient. It’s not essential to go extra granular.

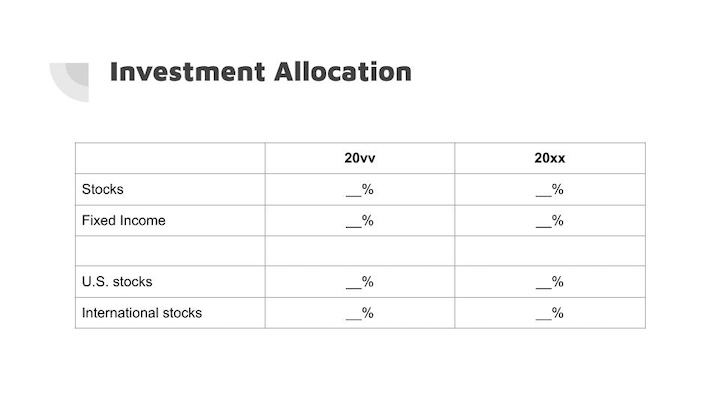

Funding Allocation

Subsequent, we take a look at the funding portfolio’s asset allocation on the highest stage: shares versus mounted earnings, and U.S. shares versus worldwide shares. This tells us the way it modified from the earlier yr and whether or not we have to rebalance.

We get these numbers from Constancy’s Evaluation characteristic, which I described within the second half of Constancy Full View + Evaluation: Monitor Your Portfolio Throughout All Accounts. Evaluation examines the funding holdings from all accounts in Full View. You should utilize different instruments or a spreadsheet.

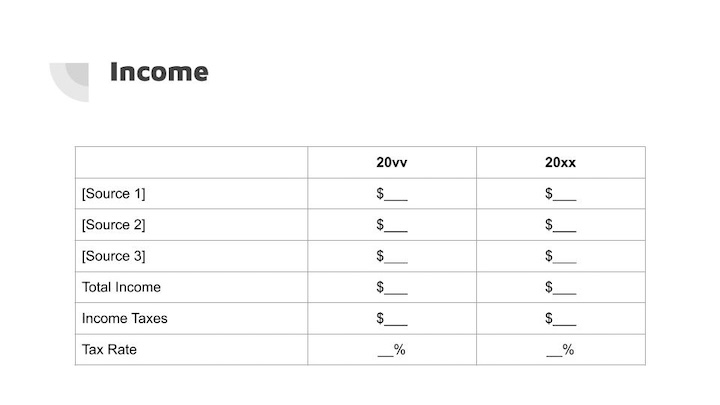

Earnings

That is our tax return boiled right down to its easiest type. What are the foremost sources of earnings? How a lot will we pay in taxes? How a lot is it as a share of our complete earnings?

We get the earnings numbers from Microsoft Cash, which was discontinued a few years in the past however nonetheless runs in Home windows 11. Every other earnings and expense monitoring software program works as effectively. Taxes for the prior yr are from the precise federal and state tax returns. Taxes for the yr that simply ended are estimated.

Once more, use not more than two most important digits, as in $25k, not $24,736.

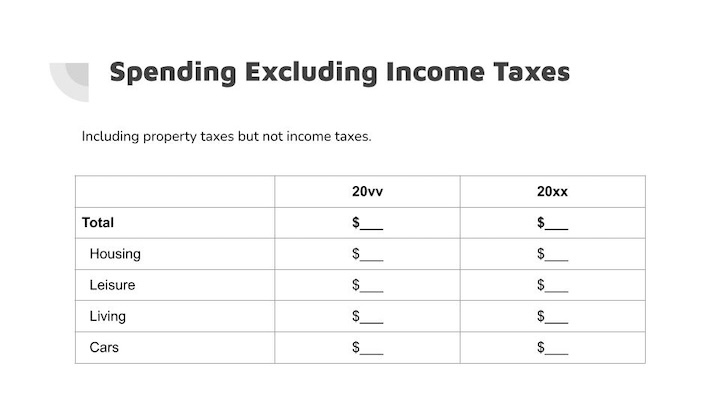

Bills

Now we come to the bills facet. We embrace property taxes however not earnings taxes as bills. Earnings taxes are largely a perform of earnings. The quickest strategy to decrease taxes is to decrease earnings. Earnings and taxes are already coated within the earlier part.

We preserve earnings and bills in solely three or 4 main classes. Fewer classes current a clearer view with out distraction from too many particulars. The bills information additionally come from Microsoft Cash. Once more, many different earnings and expense monitoring software program work too.

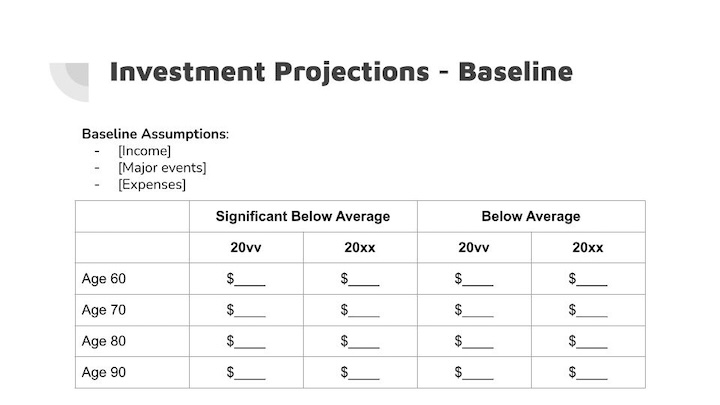

Baseline Retirement Projections

We run a baseline projection in Constancy’s retirement calculator. I up to date my put up, Constancy Retirement Planning Software: Excessive-Degree Mannequin, Not Tactical, with Constancy’s newest consumer interface. The retirement calculator makes use of accounts in Full View assigned to the retirement aim.

The baseline assumptions embrace our greatest guesses for earnings, bills, and main occasions. The retirement calculator initiatives a trajectory of the funding portfolio when market returns are considerably under common or merely under common. I take a look at the projected values in in the present day’s {dollars} at main age milestones. Evaluating with projections from final yr tells us whether or not we’re off observe.

Projections by definition are educated guesses. Something past the one most important digit within the numbers is meaningless.

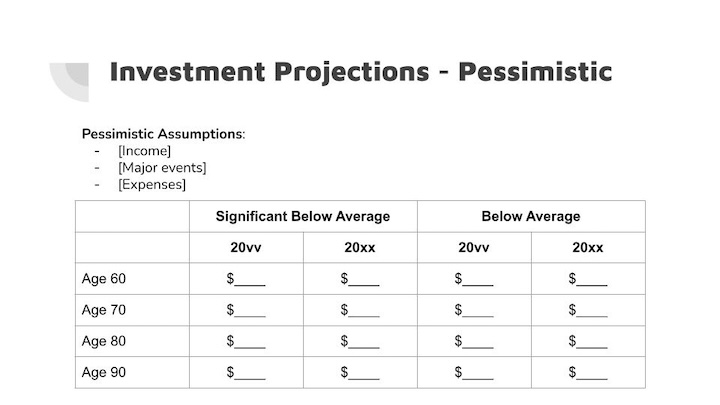

Pessimistic Retirement Projections

We run the projections once more in my spouse’s account with a extra pessimistic set of assumptions: decrease earnings, greater bills, and surprising occasions. We do it in two accounts as a result of Constancy’s retirement calculator doesn’t enable saving two eventualities in a single account.

The pessimistic assumptions function a stress take a look at for the longer term outlook. What if our greatest guesses are off considerably? We would like our plan to outlive these opposed circumstances. Operating these projections revealed the 2 basic drivers of monetary success in retirement.

Abstract

Lastly, we summarize the earlier sections. This recaps the earlier yr and guides the present yr.

We deliberately preserve the annual monetary evaluation quick and easy as a result of we consider it’s most helpful to have a giant image. We use Constancy’s instruments and Microsoft Cash as information sources, however it’s also possible to populate the evaluation with information from different sources.

In the event you discover this format useful, you may obtain the template from Google Drive. It’s set as view-only. Please use File -> Obtain to obtain it in PowerPoint or ODP format and modify it as desired.

Be taught the Nuts and Bolts

I put every part I exploit to handle my cash in a ebook. My Monetary Toolbox guides you to a transparent plan of action.

Learn Opinions