Based in 2021, CD Valet is a searchable database of certificates of deposit charges created by John Blizzard by Seattle Financial institution, the place he has been President and CEO since April of 2014.

Although it was created by a single financial institution, it lists over 30,000 CD charges throughout the nation.

CD Valet’s power is that it lists CDs throughout the nation, means that you can search by state and financial institution title, and might filter primarily based on minimal time period (<6 months to 60 months) and most time period lengths, APY, and quantity. They cowl business banks in addition to credit score unions.

They are going to floor charges you might be unlikely to search out your self. For instance, do you know that the Lynchburg Municipal Workers FCU has a 78-month CD with a 6.50% APY? (as of 1/13/2026)

In all probability not. It’s a sixty fifth anniversary particular however membership is restricted to of us who stay or work in Lynchburg, VA.

You may say to your self – “who cares about an superior CD if I can’t get it?”

Proper now, there are many of us in Lynchburg who don’t find out about this CD. This can be the case for you too.

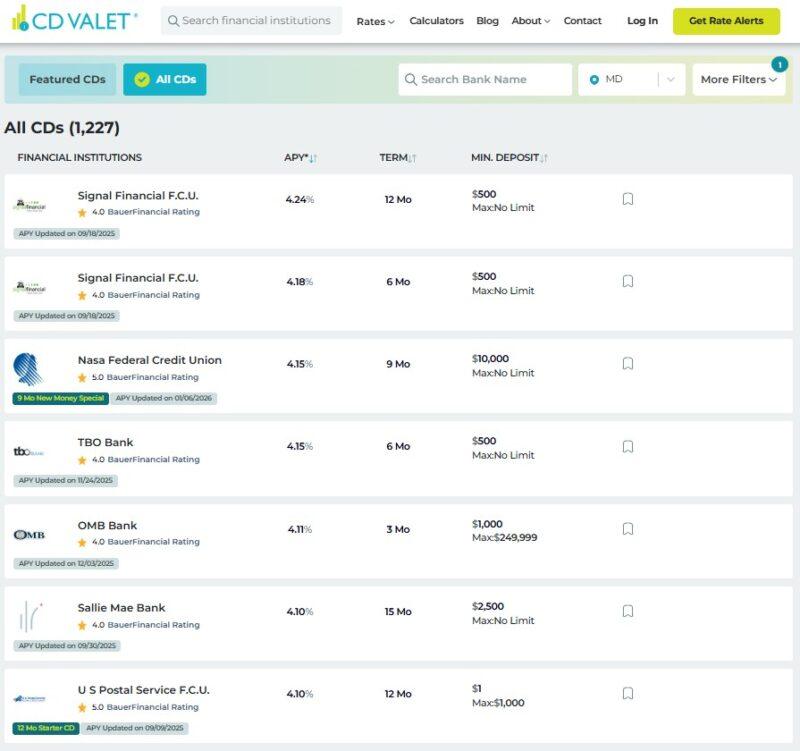

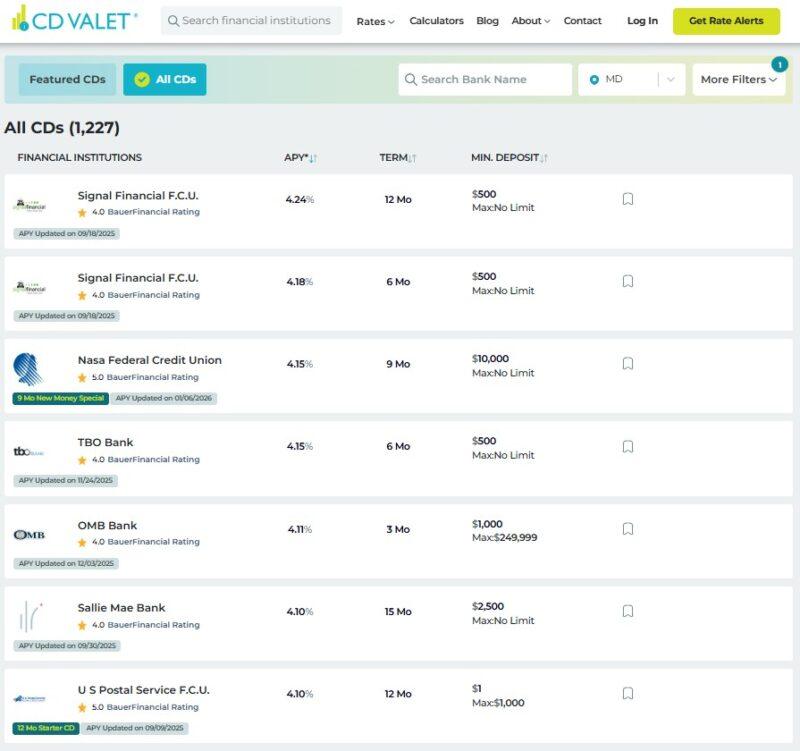

In Maryland, I discovered a Sign Monetary F.C.U. with a 4.24% APY 12-month CD that’s barely higher than the very best CD charges accessible proper now nationwide (presently an Alliant Credit score Union 12-month CD at 4.00% APY). I’m able to be a part of Sign by donating $5 to their charitable basis and since I stay in Maryland.

You by no means know the place a excessive price will probably be. Credit score unions are inclined to have barely higher charges than nationwide banks. Native credit score unions are inclined to have higher charges than nationally accessible credit score unions. And except you propose to search for all of your native charges, you received’t discover them.

Desk of Contents

- How I’d Use CD Valet

- Who’s CD Valet For?

- Is CD Valet Protected?

- CD Valet vs. Raisin

- CD Valet vs. Different Websites

- Is CD Valet Price It?

How I’d Use CD Valet

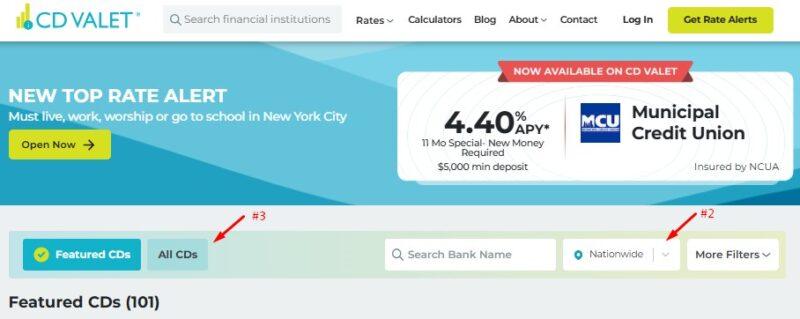

If I have been on the lookout for a 12-month CD, that is precisely how I’d use it.

- Go to CD Valet

- Swap the search to Maryland

- Click on on All CDs

4. Evaluate the CDs!

In some circumstances, possible the place CD Valet and the monetary establishment have a advertising and marketing relationship, you’ll see a inexperienced Open Now button. You’ll be able to click on on that to open.

If there isn’t that button, do a Google seek for the financial institution and open it instantly.

Who’s CD Valet For?

If you happen to’re on the lookout for the very best CD charges however don’t wish to (or don’t have the time to) do the analysis your self, CD Valet is an effective instrument for the job.

If you happen to’re saving plenty of cash, the place 0.25% to 0.50% bump in your yield makes a distinction, a fast examine of CD Valet will provide you with confidence you’re choosing the right financial institution.

It’s not for folk who don’t wish to soar by hoops as a result of lots of the highest charges will probably be from smaller credit score unions with strict eligibility guidelines. Even those that don’t have strict guidelines, like Sign Monetary FCU, you will have to make a small donation or be a part of a company to realize eligibility.

Additionally, for those who’re not snug with a non-name model financial institution (you received’t discover Chase, Financial institution of America, or Wells Fargo listed too extremely as a result of their CD charges aren’t nice), it’s additionally not a great tool for you.

Lastly, CD Valet solely lists the charges. You don’t work with CD Valet in any approach, it’s important to go to the financial institution or credit score union on to open an account.

Is CD Valet Protected?

Sure, completely protected.

CD Valet solely lists charges and also you by no means open an account with them. If you happen to register for his or her electronic mail record, you get weekly updates on price modifications and different information however you don’t set up a monetary relationship.

As for the establishments they record, CD Valet pulls within the BauerFinancial Ranking. It is a ranking system from BauerFinancial, which is an unbiased financial institution analysis agency that provides every financial institution or credit score union 1 to five stars. 5 stars means it’s a “Superior” establishment that BauerFinancial recommends and 1 star means it’s troubled. I discover these scores to be superfluous as a result of the monetary establishments are lined by FDIC or NCUA insurance coverage.

What you see on CD Valet is what you will note on the financial institution or credit score union web site. CD Valet simply lists them in a single place so you’ll be able to examine them in opposition to others.

CD Valet vs. Raisin

One pure comparability is versus Raisin. Raisin is a monetary expertise firm that gives banking providers with increased yield by its companion banks. Whenever you view charges on Raisin, you’re seeing particular charges that they’ve negotiated with banks and credit score unions.

With Raisin, you open an account and really deposit cash with Raisin. Raisin will get you entry to increased charges from their companion banks as a result of the banks want to safe extra deposits. Your cash is put with different Raisin clients and positioned in a pooled account on the establishment. You’ve gotten entry to it however you by no means have a relationship with the financial institution itself and also you get pass-through FDIC/NCUA insurance coverage.

✨ Associated: Learn our Raisin overview for extra.

With CD Valet, you’re employed instantly with the banks and credit score unions. CD Valet simply lists the charges. So if you wish to open an account, it’s important to go to the financial institution and credit score union. The account will probably be in your title, not pooled, and you’re a identified buyer to the establishment.

CD Valet vs. Different Websites

There are different price websites however most of them focus solely on nationally accessible charges. They don’t drill down into state particular or into credit score unions.

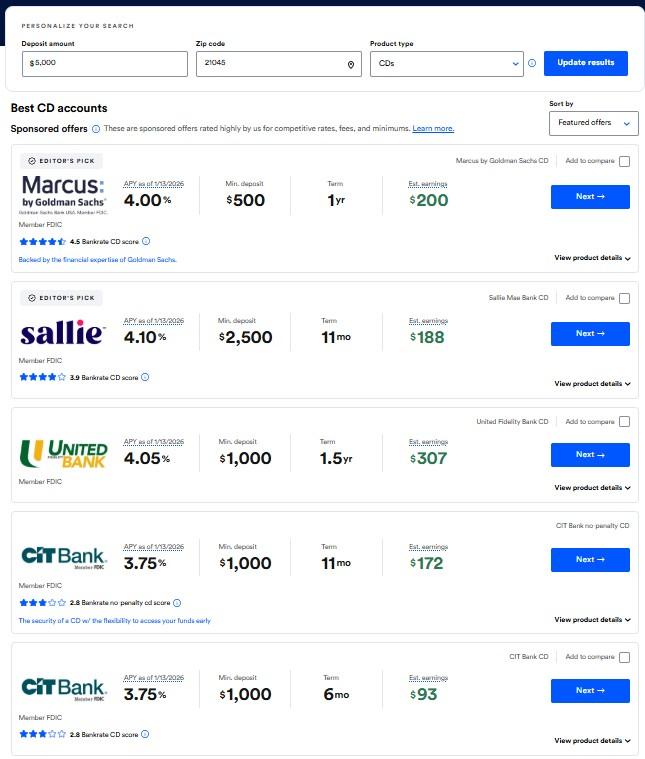

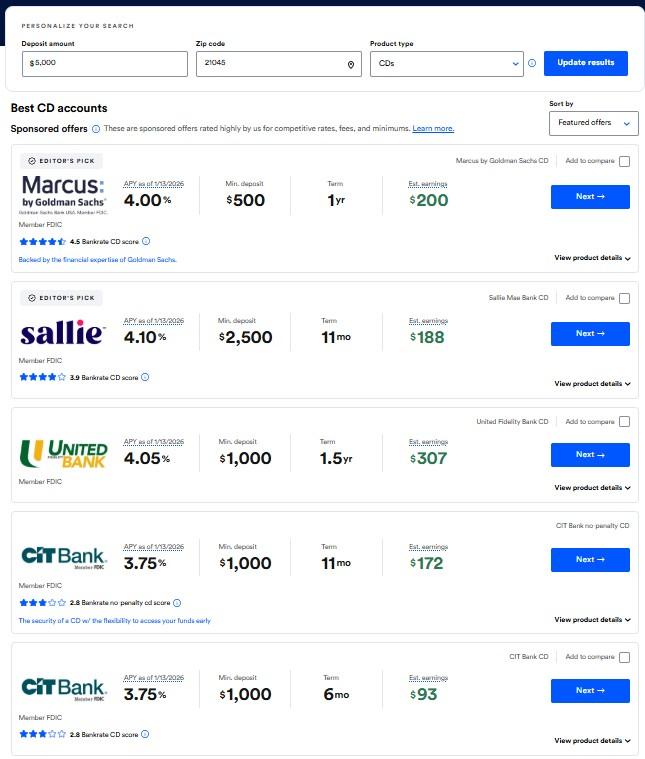

Bankrate, which began as a price itemizing service in newspapers, tends to solely record nationally accessible charges these days. You’ll be able to enter in your zip code but it surely’s not surfacing charges from small credit score unions.

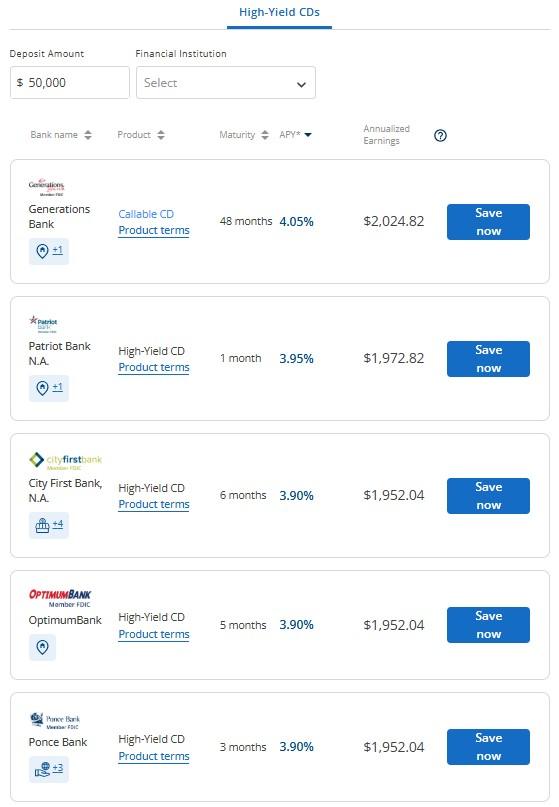

I appeared for charges in 21045 (Columbia, MD) and it confirmed me:

That is what CD Valet confirmed for Maryland:

CD Valet confirmed me 4 credit score unions with increased charges than something on Bankrate’s record and it wasn’t till Sallie Mae Financial institution that the 2 lists matched.

For comparability’s sake, right here’s Raisin’s record:

As you’ll be able to see, CD Valet nonetheless comes out on high by way of charges although you can argue Raisin makes it simpler to open an account with every financial institution for those who’re snug with FDIC/NCUA pass-through insurance coverage.

Is CD Valet Price It?

It’s an inventory of the very best charges and so they survey hundreds of economic establishments, it’s definitely value a free peek to see if you may get a greater price in your CDs.

Most of the charges are barely increased than what you may get from on-line banks. For instance, my Ally Financial institution CD charges appear to lag what’s listed on CD Valet by round 25 foundation factors.

Whereas it might not make sense for me to open up a completely new account simply to get 25 foundation factors on a CD, somebody with loads of time and on a hard and fast revenue could discover it helpful to take action.

However you solely know what the very best charges are if you could find a trusted supply for it and for me, that supply is CD Valet.

👉 Try CD Valet