Perceive the brand new NPS exit and withdrawal guidelines 2025, larger lump sum limits, decrease annuity guidelines, and what these adjustments imply to your retirement planning.

Not too long ago, PFRDA launched new NPS (Nationwide Pension System) Exit and Withdrawal guidelines. These adjustments in some ways, are recreation changers. Allow us to focus on these adjustments intimately on this submit.

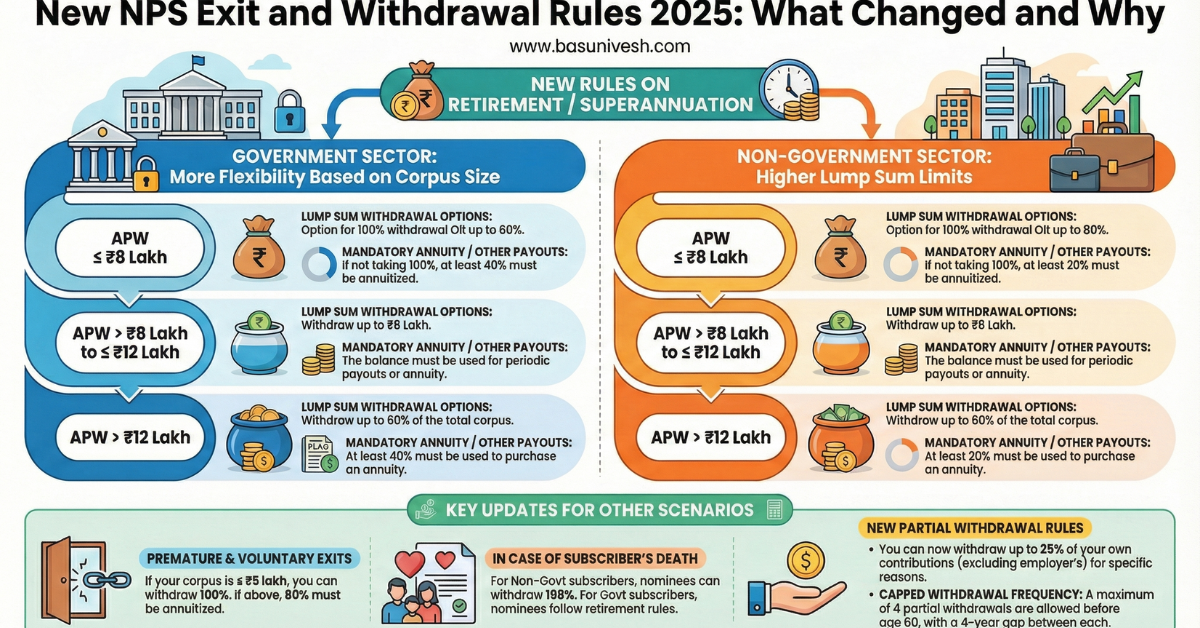

New NPS Exit and Withdrawal Guidelines 2025: What Modified and Why

The PFRDA (Exits and Withdrawals underneath the Nationwide Pension System) (Modification) Rules, 2025symbolize a big shift in how pension wealth is managed and accessed in India. By changing the 2015 framework, these amendments modernise terminology, lengthen the participation interval, and introduce extra versatile payout choices equivalent to systematic withdrawals.

1. Change in Terminology and Construction

The laws change the time period “Everlasting Retirement Account” with “Particular person Pension Account” and change the phrase “corpus” with “wealth”. This isn’t beauty. It displays that every account is handled independently.

If a subscriber has a number of accounts — for instance, a authorities account and an All Citizen account — every account is now ruled independently for exit, withdrawal, and annuity functions. This provides subscribers higher management and readability over every stream of retirement financial savings.

The time period “deferment” can be formally outlined, that means the subscriber might postpone lump sum withdrawal or annuity buy.

2. Subscriber Categorisation

Subscribers at the moment are formally categorised as Authorities Sector, Non-Authorities Sector, and NPS-Lite/Swavalamban. Every class has its personal exit and withdrawal framework.

This readability reduces confusion and ensures that guidelines are utilized accurately based mostly on the kind of subscriber fairly than treating all subscribers identically.

3. Potential to Keep Invested Till Age 85

Each authorities and non-government subscribers can now stay in NPS till age 85. They could defer each lump sum withdrawal and annuity buy.

Whereas this offers flexibility for financially unbiased retirees, for many traders this extension is of restricted sensible worth as a result of retirement bills typically begin a lot sooner than 85.

4. Exit Guidelines for Authorities Subscribers

At retirement, no less than 40% of the wealth should be used to purchase an annuity. The steadiness might be withdrawn as lump sum or by means of systematic withdrawals.

If the wealth is Rs.8 lakh or much less, the subscriber can withdraw 100% with none annuity.

If the wealth is between Rs.8 lakh and Rs.12 lakh, as much as Rs.6 lakh might be withdrawn and the steadiness should be used for annuity or systematic withdrawals over no less than six years.

If a authorities worker resigns or is eliminated, the exit is handled as untimely, and usually 80% should be used for annuity except the wealth is Rs.5 lakh or much less.

5. Exit Guidelines for Non-Authorities Subscribers

Non-government subscribers usually exit upon reaching the age of 60. The 15-year situation refers to minimal eligibility for sure withdrawal advantages however doesn’t convert exits earlier than 60 into regular exits.

Nonetheless, exits earlier than age 60 are handled as untimely exits and have stricter circumstances.

At regular exit (age 60):

At the least 20% should be used for annuity and as much as 80% might be withdrawn.

If the wealth is Rs.8 lakh or much less, 100% might be withdrawn.

If the wealth is between Rs.8 lakh and Rs.12 lakh, as much as Rs.6 lakh might be withdrawn and the remaining should be annuitised or withdrawn progressively over six years.

For late joiners (becoming a member of at age 60 or later), if the wealth is Rs.12 lakh or much less, your complete quantity might be withdrawn.

This flexibility is useful, but it surely doesn’t take away the core situation — annuities stay low-return and poor inflation protectors.

6. Bodily Incapacity

If a subscriber is completely incapacitated and medically licensed as unfit to proceed employment, the exit is handled as a traditional retirement exit fairly than untimely exit.

This protects subscribers who’re pressured into early retirement as a consequence of well being causes.

7. NPS-Lite and Swavalamban Subscribers

For these subscribers, the brink for full lump sum withdrawal has been elevated to Rs.2 lakh.

This can be a significant enchancment for low-income subscribers for whom annuities have been impractical.

8. Particular Exit Eventualities

If a subscriber renounces Indian citizenship, your complete wealth might be withdrawn.

If a subscriber is lacking, 20% of the wealth might be launched as interim aid after submitting an FIR and indemnity bond. The remaining quantity is launched solely after courtroom declaration.

9. Partial Withdrawals and Mortgage Collateral

Subscribers can withdraw as much as 25% of their very own contributions for particular functions equivalent to medical wants or housing.

They will additionally use their NPS account as collateral for loans by permitting monetary establishments to put a lien on the account.

This improves flexibility but additionally will increase the chance of eroding retirement financial savings.

NPS Exit & Withdrawal Guidelines 2025 — Abstract Desk

| State of affairs | Wealth Threshold | Lump Sum / Periodic Withdrawal | Annuity Requirement |

|---|---|---|---|

| Govt. Retirement | Rs.8 lakh or much less | 100% | 0% |

| Govt. Retirement | Between Rs.8 lakh and Rs.12 lakh | As much as Rs.6 lakh | Stability by way of annuity or systematic withdrawals |

| Govt. Retirement | Greater than Rs.12 lakh | 60% | 40% |

| Non-Govt. Regular Exit (Age 60) | Rs.8 lakh or much less | 100% | 0% |

| Non-Govt. Regular Exit (Age 60) | Between Rs.8 lakh and Rs.12 lakh | As much as Rs.6 lakh | Stability by way of annuity or systematic withdrawals |

| Non-Govt. Regular Exit (Age 60) | Greater than Rs.12 lakh | As much as 80% | At the least 20% |

| Non-Govt. Untimely Exit (Earlier than age 60) | Rs.5 lakh or much less | 100% | 0% |

| Non-Govt. Untimely Exit (Earlier than age 60) | Greater than Rs.5 lakh | As much as 20% | At the least 80% |

| Govt. Resignation / Removing | Rs.5 lakh or much less | 100% | 0% |

| Govt. Resignation / Removing | Greater than Rs.5 lakh | As much as 20% | At the least 80% |

| NPS-Lite / Swavalamban (Age 60) | Rs.2 lakh or much less | 100% | 0% |

| NPS-Lite / Swavalamban (Age 60) | Greater than Rs.2 lakh | As much as 60% | At the least 40% |

Conclusion

The 2025 amendments make NPS extra humane and versatile. Small subscribers are now not pressured into meaningless annuities. Late joiners are handled pretty. Particular conditions are dealt with with extra sensitivity.

Nonetheless, NPS stays a product with strict exit controls, illiquidity, regulatory dependence, and necessary annuitisation. These guidelines might change once more sooner or later.

Due to this fact, NPS must be seen as a supplementary retirement product, not the muse of retirement planning. For disciplined traders, it may be helpful. For many who worth flexibility and management, it stays restrictive.