I shared this chart not too long ago concerning the basic breakdown of S&P 500 returns in 2025:

The truth that the dividend yield plus the earnings development roughly equalled the overall return makes for a clear story.

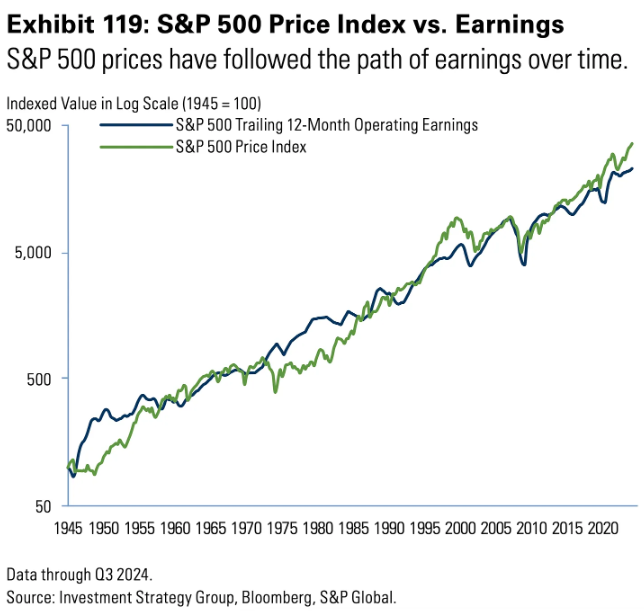

Buyers are inclined to give attention to all kinds of variables — the Fed, geopolitics, rates of interest, inflation, financial development, and so forth. — however company earnings are the largest driver of inventory market returns over the long term:

Having mentioned that…the connection between earnings development and inventory market returns isn’t at all times as clear-cut because it was in 2025.

There are many occasions when earnings and the market are usually not in sync with each other.

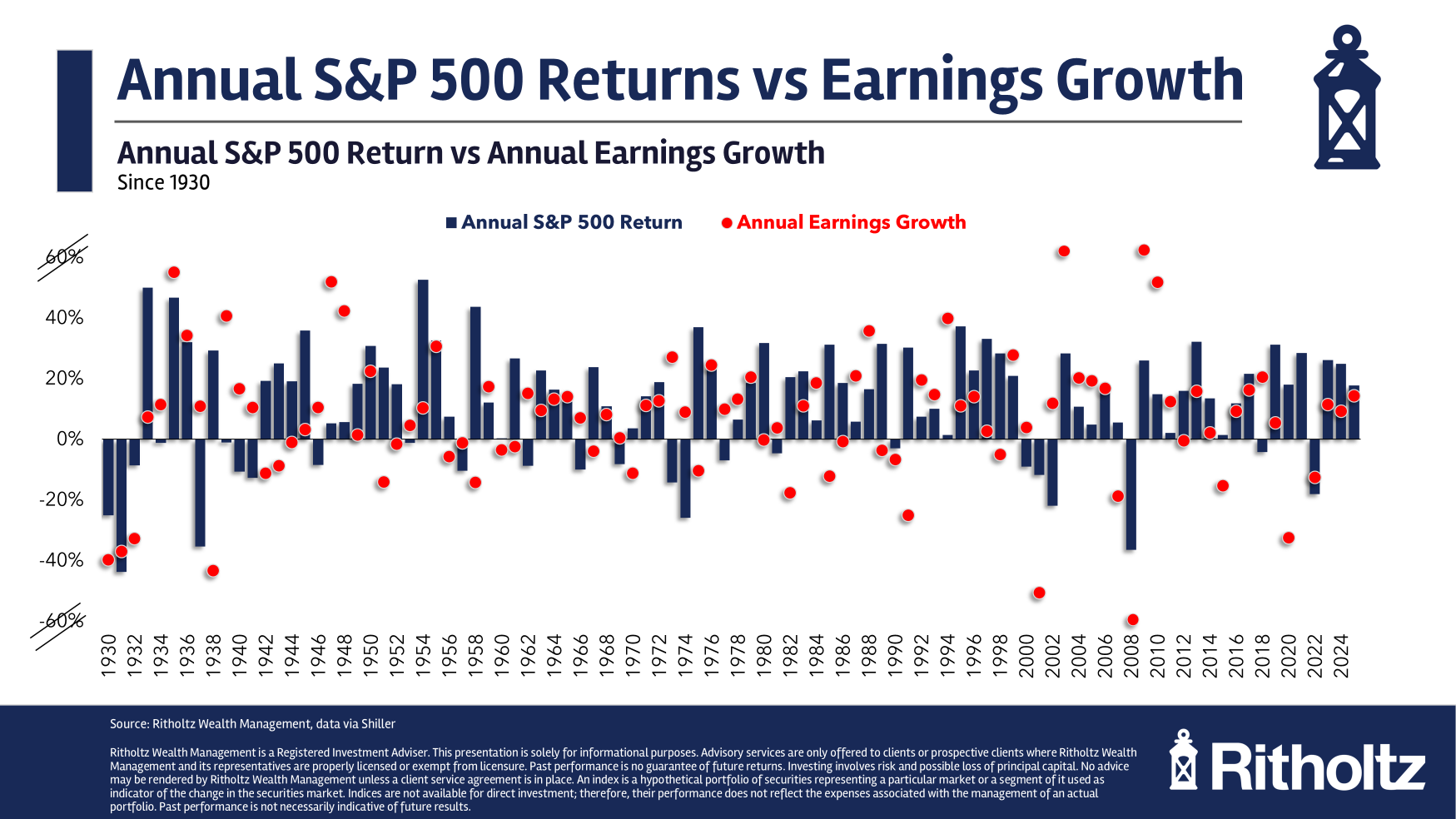

Right here’s a take a look at the annual returns for the S&P 500 together with the year-end change in earnings going again to 1930:

You may see the connection between the 2 development charges isn’t precisely one-to-one in most years. In actual fact, there are many years when returns are up, however earnings are down and vice versa.

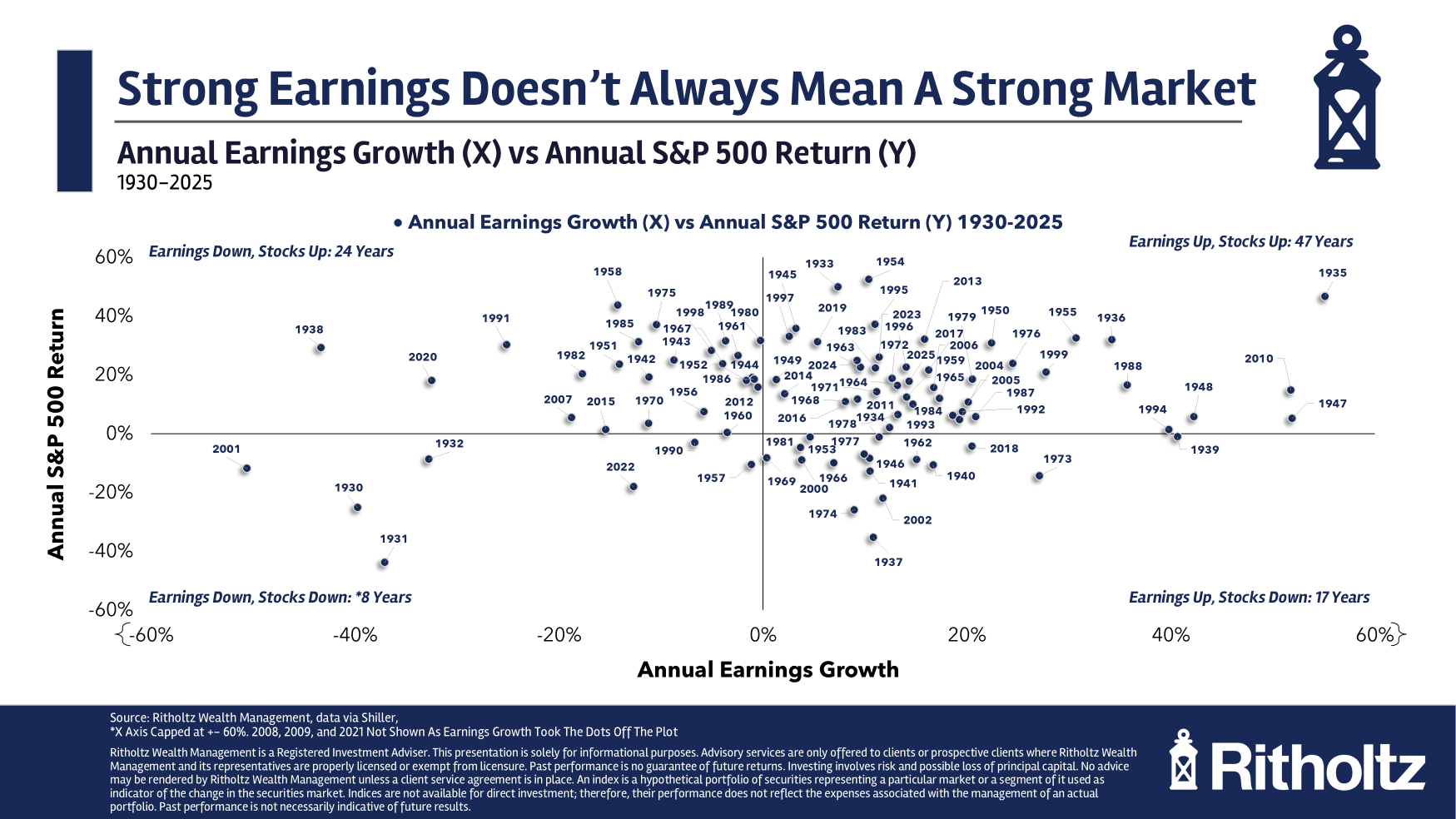

Right here’s one other approach of visualizing this:

The quadrant with probably the most dots is earnings up, shares up. That occurred in 47 out of the previous 96 years, roughly half the time. Then there have been 8 years when shares and earnings each fell concurrently.1 This additionally is sensible.

Up to now so good.

However there have been 24 cases when earnings fell in the identical yr shares completed the yr up.

And there have been 17 years through which the inventory market was down however earnings really rose.

Meaning practically 45% of the time shares and earnings have gone in numerous instructions in a given yr since 1930. Virtually half of all years the connection between earnings development and worth development breaks down.

There are explanations for this in fact.

Earnings are reported on a lag. The market is forward-looking. Generally investor expectations are caught offside.

It is a good reminder that long-term market forces can usually get distrupted within the short-term. Even should you knew what earnings have been going to do in a given yr doesn’t essentially imply you may predict what is going to occur within the inventory market.

Shares can rise throughout an earnings recession.

Shares can fall when earnings are going larger.

Something is on the desk in a given yr as a result of feelings, tendencies and expectations usually have extra to do with short-term efficiency than fundamentals.

Plan accordingly.

Michael and I talked about company earnings, small caps, the inventory market and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

2025 Investing Classes

Now right here’s what I’ve been studying these days:

Books:

1The rationale you don’t see 2008 on this chart is as a result of earnings fell practically 80% that yr. We needed to cap the axis on the chart to make it simpler to learn. So 2008 is included within the whole, you simply can’t see the dot. Similar factor with 2009 on the upside when earnings grew greater than 200%.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.