A reader asks:

I’m a Bogle-DIY investor with a broad allocation with most of my cash in whole US and international inventory index funds. However I additionally sprinkle some smaller allocations to small cap worth, rising markets and bonds. Every thing exterior of US shares has been sucking wind for the previous decade…till the previous 15 months. Ben, is it lastly time for diversification to repay? Please say sure.

If you happen to zoom out, worldwide shares have skilled a future of underperformance relative to U.S. shares:

Traditionally, this relationship has been cyclical, however the present cycle dates again to the tip of the Nice Monetary Disaster.

Now let’s zoom in.

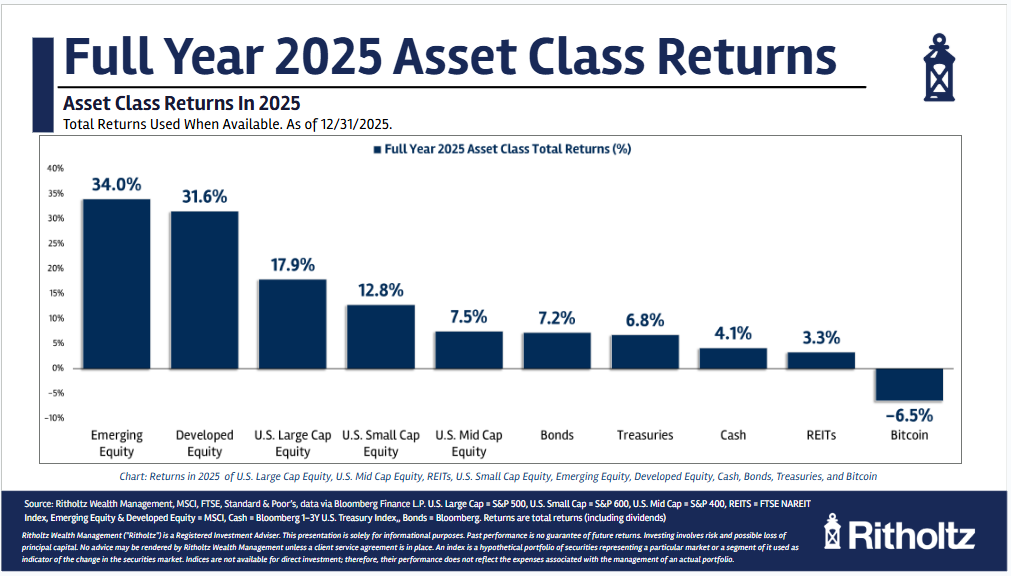

Right here’s what occurred to varied asset lessons in 2025:

Worldwide shares flipped the script for the primary time in years. In actual fact, it was the most important relative outperformance for international developed markets since 1993.

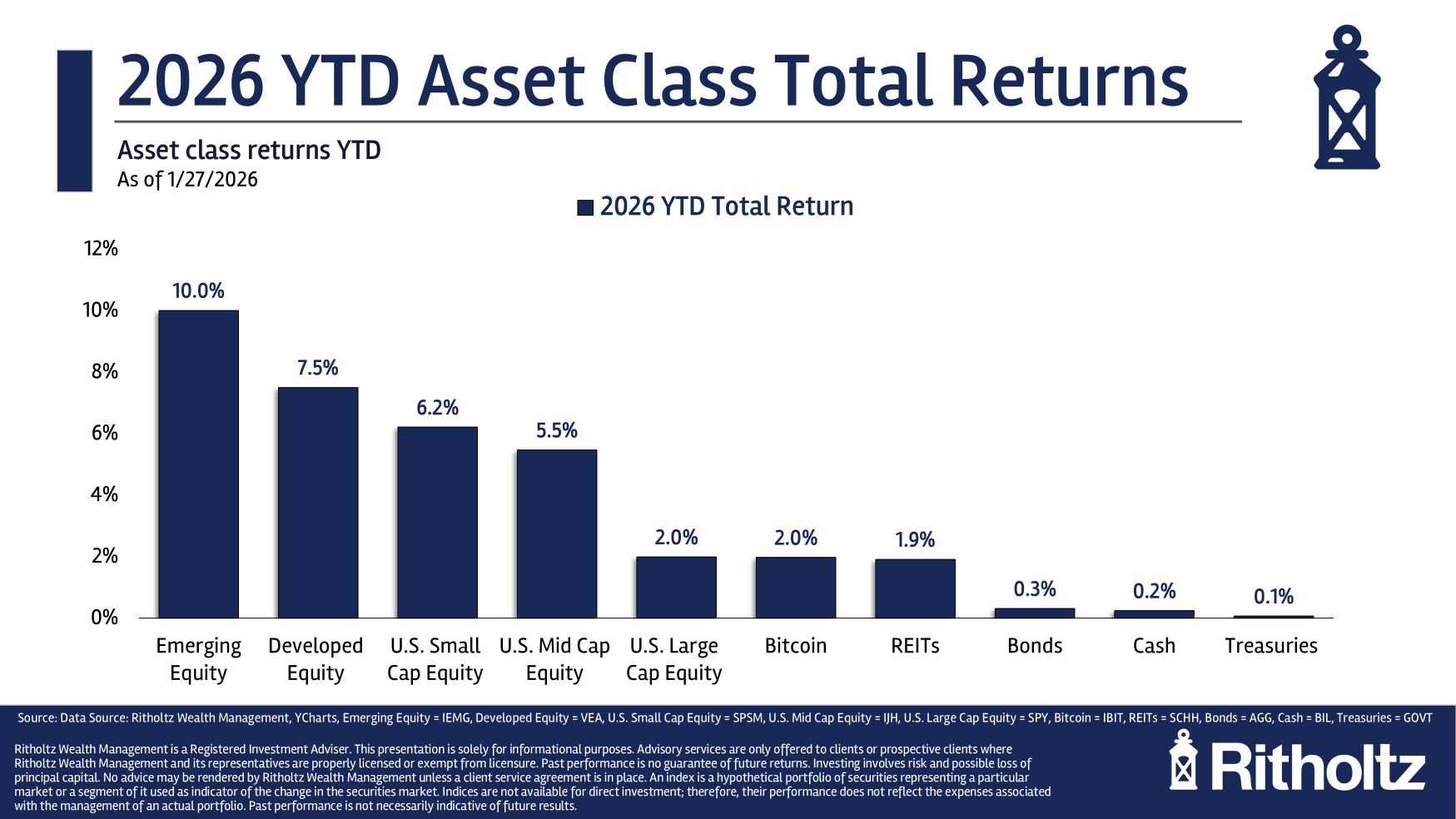

Now right here’s what the admittedly very early 12 months so far returns appear like in 2026:

There may be some follow-through right here. International shares are outperforming but once more. Small and mid cap shares have joined the get together too.

Clearly, 13 months doesn’t make a long-term development, however this has to really feel like a reprieve for many who have been geographically diversified.

Can it proceed?

There are some developments in place that might assist these different asset lessons. Let’s make the case.

The greenback goes down. That’s good for worldwide shares, particularly rising markets. The greenback rolling over has additionally been a tailwind for gold and different laborious belongings.

If rates of interest proceed to fall, that might profit small and mid cap firms who rely extra closely on debt markets than massive cap companies.

Massive caps nonetheless have the AI factor going for them however AI might additionally degree the enjoying subject for smaller companies by making them extra environment friendly and bettering margins.

However, you might simply make the case this will probably be a blip. The most important, greatest firms are nonetheless on the prime of the S&P 500. They produce additional cash move, extra revenue and have greater margins.

One other reader asks:

Undecided how sizzling or well timed a subject that is however…would take pleasure in listening to you speak about rising markets. However I’ve owned an EM ETF for five years and it principally hasn’t gone wherever in all that point even going again to 2017 it’s flat. The way you one spend money on rising markets and really earn a living?

This query got here in again in 2024, earlier than the present run-up in EM but it surely’s price trying on the historical past of efficiency cycles within the creating world markets.

On a relative foundation, the S&P 500 and MSCI Rising Markets Index have a boom-bust relationship:

The returns go from huge outperformance to huge underperformance relying on the cycle.

The newest cycle has been of the bust selection for rising markets. From 2010-2024 the EM index was up simply 3.4% per 12 months versus an annual acquire of 13.9% for the S&P 500.

It’s been a brutal run.

Perhaps it’s not so dangerous in case you’ve been greenback price averaging into EM however that is determined by what occurs from right here. The previous 12 months and alter has lastly seen some life in these shares.

Is that this the turning level within the boom-bust cycle?

The three wisest phrases any investor can utter are:

1. I

2. Don’t

3. Know

If you happen to knew what was going to occur you wouldn’t must diversify within the first place. Diversification solely “works” since you don’t have to find out the winners prematurely.

If you happen to personal some U.S. shares, some worldwide shares, some rising market shares, some small cap shares, some bonds, possibly some gold or bitcoin or different asset of your alternative one among them goes to outperform.

You’ll want you had a a lot greater allocation to that asset.

A number of will even underperform. You’ll want you had a a lot decrease allocation to that asset.

It’s simple to know what outperformed prior to now however practically not possible to foretell what’s going to outperform within the futre.

That’s why you diversify.

You quit on house runs to keep away from hanging out.

I answered these questions on this week’s Ask the Compound:

We additionally mentioned questions on rental investments, the advantages of taxable brokerage accounts and the 4% rule.

Additional Studying:

6 Surprises From 2025