PayPal is among the nice know-how tales of the previous 30 years.

The funds firm was based within the dot-com bubble. The PayPal Mafia of founders and staff who struck it wealthy when the corporate was bought to eBay in 2002 consists of Peter Thiel, Elon Musk, Reid Hoffman, Max Levchin and extra.

EBay spun out PayPal as its personal public firm in 2015. The seperation was a spectacular success for individuals who hung onto the shares of PayPal. From 2015 by way of the summer time of 2021, PayPal inventory was up practically 750% versus a achieve of 140% for the S&P 500.

After which the wheels fell off.

The inventory worth is now down 87% from the July 2021 peak.

Not solely has the inventory badly lagging the S&P 500 because the eBay spin-off, however you’ll even have been higher off sitting in T-bills!

The tortoise beat the hare.

Hendrik Bessembinder’s analysis reveals that one thing like 60% of all shares underperform T-bills over the lengthy haul. PayPal is a living proof.1

The run-up in PayPal shares reveals how focus could make you wealthy within the inventory market. Hit only one grand slam and you might be set for all times.

Nevertheless, the opposite facet of the mountain reveals the darker facet of focus. Generally you strike out even after hitting a house run.

The present market surroundings is an efficient reminder that typically the excessive flyers are topic to a crash touchdown.

If you happen to checked out any kind of diversified index or fund proper now you’ll suppose issues are going swimmingly.

The S&P 500 is simply 0.66% off its all-time highs. The All-Nation World Index simply hit new all-time highs. So did the MSCI EAFE, the S&P 500 Equal Weight Index and the Russell 2000. The Dow hit 50,000 this week.

Some traders (not me) wish to say It’s not a inventory market; it’s a market of shares.

If you happen to look beneath the hood a bit, there are many particular person names which might be in outright crashes proper now.

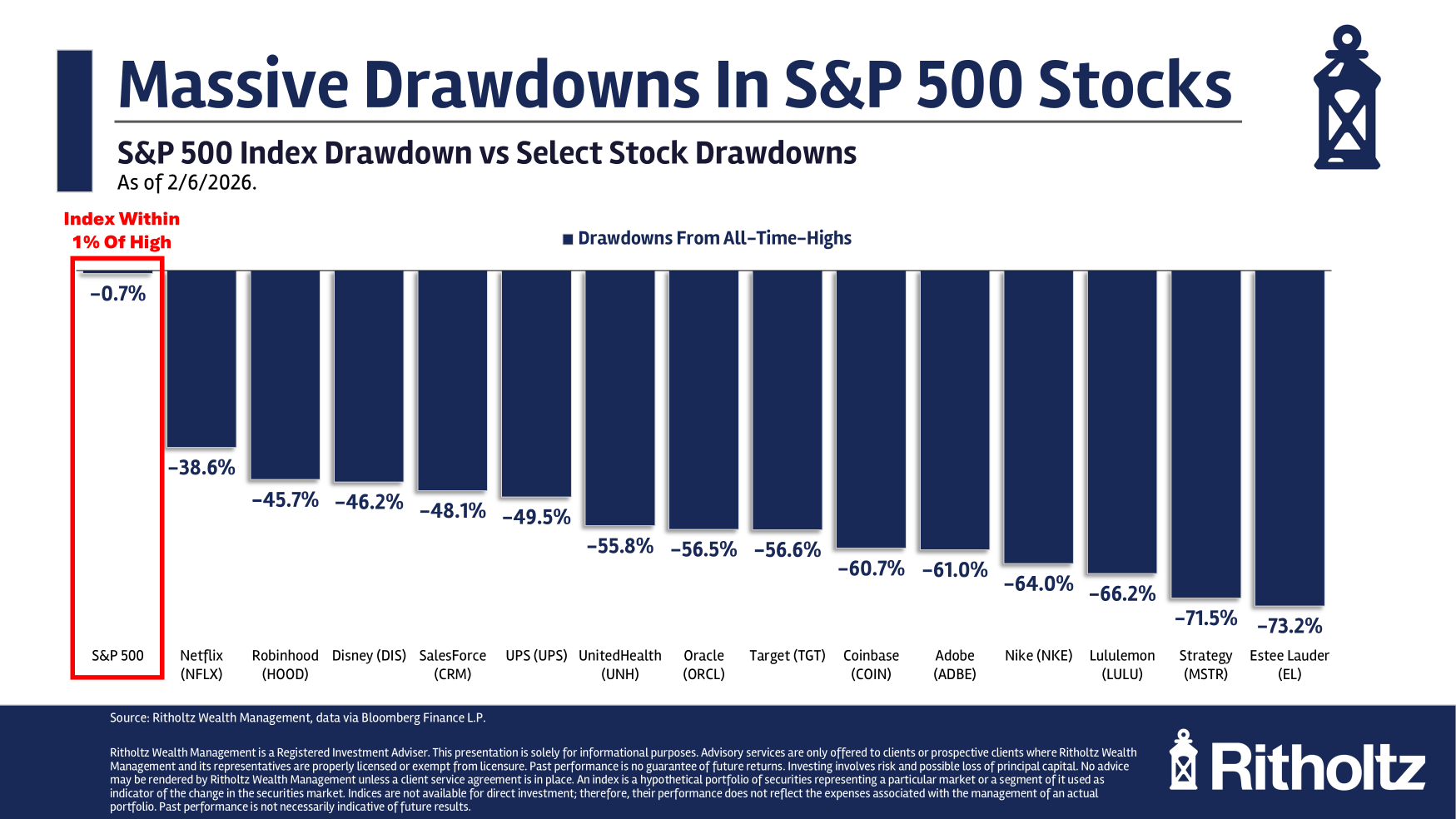

I took a have a look at the newest checklist of drawdowns in particular person companies and pulled out some family names you understand:

My youngsters would say these shares are crashing out.

These are title manufacturers. You possible use many of those services or products. These aren’t merely wholesome corrections. These are gigantic crashes of 40%, 50%, 60%, even 70% or worse.

All whereas the inventory market as an entire is kind of sitting at new highs.

Perhaps these shares are a harbinger of issues to return. It’s attainable the volatility in sure shares, mixed with the rollercoaster experience in crypto and valuable metals is foreshadowing ache forward within the inventory market.

Both approach, the motion in these names presents a warning to traders with concentrated positions in particular person shares.

The inventory market has skilled one 20% crash in a single day on Black Monday in 1987. That occurs to particular person shares a handful of instances per 12 months.

You may get 2-3 crashes in extra of fifty% in your lifetime for the general inventory market. That occurs to particular person shares regularly, no matter what’s occurring available in the market.

Investing in particular person shares could make you some huge cash once you’re proper.

That upside potential solely exists due to the large draw back potential.

Concentrated positions are very enjoyable on the upside.

They will additionally wreck you on the draw back.

Additional Studying:

Is Diversification Lastly Working Once more?

1It’s additionally value declaring that some traders clearly made cash in PayPal shares within the meantime in the event that they took some income and bought.

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here can be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.