Jim Simons created maybe the best market-beating machine ever constructed at Renaissance Applied sciences.

The Medallion Fund returned a preposterous 66% per 12 months for 30 years.

The fund traded lots and I’m nonetheless not fairly certain what indicators the code-breakers and rocket scientists used. However in Greg Zuckerman’s ebook The Man Who Solved the Market, one of many companions on the agency stated they have been solely proper about 50.75% of their trades.

Nobody bats a thousand within the markets. Everybody will get stuff mistaken.

Listed below are a few of the issues I’ve been mistaken about lately:

I believed bitcoin had an opportunity to turn out to be digital gold. At my daughter’s soccer recreation final 12 months I obtained right into a crypto dialogue with a few of the different soccer dads. One man is a large bitcoin fanatic. He requested for my long-term take.

I stated if bitcoin turns into digital gold that might be a win.

He checked out me like I simply ran onto the sector and tripped one of many women. That’s it?! Bitcoin is gonna be method greater than gold. Simply watch.

Perhaps that’s the case however I feel we are able to put the digital gold comparisons to mattress for now.

When central banks across the globe wished to diversify away from Treasuries they purchased gold. When traders wished a technique to hedge larger fiscal deficits and a decrease greenback they purchased gold.

Bitcoin has been tanking whereas gold has been hovering.

I’m not going to pour dust on bitcoin’s grave simply but. Crypto has regarded deader than a doornail many instances earlier than and are available roaring again.

However this setting is a blackeye for the crypto house. All the things we have been instructed bitcoin might be has not come to move.

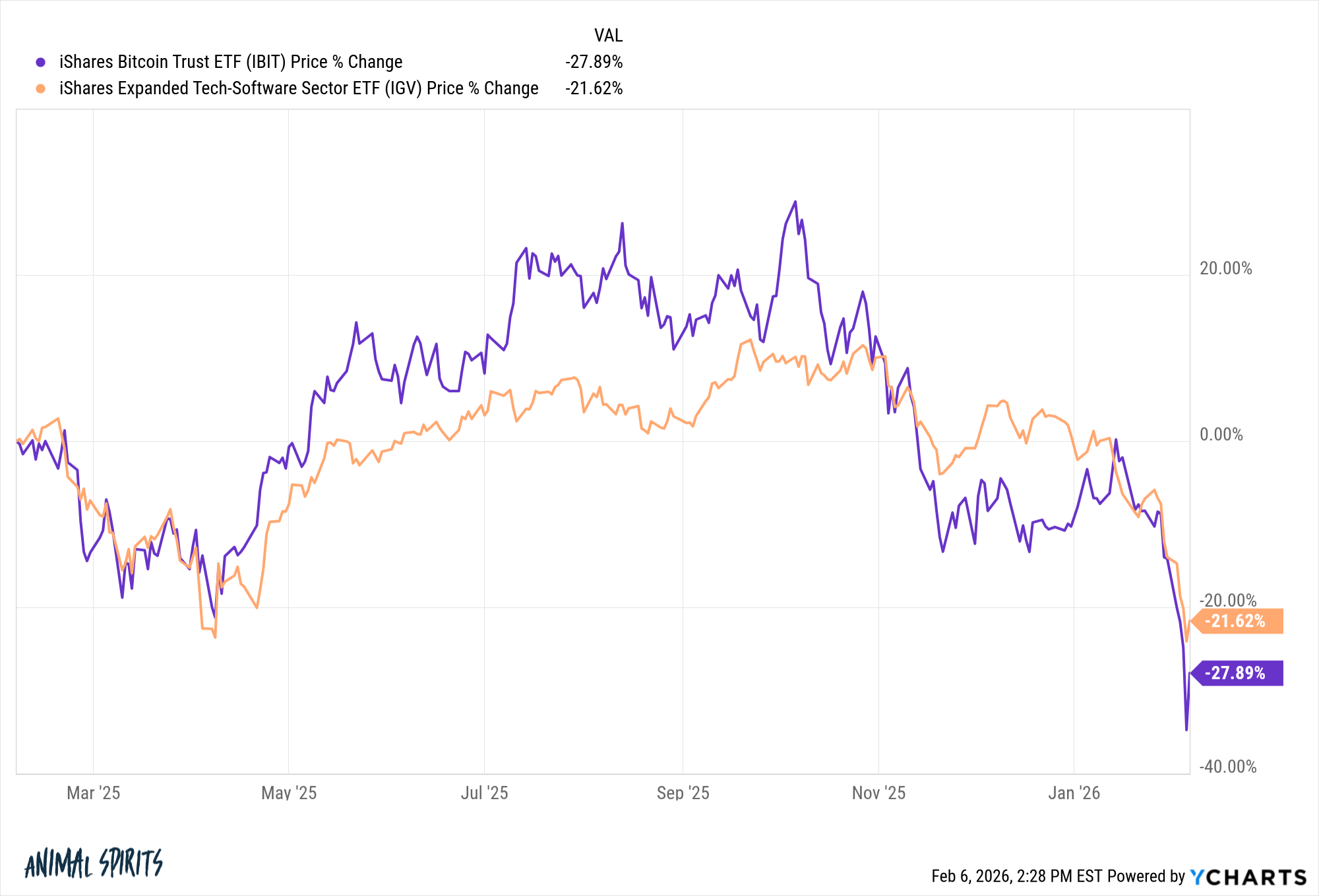

It’s nonetheless mainly performing like a tech inventory:

I’m certain there shall be a brand new bitcoin narrative sooner or later however the ones which were trotted out to date haven’t caught.

I believed bitcoin had an opportunity to dethrone gold on this new age of expertise and innovation.

Up to now, I’ve been mistaken.

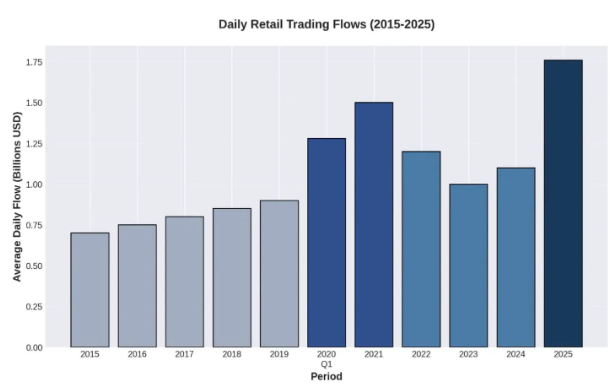

I believed the meme inventory crash of 2021 would sluggish the hypothesis. On the time it felt like GameStop, AMC and the opposite meme shares have been a flash within the pan factor.

Individuals had more money from Covid checks and time on their palms due to the pandemic. Speculating on shares made sense.

From the euphoric highs in early 2021, GameStop and AMC are down 71% and 99%, respectively. Losses of that magnitude have been purported to wipe out the speculative fever of the Reddit/Robinhood merchants. That was my thesis anyway.

Nope.

Retail buying and selling continues to take market share:

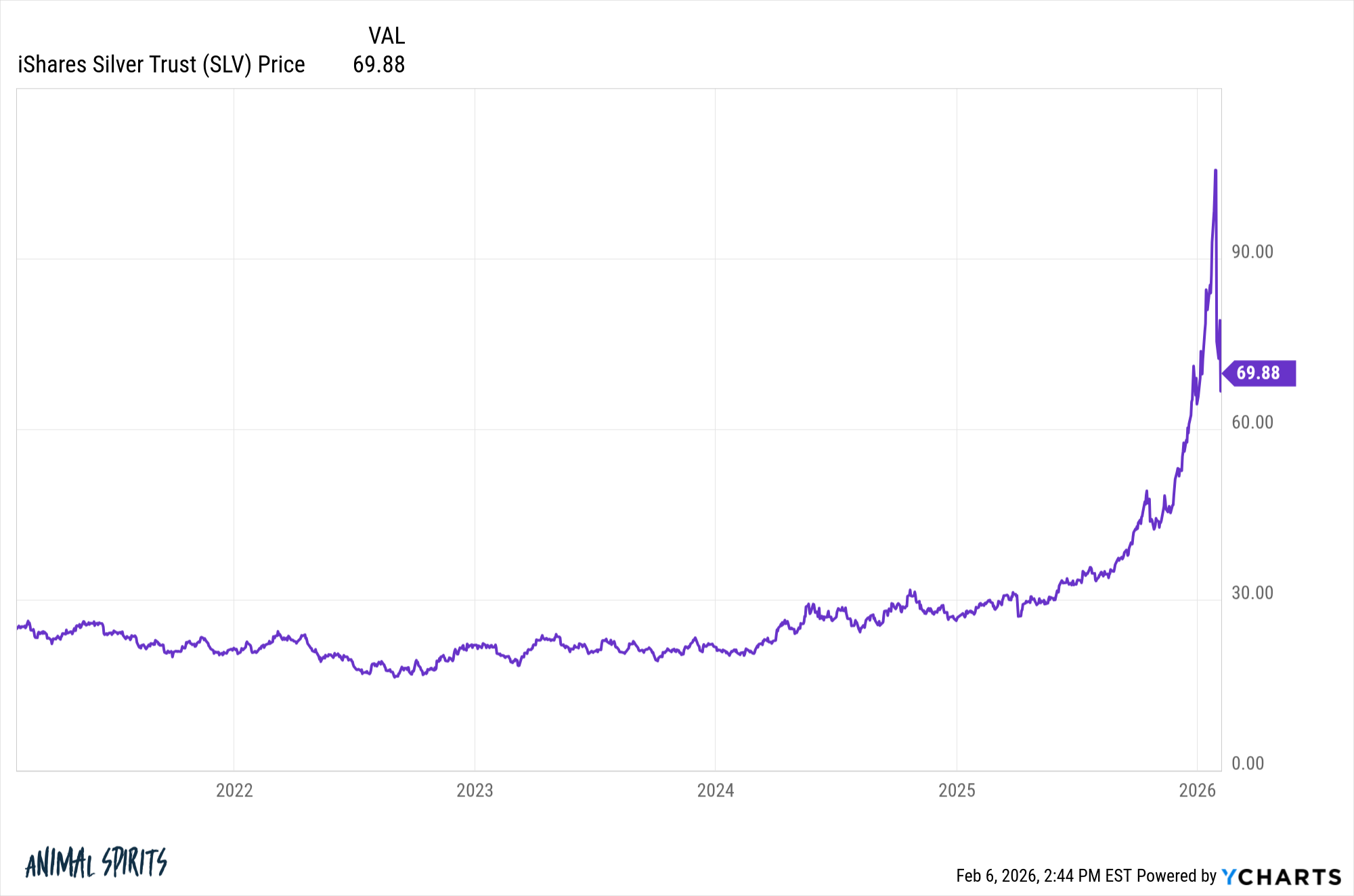

Retail merchants have gotten bigger gamers in buying and selling particular person shares, choices, and futures. They swarm themes and trades like a pack of locusts.

That’s the way you get a chart of silver that appears faux by way of the parabolic rise and the insane crash we witnessed over the previous week:

Social media has modified the market construction for good.

This isn’t going away.

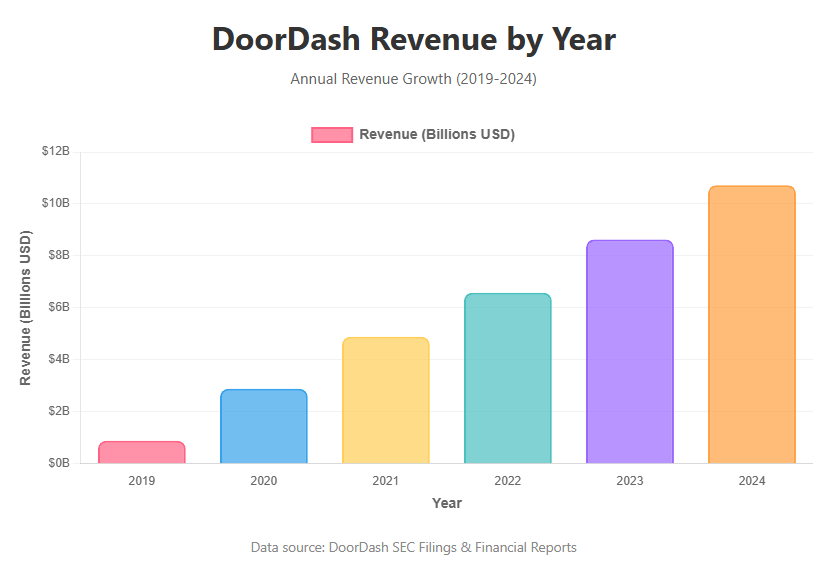

I believed DoorDash could be a Covid fad. Through the pandemic once we have been all caught in our homes it made sense that meals supply grew to become extra helpful.

As soon as the world opened up once more I assumed folks would cease paying for comfort, particularly when inflation skyrocketed in 2022.

Mistaken.

In keeping with The New York Instances, practically three out of each 4 restaurant orders aren’t eaten within the restaurant. Have a look at the income progress for DoorDash by 12 months:

That’s practically 40% 12 months over 12 months progress in gross sales since 2020.

For a lot of households, paying for the comfort of meals supply went from luxurious to necessity.

This was not a fad.

Many households at the moment are addicted and it’s altering the meals trade (some would say for the more severe).

I didn’t suppose the Fed would be capable of elevate rates of interest so excessive due to authorities debt ranges. I wrote a weblog publish again in 2021 about how rates of interest wanted to be stored low due to our ballooning authorities debt.

That one ages like a Excessive Midday left within the solar all day.

My thesis was primarily based on the concept that we couldn’t permit the curiosity expense to eat up an enormous portion of the finances. That was mistaken.

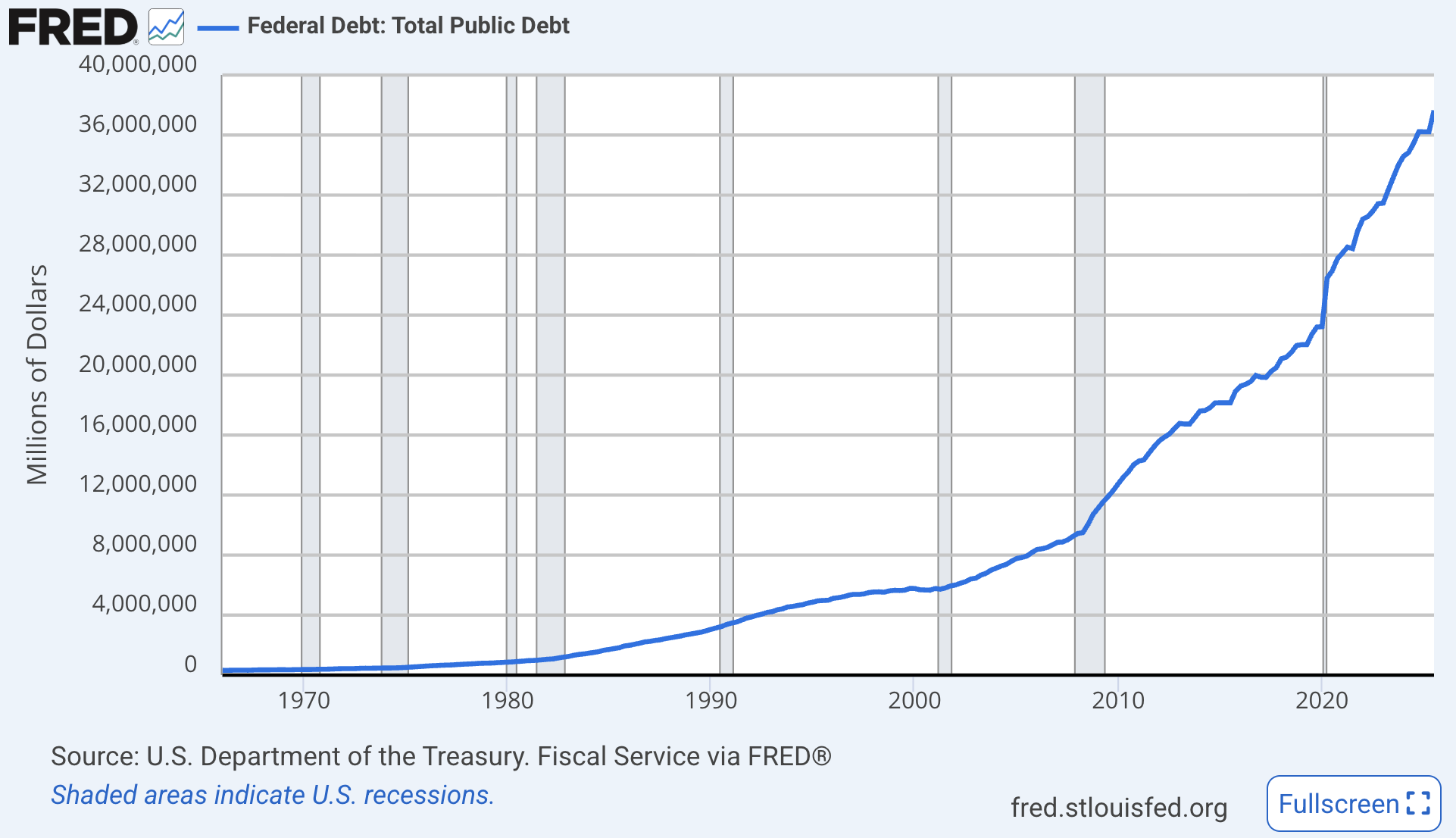

You possibly can see authorities debt rocketing larger this decade:

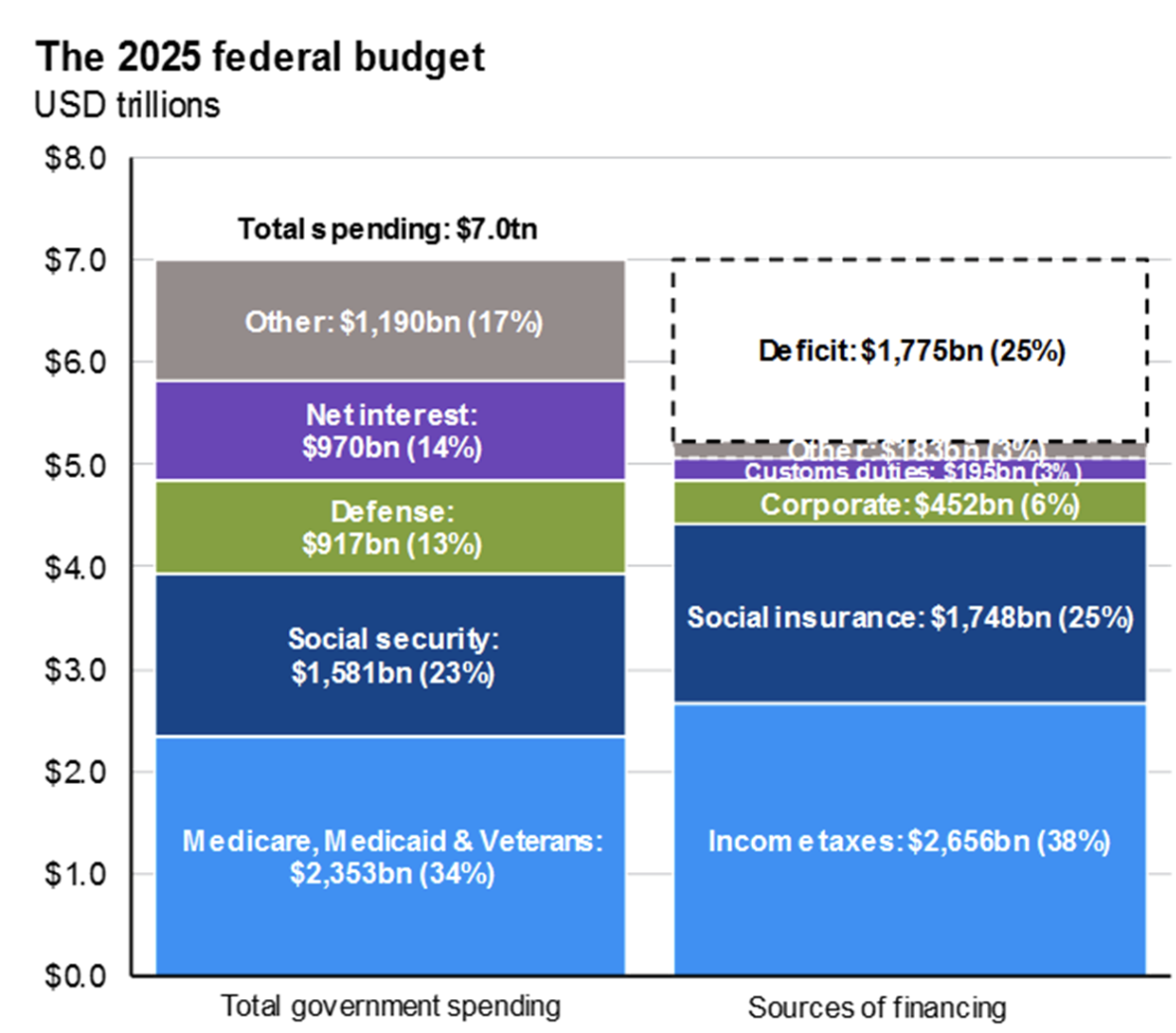

In 2022, the curiosity expense on our debt was roughly $400 billion or 7% of whole spending. Final 12 months it was 14% and practically $1 trillion:

I suppose we simply determined to borrow extra and pay the upper charges.

I ought to have identified.

I believed the Lions have been going to make the Tremendous Bowl one among these years. The NFC Championship recreation in opposition to the 49ers two years in the past was our alternative. Now it feels just like the window has closed. Oh effectively.

I believed an AI bubble was inevitable. Based mostly purely on the historical past of how this stuff work, my baseline place has been that each one the AI capex would result in a bubble. It nonetheless may.

However AI is progressing so rapidly that you must have an open thoughts a couple of state of affairs the place this complete factor isn’t a speculative bubble that pops.

Anthropic’s Claude Code is the primary iteration of my AI dream which is a customized AI assistant to deal with a number of duties for you without delay.1 Claude appears to have singlehandedly taken down the inventory costs of the software program advanced in latest weeks.

This one remains to be TBD however I feel it’s time to begin serious about the likelihood that AI adoption occurs sooner than we imagined.

It’s equal components thrilling and scary.

Michael and I talked about bitcoin, gold, DoorDash, AI and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Railway Bubble vs. The AI Bubble

Now right here’s what I’ve been studying currently:

Books:

1My solely hope for the AI increase is all of us get a Scarlett Johansson-like private assistant from the film Her.